- United States

- /

- Other Utilities

- /

- NYSE:NI

NiSource (NI): Assessing Valuation After Solid 12 Months

Reviewed by Simply Wall St

NiSource (NI) shares slipped about 2% today. Despite this short-term dip, the total shareholder return stands at a robust 24.4% over the past twelve months, and long-term holders have seen a rewarding 111% five-year return. This demonstrates that momentum is still solid.

See our latest analysis for NiSource.

With shares still trading below analyst price targets and a solid track record of returns, investors may wonder if NiSource is undervalued or if the market is already pricing in all the future growth.

Most Popular Narrative: 4.8% Undervalued

NiSource closed at $42.46, while the narrative model pegs fair value at $44.60. This edge highlights where analyst thinking diverges from the current market price.

Robust infrastructure upgrades and digital efficiencies are reducing costs, expanding margins, and positioning NiSource for sustained earnings and regulated revenue growth. Constructive regulatory relationships and proactive investments in decarbonization and economic development are expanding market opportunities and supporting long-term reinvestment.

Curious why experts see lasting outperformance? The foundation of this narrative is a series of bold capital allocation bets and a transformation of the earnings profile. If you want to know what key assumptions drive this above-market fair value—not just today’s market enthusiasm—see which forecasts move the needle and hint at a different future.

Result: Fair Value of $44.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerated electrification or delays in critical regulatory approvals could erode NiSource's profits or limit growth. This could challenge the analyst outlook.

Find out about the key risks to this NiSource narrative.

Another View: Market Multiples Raise a Caution Flag

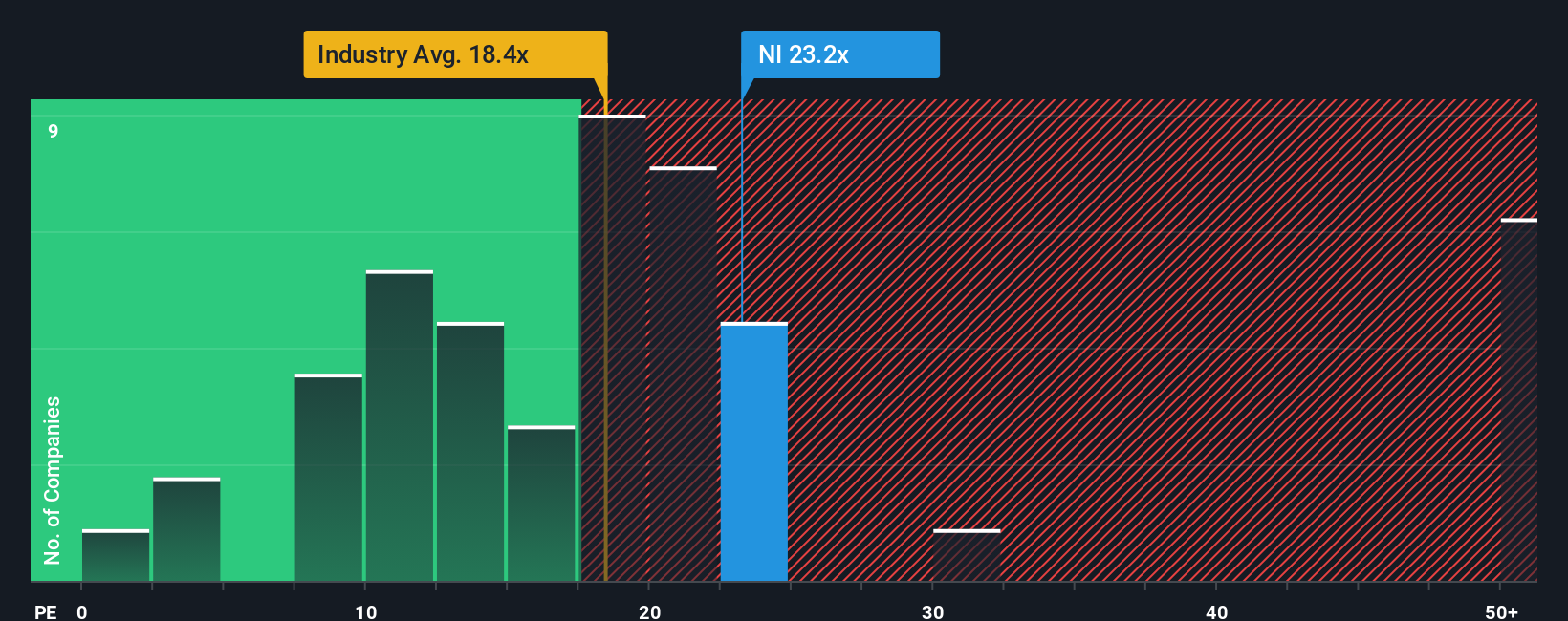

While the narrative points to a fair value edge, a look at price-to-earnings ratios tells a more cautious story. NiSource trades on a multiple of 22.6x, higher than its US industry peers at 21.6x and well above the industry global average of 18.3x. Compared to the fair ratio of 20.4x, this signals the market may be pricing in a lot of optimism, introducing risk if growth stalls. Is the market overlooking long-term risks, or is this confidence justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NiSource Narrative

If this perspective doesn’t fit your investment mindset or you’d rather dive into the details yourself, you can build your own take in just minutes: Do it your way

A great starting point for your NiSource research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

There’s a world of potential beyond NiSource. Let smart screening help you pinpoint new stocks poised for growth, momentum, or resilient income streams. Don’t let your next opportunity slip by.

- Capture early-stage upside and momentum by following these 3586 penny stocks with strong financials , where unique growth stories often begin.

- Target stable, passive income with these 21 dividend stocks with yields > 3% , which boast strong yields and consistent payouts for your portfolio.

- Ride the next tech wave by acting on breakthroughs with these 28 quantum computing stocks , connecting you to pioneers in quantum innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NiSource might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NI

NiSource

An energy holding company, operates as a regulated natural gas and electric utility company in the United States.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives