- United States

- /

- Electric Utilities

- /

- NYSE:NRG

How Investors May Respond To NRG Energy (NRG) Expanding Texas Gas Power With $360M Facility Investment

Reviewed by Sasha Jovanovic

- Earlier this week, NRG Energy announced a US$360 million investment to expand power generation with a new 456-megawatt natural gas facility in Harris County, Houston, supported by Texas state programs and projected to begin operations by summer 2026.

- This expansion, combined with state-backed financing and recent tax abatements, highlights NRG's intention to address Texas's rising electricity demand while reinforcing grid reliability and creating both construction and permanent jobs in the region.

- We'll explore how NRG's commitment to expanding gas-fired generation capacity in Texas could reshape its investment narrative for long-term growth.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

NRG Energy Investment Narrative Recap

The heart of the NRG Energy investment case revolves around the company’s ability to meet surging electricity demand, particularly from data centers and electrification trends, while balancing the substantial capital requirements of new generation projects. The news of a US$360 million natural gas plant in Houston aligns with this broader narrative and underscores NRG’s focus on Texas grid reliability, but it does not materially reduce the near-term risks tied to heavy debt financing and potential interest rate pressures, which remain the most immediate catalysts and threats for the stock.

Among recent announcements, NRG’s fresh round of debt issuance, over US$4.9 billion in secured and unsecured notes in October, stands out in context. This move highlights the significant financial commitments underpinning the company’s ongoing project and acquisition strategy, illustrating how the scale of investment needed for expansion could impact financial flexibility, especially if market conditions shift unfavorably.

Yet, investors should be aware that pressures from mounting debt costs and refinancing requirements could become more acute if interest rates...

Read the full narrative on NRG Energy (it's free!)

NRG Energy's outlook anticipates $34.5 billion in revenue and $1.6 billion in earnings by 2028. This projection is based on a 5.5% annual revenue growth rate and an increase in earnings of about $1.1 billion from the current $455.0 million level.

Uncover how NRG Energy's forecasts yield a $194.77 fair value, a 14% upside to its current price.

Exploring Other Perspectives

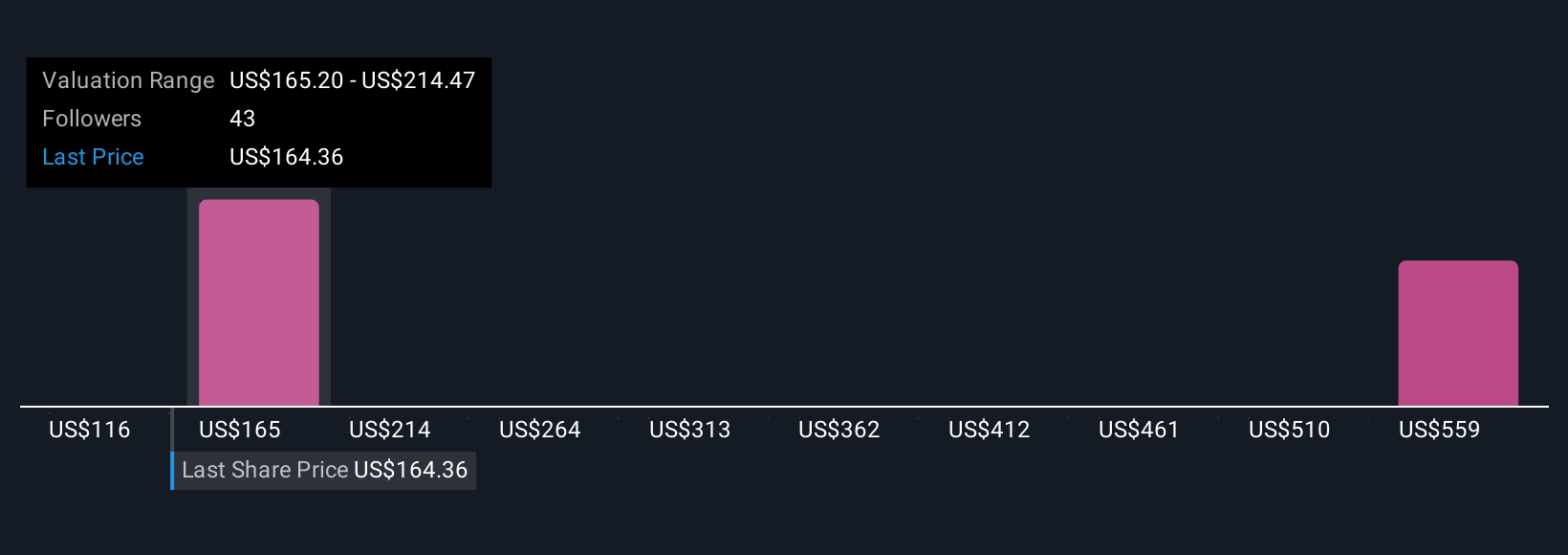

Four members of the Simply Wall St Community see NRG’s fair value estimates spread widely, from US$115.93 to US$632.43. While many are drawn to NRG’s growth opportunity, the company’s considerable capital needs and elevated debt load could weigh on future profitability, explore how differing assumptions could affect your own valuation outlook.

Explore 4 other fair value estimates on NRG Energy - why the stock might be worth 32% less than the current price!

Build Your Own NRG Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NRG Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NRG Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NRG Energy's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NRG Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NRG

NRG Energy

Operates as an energy and home services company in the United States and Canada.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives