- United States

- /

- Electric Utilities

- /

- NYSE:NRG

NRG Energy (NRG): Evaluating Valuation Following Surging Profits and Expanded Share Buyback Program

Reviewed by Simply Wall St

NRG Energy (NRG) just posted a major turnaround for investors, moving from a net loss last year to strong profits in the latest quarter. The company also made significant progress with its ongoing share buyback program and authorized additional repurchases.

See our latest analysis for NRG Energy.

NRG’s recent surge in profitability and bold share buybacks come amid a stock that’s already been on a tear. Its share price is up 79% year-to-date, with total shareholder returns soaring over 83% in the past year and a remarkable 334% over three years. Momentum is clearly building, fueled by both financial turnaround and shareholder-focused actions.

If you’re looking to expand your search for growth stories with committed management, now is a great moment to discover fast growing stocks with high insider ownership.

With shares riding impressive gains and financials flashing strength, the key question now is whether NRG’s rapid rise still leaves room for upside or if investors have already priced in the company’s growth potential.

Most Popular Narrative: 19.8% Undervalued

NRG Energy's widely followed narrative fair value stands at $207, noticeably higher than the last close price of $166.15. Enthusiasm around a digital power revolution and market share gains is fueling a bold upside thesis.

Ongoing optimization of the generation portfolio, including acquisitions of natural gas and C&I virtual power plant assets in attractive growth markets (PJM, ERCOT), positions NRG to capture market share from legacy players, drives operational efficiencies, and should lead to improved net margins and accelerated long-term earnings growth.

Want to know what is really powering this lofty price target? The narrative spotlights a future unlocked by outsized earnings escalations, stickier customers, and aggressive share buybacks. Which numbers and trends are so compelling that bulls argue for a premium multiple and massive new revenues? There is a striking story behind the fair value figure. Dive deeper and uncover the secrets driving this valuation.

Result: Fair Value of $207 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained regulatory shifts toward renewables or setbacks integrating new acquisitions could present challenges to NRG’s bullish outlook and slow expected earnings growth.

Find out about the key risks to this NRG Energy narrative.

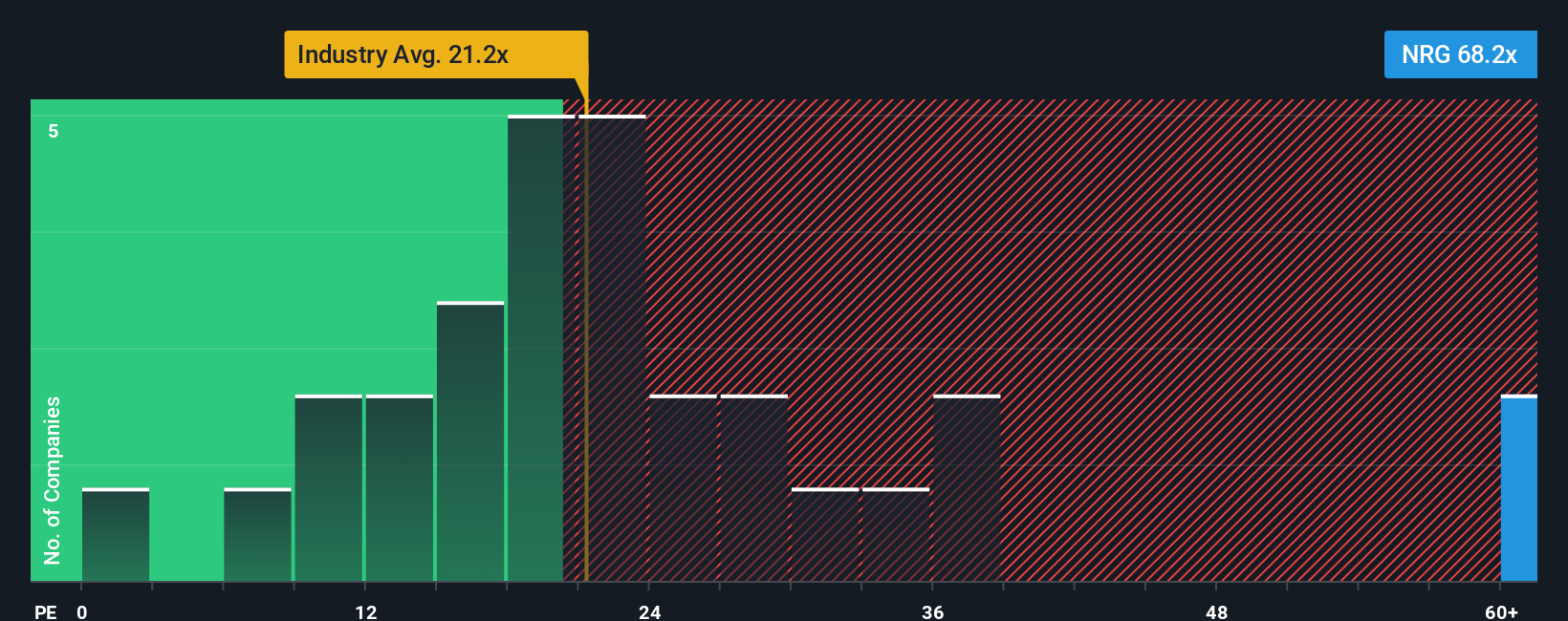

Another View: Not So Cheap on Earnings Multiples

While fair value estimates highlight NRG as undervalued, a quick check on the earnings multiple tells a different story. NRG trades at 23.2 times earnings, which is pricier than both its peers (20.8x) and the industry average (20.7x). This could pose valuation risk if market sentiment shifts or performance slips. Is the current premium justified, or is the optimism already in the price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NRG Energy Narrative

If you want to dig deeper or see things differently, jump into the numbers and put together your own story in just a few minutes, then Do it your way.

A great starting point for your NRG Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Transform your search for winning stocks by using powerful screeners that highlight unique opportunities you might otherwise miss. Check out these smart investment ideas before the crowd does:

- Boost your income potential by tapping into these 15 dividend stocks with yields > 3% offering strong yields and reliable cash returns.

- Unlock rapid growth prospects with these 26 AI penny stocks featuring companies shaping the AI revolution and leading market innovation.

- Capitalize on value by targeting these 875 undervalued stocks based on cash flows which may be flying under the radar despite robust fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NRG Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NRG

NRG Energy

Operates as an energy and home services company in the United States and Canada.

Reasonable growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives