- United States

- /

- Electric Utilities

- /

- NYSE:PCG

PG&E (NYSE:PCG) Declares US$0.03 Per Share Dividend for Q2 2025

Reviewed by Simply Wall St

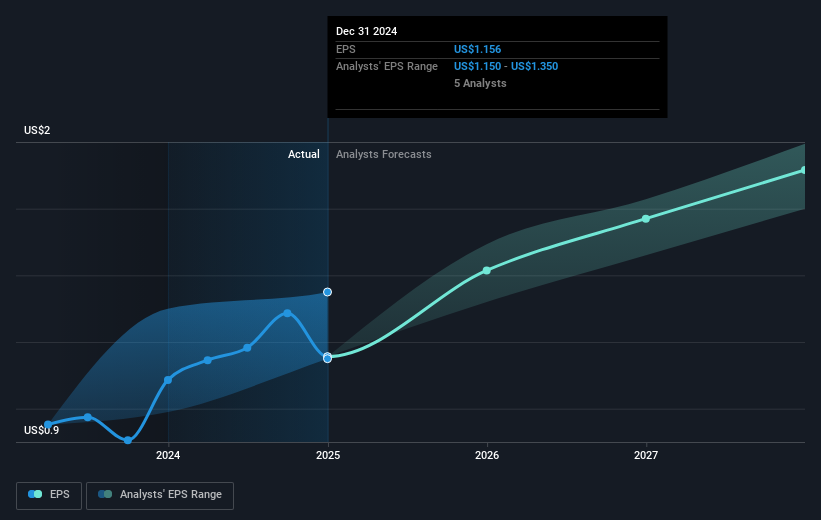

PG&E (NYSE:PCG) recently affirmed a regular cash dividend of $0.03 per share, which reflects its continuation of shareholder remuneration. Over the past quarter, PG&E's share price rose by 6% amid a fluctuating market backdrop marked by growing trade tensions and tech sector weakness. While the company's earnings report showed a decline in net income, its consistent dividend and updated earnings guidance for 2025 provided a stable outlook amid market volatility. In contrast, broader indices like the Dow Jones and S&P 500 experienced declines amidst geopolitical concerns and fluctuating economic indicators shaping investor sentiment during the same period.

Every company has risks, and we've spotted 1 risk for PG&E you should know about.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

PG&E's reaffirmation of a $0.03 per share dividend caters to shareholder interests amidst fluctuating market conditions, underscoring its intent to provide stable returns. Over the longer term, PG&E's shares have achieved a total return of 46.44% over the past five years, offering context to its recent 6% increase in the past quarter. While the broader market indices like the Dow Jones and S&P 500 declined during the recent quarter, PG&E's consistent dividend may appeal to investors seeking stable returns, despite the company's negative earnings growth in the past year compared to the US Electric Utilities industry at 7.6%.

The strategic capital investments and legislative resolution efforts highlighted in the narrative could significantly impact PG&E's revenue and earnings forecasts. The company's substantial $63 billion investment plan through 2028 aims to bolster infrastructure efficiency and earnings growth. However, uncertainties, such as the outcomes of AB 1054 and wildfire risks, could present hurdles. Given the current share price of US$17.04 and the consensus price target of US$20.83, there exists an expectation of an 18.2% rise, illustrating market optimism despite challenges. Investors should weigh these factors when considering PG&E's potential for long-term value creation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PCG

PG&E

Through its subsidiary, Pacific Gas and Electric Company, engages in the sale and delivery of electricity and natural gas to customers in northern and central California, the United States.

Good value with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion