- United States

- /

- Electric Utilities

- /

- NYSE:OKLO

Siemens Deal Advances Oklo (OKLO) Project Execution—But What Does This Mean for Its Competitive Edge?

Reviewed by Sasha Jovanovic

- Siemens Energy recently announced it has signed a binding contract to design and deliver the power conversion system for Oklo's first advanced Aurora powerhouse reactor at Idaho National Laboratory, authorizing the start of engineering, procurement, and manufacturing for critical components.

- This collaboration is seen as a significant step in de-risking supply chain challenges and accelerating Oklo’s path to commercial deployment of its advanced reactor technology.

- We’ll explore how Siemens Energy’s involvement in Oklo’s Aurora project reinforces Oklo’s execution capability and shapes its investment narrative.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Oklo's Investment Narrative?

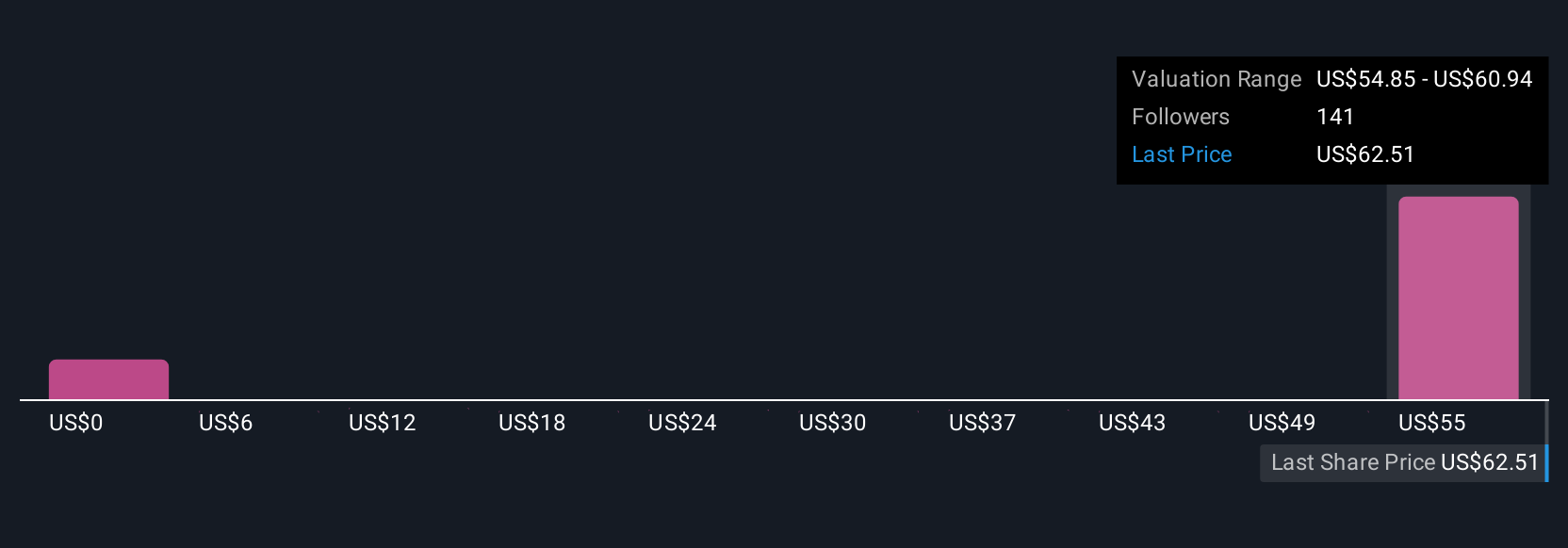

To stand behind Oklo, you have to believe that its advanced nuclear technology, robust partnerships, and regulatory momentum can ultimately translate into commercial success, and that the company’s ambitious buildout will reach critical milestones despite being pre-revenue and deeply unprofitable. The newly announced binding contract with Siemens Energy materially shifts the story by directly addressing a prominent execution risk, as supply chain bottlenecks and procurement challenges loomed over the Aurora project’s short-term timetable. With Siemens empowered to begin key engineering and manufacturing, Oklo reduces uncertainty around long-lead equipment and shows tangible movement toward delivering its first reactor at Idaho National Laboratory. However, this progress arrives amid high near-term volatility: shares have seen steep falls and gains recently, reflecting both excitement and concern around Oklo’s sky-high valuation, insider selling, and the sector-wide retreat from speculative AI-exposed stocks. While the Siemens partnership may strengthen confidence in project execution, Oklo remains highly speculative as it still faces a lengthy runway to generating revenue and achieving profitability.

But not all signs are reassuring, insider sales and ongoing losses are still risks investors should watch.

Exploring Other Perspectives

Explore 69 other fair value estimates on Oklo - why the stock might be worth as much as 20% more than the current price!

Build Your Own Oklo Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oklo research is our analysis highlighting 5 important warning signs that could impact your investment decision.

- Our free Oklo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oklo's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OKLO

Oklo

Develops advanced fission power plants to provide clean, reliable, and affordable energy at scale to the customers in the United States.

Flawless balance sheet with moderate risk.

Similar Companies

Market Insights

Community Narratives