- United States

- /

- Gas Utilities

- /

- NYSE:NJR

Is New Jersey Resources' (NJR) Leadership Refresh a Signal of Strategic Evolution or Uncertainty?

Reviewed by Sasha Jovanovic

- New Jersey Resources recently announced executive and senior leadership promotions, effective January 1, 2026, including vice president appointments and succession plans for several retiring leaders to support its growth strategy and sustainability goals.

- This transition marks a significant refresh of the company’s senior management team and aligns leadership capabilities with ongoing investments in clean energy and regulatory initiatives.

- We'll examine how the introduction of a dedicated strategy function could influence New Jersey Resources’ long-term growth approach and investor outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

New Jersey Resources Investment Narrative Recap

Shareholders of New Jersey Resources must have conviction in the company’s ability to execute on its transition from a traditional gas utility toward cleaner energy solutions, amid evolving regulatory environments and sustainability priorities. The recent executive promotions are unlikely to materially impact the company’s biggest short-term catalyst, timely cost recovery for capital investments through regulatory processes, nor do they eliminate the largest immediate risk: regulatory or policy shifts that could reduce future rate approvals tied to gas infrastructure.

Of the recent announcements, the appointment of Daniel Sergott as vice president to lead a newly created strategy function is particularly relevant. His new role may enhance NJR’s ability to align its growth plans with the fast-changing regulatory and energy policy environment, directly tying into the short-term catalyst of sustaining favorable outcomes for new investments.

Yet, in contrast to the positive leadership changes, investors should be aware that future regulatory decisions could limit approval or reduce rate recovery on major projects...

Read the full narrative on New Jersey Resources (it's free!)

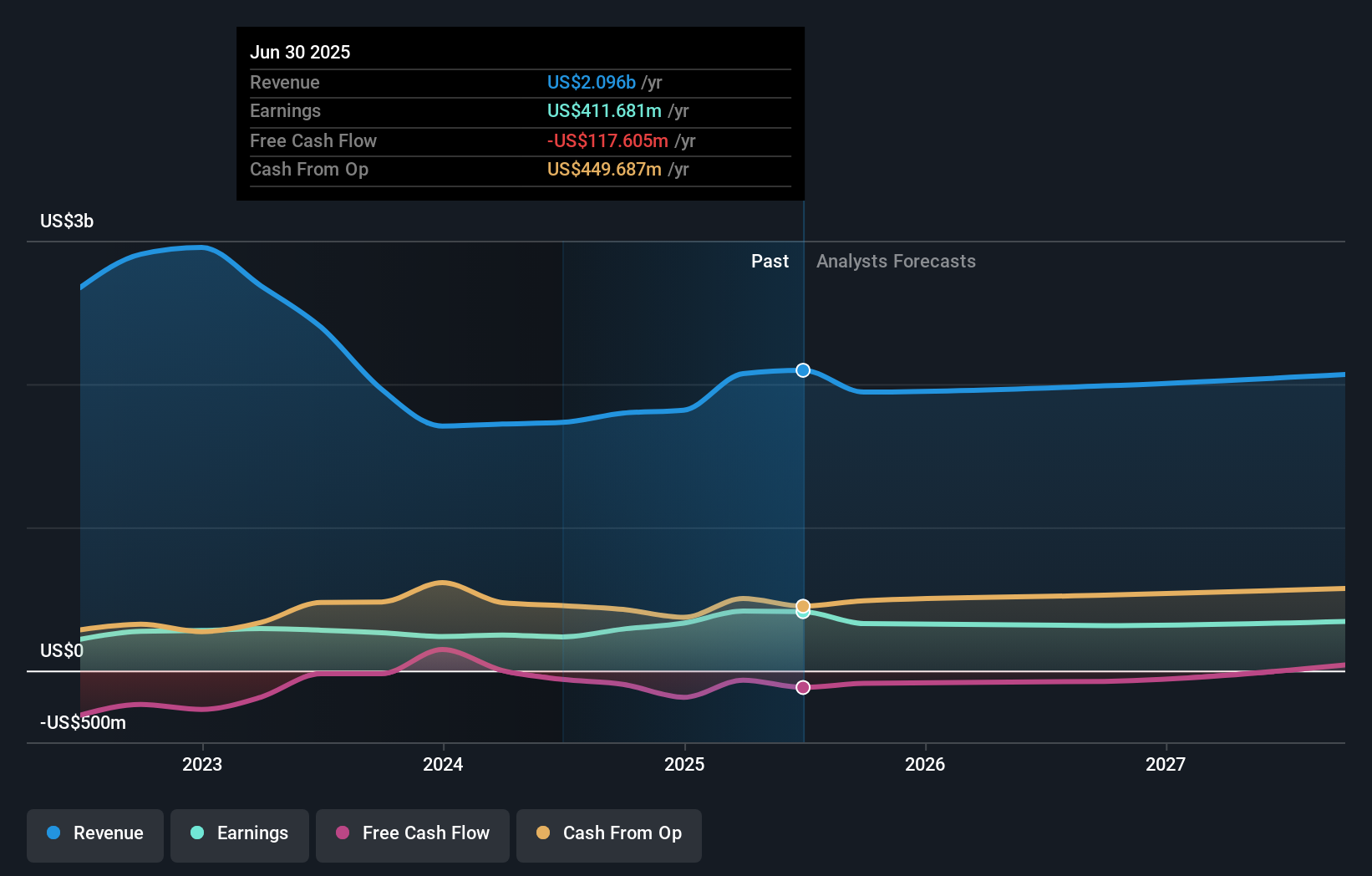

New Jersey Resources is projected to have $2.1 billion in revenue and $399.3 million in earnings by 2028. This reflects a -0.1% annual revenue decline and a $12.4 million decrease in earnings from the current $411.7 million.

Uncover how New Jersey Resources' forecasts yield a $53.57 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Only one fair value estimate from the Simply Wall St Community comes in at US$53.57 per share. Despite this singular outlook, future regulatory shifts could impact New Jersey Resources’ growth plans, meaning your own valuation might differ widely.

Explore another fair value estimate on New Jersey Resources - why the stock might be worth just $53.57!

Build Your Own New Jersey Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your New Jersey Resources research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free New Jersey Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate New Jersey Resources' overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Jersey Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NJR

New Jersey Resources

An energy services holding company, distributes natural gas.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives