- United States

- /

- Renewable Energy

- /

- NYSE:ORA

Ormat Technologies (ORA): Margin Expansion Reinforces Bullish Narrative Despite Slower Earnings Growth

Reviewed by Simply Wall St

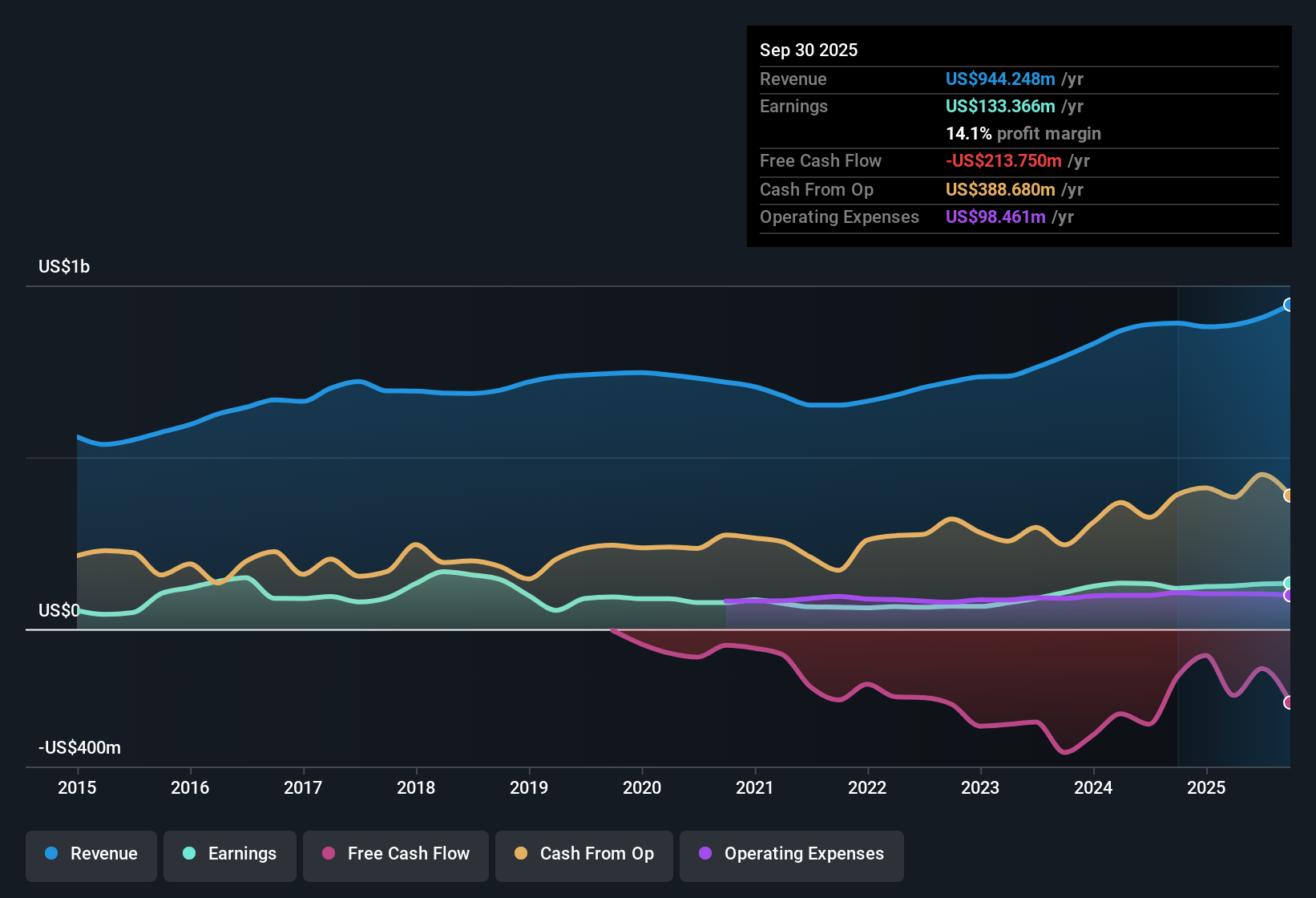

Ormat Technologies (ORA) posted net profit margins of 14.1%, up from last year’s 13.3%, and delivered 16.7% average annual earnings growth over the past five years. However, the latest year’s earnings growth was 12.4%, trailing both the company’s own historical average and the projected pace of 8.1% earnings and 8.6% revenue growth going forward. Both figures are below the US market’s forecasted profit and revenue growth rates of 16% and 10.5%. These results come as the stock trades at a 49.5x price-to-earnings ratio, noticeably higher than industry norms, signaling that robust margins are now measured against premium valuations and investor scrutiny on future growth drivers.

See our full analysis for Ormat Technologies.The next section puts these figures head-to-head with the main narratives around Ormat, looking at where the recent performance confirms or questions market expectations.

See what the community is saying about Ormat Technologies

Policy Support Drives Margin Stability

- The consensus narrative notes that recent federal permitting reforms and extensions of production and investment tax credits (PTC/ITC) are helping lower Ormat’s project costs and maintain elevated profit margins. These margins currently stand at 14.1%, up from last year’s 13.3%.

- Analysts' consensus view: Lower capital costs from ITC/PTC support are expected to boost both net margins and earnings over the next decade. This is expected to help Ormat counterbalance slower forecasted earnings growth of 8.1% per year compared to the US market’s 16%.

- Improved margin durability is highlighted by the continued expansion in energy storage and product segments. These segments delivered revenue growth of 62.7% and 57.6% year-over-year, respectively, supporting both profitability and long-term scale.

- Growing demand from data centers and industrial customers for carbon-free baseload power has supported robust power purchase agreement (PPA) pricing. This has helped Ormat secure a stronger margin profile despite industry volatility.

- Analysts' consensus view: These industry trends provide Ormat with a more predictable earnings stream even though its future annual revenue growth of 8.6% is projected to trail the broader US market's 10.5% pace.

- High visibility into future cash flows is seen as positive by analysts, supporting confidence in the company’s ability to navigate regulatory changes and competitive threats.

Heavy Capex and Battery Risk Cast Shadows

- The EDGAR summary flags $200 million in capital expenditure for the electricity segment, plus up to $150 million annually on exploration drilling. Net debt to EBITDA stands high at 4.4x, underscoring leverage and funding risks.

- Analysts' consensus view: These heavy capex requirements, combined with substantial reliance on Chinese-sourced batteries for the energy storage business, mean that any U.S. regulatory shifts post-2028 could significantly impact margins if foreign battery components are restricted.

- Critics highlight that regulatory or supply-chain snags could eat into margin gains from new storage projects, with exposure to policy priorities and credit conditions serving as ongoing watch points for risk-focused investors.

- Ormat’s product segment is exposed to cyclical demand and regional regulatory changes, especially in markets like New Zealand and Indonesia. This could potentially increase year-to-year revenue volatility and pressure on market share.

- Analysts' consensus view: While analysts see a strong current backlog, competitive threats from low-cost solar-plus-storage entrants and delays in contract markets may weigh on visibility, especially as broader industry rivals benefit from scale and cost advantages.

- This tension raises the bar for consistent execution and reinforces why high debt levels and capex could matter more if growth expectations aren’t met.

Premium Valuation Heightens Expectations

- Ormat trades at a price-to-earnings ratio of 49.5x, well above both peers (45.9x) and the global renewable energy industry (17.5x), and significantly higher than its DCF fair value of 39.34. This focuses scrutiny on its growth runway and risk profile.

- Analysts' consensus view: With the share price at $108.65, comfortably exceeding the only allowed price target of 105.7, the stock is priced for superior execution. However, consensus highlights that projected annual profit growth of 8.1% lags the broader market.

- This elevated valuation suggests that even modest surprises in growth, policy support, or capital efficiency could cause significant price swings as investors reassess risk versus reward.

- The tight gap between current share price and analyst targets signals a market less convinced of big near-term upside. As a result, management’s delivery on cash flow, debt reduction, and new project execution will likely drive re-rating potential in either direction.

- Analysts' consensus view: Fair pricing relative

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Ormat Technologies on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you interpret the numbers another way? Take a couple of minutes to turn your insights into your own narrative and share the perspective. Do it your way

A great starting point for your Ormat Technologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Explore Alternatives

Ormat’s heavy capex needs, high debt, and reliance on external battery suppliers expose it to financial pressure if cash flow or policy support falters.

If you want investment ideas with stronger balance sheets and less leverage risk, discover companies featuring robust financial health in our solid balance sheet and fundamentals stocks screener (1979 results) selection.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

- Analysts' consensus view: Fair pricing relative

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORA

Ormat Technologies

Engages in the geothermal and recovered energy power business in the United States, Indonesia, Kenya, Turkey, Chile, Guatemala, Guadeloupe, New Zealand, Honduras, France, Indonesia, the Philippines, and internationally.

Proven track record with very low risk.

Similar Companies

Market Insights

Community Narratives