- United States

- /

- Electric Utilities

- /

- NYSE:OGE

How OGE Energy's (OGE) $172.5 Million Equity Offering Could Shape Its Future Growth Strategy

Reviewed by Sasha Jovanovic

- OGE Energy Corp. recently completed a follow-on equity offering, raising approximately US$172.5 million through the sale of 4,011,628 common shares at US$43 per share, with a US$1.29 per share discount.

- This capital raise increases the company's share count and provides fresh funding, which could influence both future growth initiatives and shareholder value.

- We'll explore how the expanded share base and new capital may affect OGE Energy's forward-looking investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

OGE Energy Investment Narrative Recap

For investors considering OGE Energy, the core narrative hinges on stable, regulated utility operations, gradual demand growth, and reliable shareholder returns. The recent US$172.5 million equity raise, while increasing the share count, does not materially alter the central short-term catalyst, securing earnings growth through ongoing infrastructure expansion, nor does it significantly alleviate the sector’s exposure to regional economic cycles, which remains the foremost risk. Looking at recent company announcements, the reaffirmed 2025 earnings guidance in the range of US$2.21 to US$2.33 per diluted share stands out as especially relevant. This guidance, alongside the capital infusion from the recent offering, points to OGE’s focus on supporting asset investment and future profitability, even amid broader concerns about customer load softness and evolving regulatory risks. Yet, contrasting OGE’s continued capital investments, investors should be mindful that any prolonged weakness in industrial demand could...

Read the full narrative on OGE Energy (it's free!)

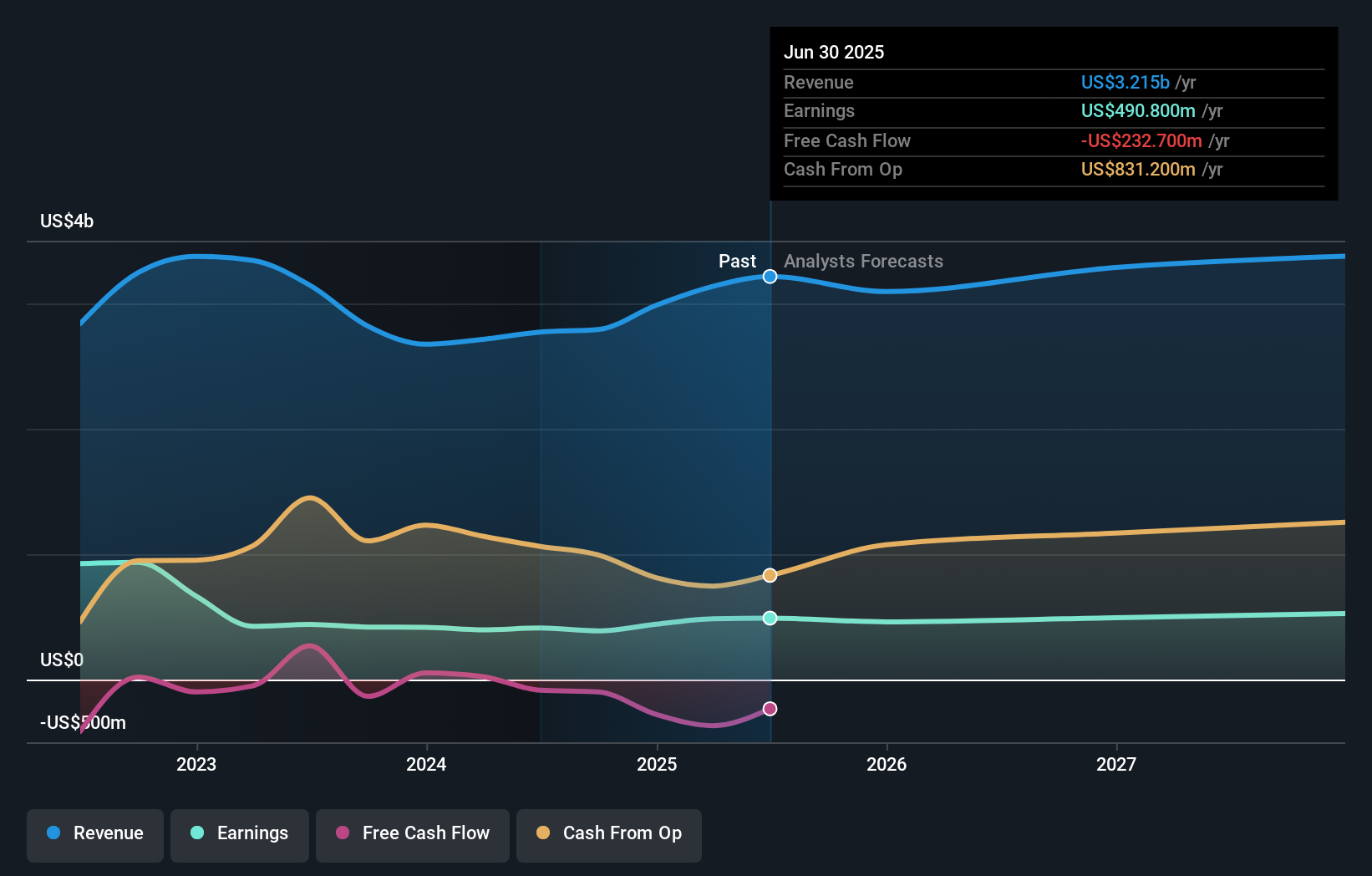

OGE Energy's outlook anticipates $3.5 billion in revenue and $545.7 million in earnings by 2028. This scenario implies a 2.7% annual revenue growth and a $54.9 million earnings increase from current earnings of $490.8 million.

Uncover how OGE Energy's forecasts yield a $47.55 fair value, a 6% upside to its current price.

Exploring Other Perspectives

All fair value estimates submitted to the Simply Wall St Community stand at US$47.55 based on one user analysis. While consensus sees steady infrastructure-driven growth, sector-specific demand risks may influence future returns, so consider a range of viewpoints.

Explore another fair value estimate on OGE Energy - why the stock might be worth just $47.55!

Build Your Own OGE Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OGE Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free OGE Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OGE Energy's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OGE

OGE Energy

Through its subsidiary, operates as an energy services provider in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success