- United States

- /

- Electric Utilities

- /

- NYSE:OGE

OGE Energy (OGE): Exploring Valuation After Recent Pullback and Long-Term Gains

Reviewed by Simply Wall St

OGE Energy (OGE) stock has caught some attention lately, and investors may be wondering what is driving recent moves. Let’s take a closer look at the company’s performance and see how it stacks up right now.

See our latest analysis for OGE Energy.

OGE Energy’s share price has been relatively stable after a good run earlier this year, pausing at $44.08 following a modest pullback over the past month. The company’s total shareholder return sits at 8.7% for the past year and an impressive 68% over five years. This suggests that its longer-term momentum outweighs recent short-term dips as investors continue to weigh growth and risk.

If you’re ready to go beyond utilities, now is an excellent time to broaden your perspective and discover fast growing stocks with high insider ownership

With OGE Energy’s recent pullback and its healthy long-term returns, investors are left to consider if today’s price offers genuine value. Alternatively, the market may already be reflecting the company’s growth prospects in the current share price.

Most Popular Narrative: 7.3% Undervalued

Market-watchers have noticed that the most-followed narrative currently values OGE Energy at a fair value higher than the last closing price of $44.08. This suggests a modest upside as analysts see room for the shares to climb.

Sustained customer growth, electrification trends, and major projects are driving higher revenue and expanding opportunities, especially with data centers and large industrial clients. Strategic investments in infrastructure, favorable policies, and a strong financial position support stable earnings, improved margins, and long-term profitability.

Curious what’s fueling this premium? The narrative’s optimistic valuation depends on some bullish assumptions for profit margins and revenue expansion. Want to uncover the precise profit multiple and see what kind of future growth OGE needs to deliver to meet this price target? Find out what’s behind the numbers driving the narrative’s bold expectations.

Result: Fair Value of $47.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued weakness in industrial demand or an unexpected rise in regulatory costs could present challenges to OGE’s path to stronger profitability in the near term.

Find out about the key risks to this OGE Energy narrative.

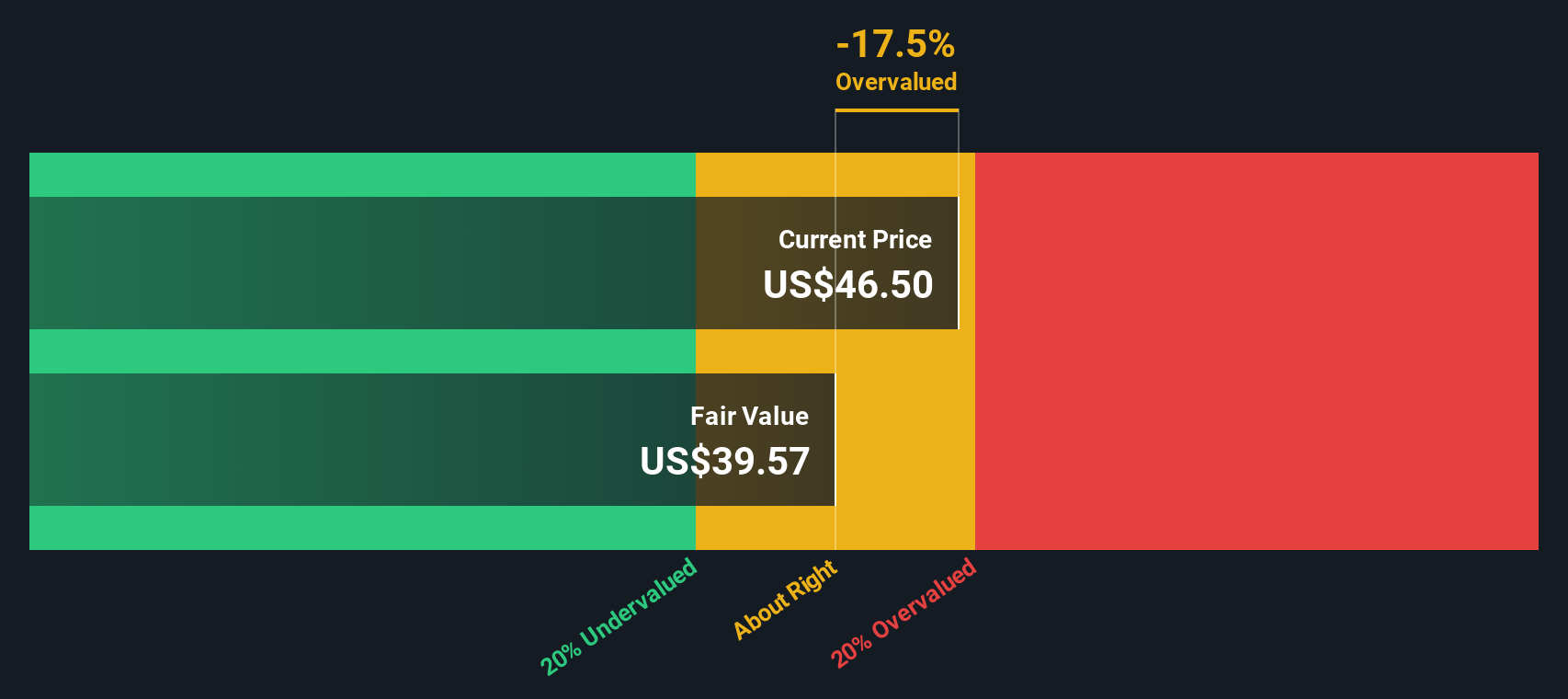

Another View: SWS DCF Model Delivers a Different Verdict

While the analyst narrative leans bullish, our SWS DCF model tells a more cautious story. According to this valuation, OGE is actually trading above its estimated fair value of $37.54. This suggests the shares might be overvalued if projected cash flows do not materialize. Which view do you trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out OGE Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 849 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own OGE Energy Narrative

If you have a different perspective or want to investigate OGE Energy’s numbers firsthand, you can easily craft your own story in just a few minutes. Do it your way

A great starting point for your OGE Energy research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investing Opportunities?

Stop waiting on the sidelines when potential winners are just a click away. Use these handpicked ideas and act now to upgrade your portfolio.

- Accelerate your passive income goals by checking out these 17 dividend stocks with yields > 3%, which pay notable yields and have solid fundamentals supporting reliable returns.

- Tap into the potential of tomorrow’s technology by starting with these 25 AI penny stocks, where you’ll find stocks championing artificial intelligence innovations.

- Strengthen your portfolio by adding value with these 849 undervalued stocks based on cash flows, featuring stocks evaluated as overlooked by the market yet rich in opportunity.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OGE

OGE Energy

Through its subsidiary, operates as an energy services provider in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives