- United States

- /

- Electric Utilities

- /

- NYSE:PNW

Pinnacle West Capital (PNW): Updated 2025 Guidance Prompts a Fresh Look at Valuation After Q3 Results

Reviewed by Simply Wall St

Pinnacle West Capital (PNW) shared its third quarter results and simultaneously raised earnings guidance for 2025. The company pointed to higher customer and sales growth supported by favorable weather trends, despite increased operations and maintenance costs.

See our latest analysis for Pinnacle West Capital.

After raising its earnings guidance and reaffirming upbeat sales growth targets, Pinnacle West Capital’s stock is starting to reflect a bit more investor optimism, with a year-to-date share price return of 5.5%. Still, momentum has been modest, and the one-year total shareholder return stands at 1.5%. The stock’s solid 38% three-year total shareholder return highlights how short-term movements often mask consistent long-term value creation for shareholders.

If you’re interested in finding what else is gaining attention among investors lately, now is a great time to broaden your horizons and discover fast growing stocks with high insider ownership

With shares still trading at a discount to analyst targets, but with recent momentum remaining modest, is Pinnacle West Capital underappreciated by the market, or is future growth already being priced into its current valuation?

Most Popular Narrative: 7.4% Undervalued

Pinnacle West Capital’s current market price of $88.98 is slightly below the narrative fair value of $96.07. This suggests a valuation gap that the most popular narrative contends may close if forecasted catalysts occur. The current price target reflects focused analyst expectations and incorporates detailed projections for growth and profit margins in the coming years.

The ongoing influx of large commercial and industrial customers (notably data centers and manufacturers), along with a backlog of nearly 20 GW in uncommitted customer interconnection requests, signals substantial upside potential for volumetric sales and rate base expansion, positively impacting revenue and long-term earnings.

Want to know the real engine behind this valuation? Get the inside track on the customer growth surge, infrastructure bets, and why analysts say future margins are primed to change the game. Don’t just take the headline; find out the pivotal numbers and shapers driving this forecasted price.

Result: Fair Value of $96.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory delays and rising costs from extreme weather could stall Pinnacle West Capital's earnings momentum. This may potentially challenge the current bullish outlook.

Find out about the key risks to this Pinnacle West Capital narrative.

Another View: What Does the SWS DCF Model Say?

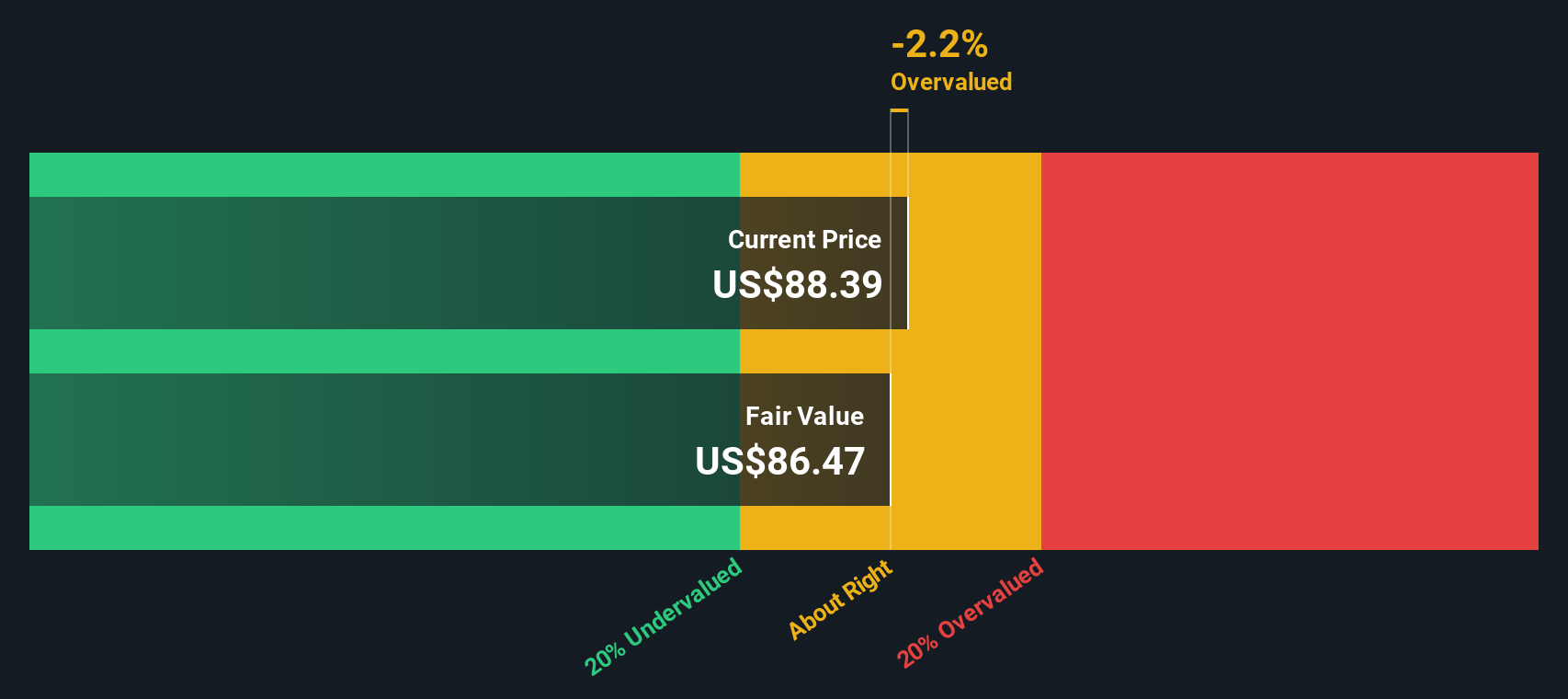

While the fair value estimate based on analyst expectations points to Pinnacle West Capital being undervalued, our DCF model suggests something different. According to this approach, the shares are actually trading a bit above fair value, implying less of a safety margin for buyers. Does this mean the market already appreciates PNW's growth story, or could this model be underestimating upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Pinnacle West Capital for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 864 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Pinnacle West Capital Narrative

If the story or numbers here don’t quite match your outlook, you can dive into the data yourself and build your own perspective in minutes with Do it your way.

A great starting point for your Pinnacle West Capital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Step ahead of the crowd and make your next investment move count. Handpicked screens below could lead you to your best stock idea yet. Don’t let these opportunities pass you by.

- Kickstart your search for steady income and reliable payouts when you check out these 14 dividend stocks with yields > 3% for companies delivering strong yields above 3%.

- Uncover the breakthroughs fueling healthcare’s future by meeting innovators in artificial intelligence with these 32 healthcare AI stocks.

- Seize potential mispriced gems now. Capture tomorrow’s winners among these 864 undervalued stocks based on cash flows and stay an edge ahead of the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PNW

Pinnacle West Capital

Through its subsidiary, provides retail and wholesale electric services primarily in the state of Arizona.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives