- United States

- /

- Electric Utilities

- /

- NYSE:OGE

Here's Why OGE Energy (NYSE:OGE) Has A Meaningful Debt Burden

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, OGE Energy Corp. (NYSE:OGE) does carry debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for OGE Energy

How Much Debt Does OGE Energy Carry?

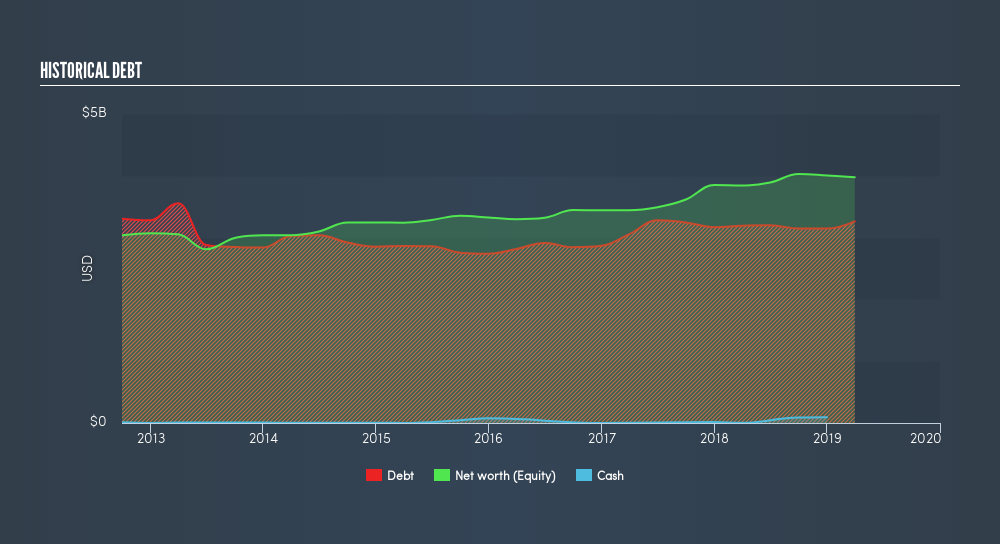

The chart below, which you can click on for greater detail, shows that OGE Energy had US$3.26b in debt in March 2019; about the same as the year before. On the flip side, it has US$94.3m in cash leading to net debt of about US$3.17b.

A Look At OGE Energy's Liabilities

According to the last reported balance sheet, OGE Energy had liabilities of US$884.2m due within 12 months, and liabilities of US$5.90b due beyond 12 months. Offsetting this, it had US$94.3m in cash and US$233.3m in receivables that were due within 12 months. So its liabilities total US$6.46b more than the combination of its cash and short-term receivables.

This is a mountain of leverage relative to its market capitalization of US$8.54b. This suggests shareholders would heavily diluted if the company needed to shore up its balance sheet in a hurry.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

OGE Energy has a debt to EBITDA ratio of 4.1 and its EBIT covered its interest expense 2.9 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Another concern for investors might be that OGE Energy's EBIT fell 13% in the last year. If that's the way things keep going handling the debt load will be like delivering hot coffees on a pogo stick. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine OGE Energy's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Looking at the most recent three years, OGE Energy recorded free cash flow of 20% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

To be frank both OGE Energy's interest cover and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. And even its conversion of EBIT to free cash flow fails to inspire much confidence. It's also worth noting that OGE Energy is in the Electric Utilities industry, which is often considered to be quite defensive. We're quite clear that we consider OGE Energy to be really rather risky, as a result of its balance sheet health. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. Given our hesitation about the stock, it would be good to know if OGE Energy insiders have sold any shares recently. You click here to find out if insiders have sold recently.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:OGE

OGE Energy

Through its subsidiary, operates as an energy services provider in the United States.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives