- United States

- /

- Electric Utilities

- /

- NYSE:NEE

Should NextEra Energy's (NEE) $40 Billion Clean Energy Expansion Prompt Investor Action?

Reviewed by Sasha Jovanovic

- Earlier this month, NextEra Energy unveiled plans to invest approximately US$40 billion through Florida Power & Light in new solar capacity, battery storage, and a proposed gas peaker plant, and completed its inaugural €2.5 billion junior subordinated debenture issuance to fund these projects.

- This marks a significant expansion of NextEra’s clean energy infrastructure, highlighting its commitment to long-term growth and diversified energy leadership through both renewables and natural gas capabilities.

- With this scale of infrastructure investment, we’ll explore how the company’s capital raise and expansion efforts could reshape its investment narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

NextEra Energy Investment Narrative Recap

At its core, owning shares of NextEra Energy means believing in steady, long-term demand growth for clean, reliable power, fueled by the company's aggressive buildout in renewables, storage, and gas assets. The recent US$40 billion investment plan and €2.5 billion debenture offering are aimed at supporting this vision, yet higher interest rates remain the key short-term catalyst and risk. These moves enhance financial flexibility but do not meaningfully shift the risk posed by persistent financing costs at this time.

Of the recent announcements, the completion of NextEra’s €2.5 billion junior subordinated debenture issuance stands out, directly tied to funding new infrastructure. While it fortifies NextEra’s access to capital for ambitious expansion, the ultimate impact on future earnings will still rely on how these investments perform against potential interest expense pressures. For investors, the next phase hinges on...

Read the full narrative on NextEra Energy (it's free!)

NextEra Energy's narrative projects $35.9 billion revenue and $9.4 billion earnings by 2028. This requires 11.5% yearly revenue growth and a $3.5 billion increase in earnings from the current $5.9 billion.

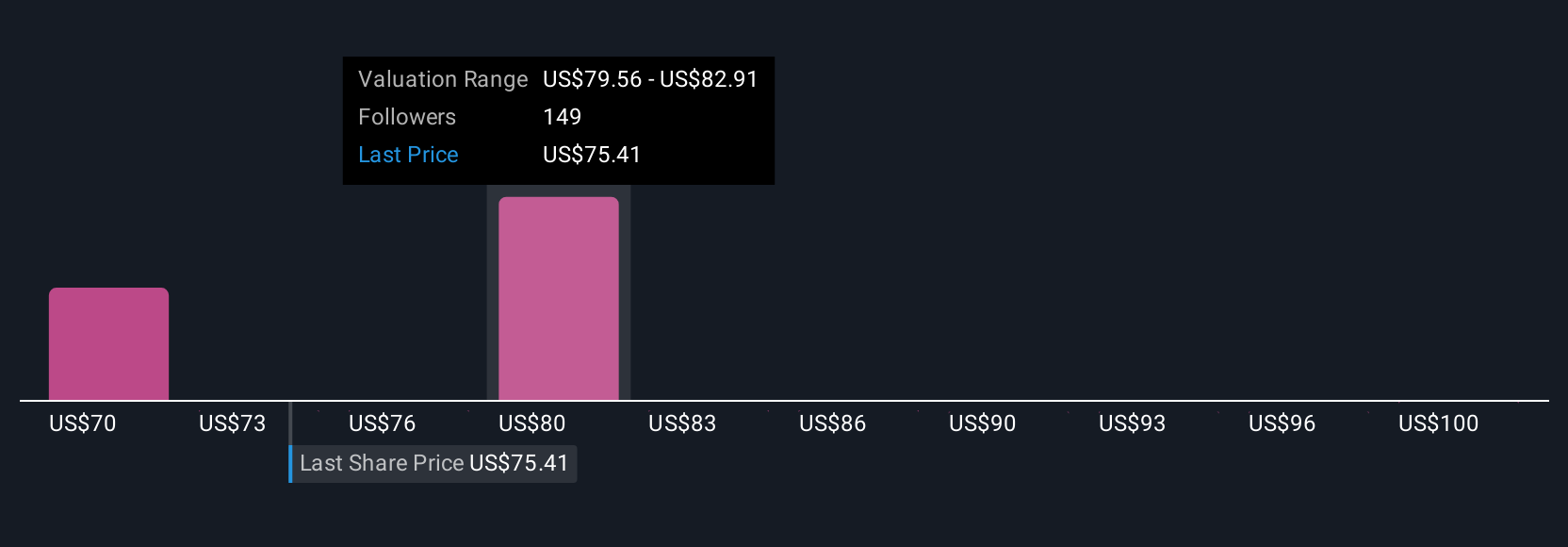

Uncover how NextEra Energy's forecasts yield a $91.00 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Some of the most optimistic analysts saw NextEra’s revenue growing at 15.7 percent a year and earnings hitting US$10.7 billion by 2028. Compared with the consensus view, these higher-end forecasts reflect a belief that NextEra’s grid modernization and advanced storage investments could unlock far greater margin growth, especially if the company’s unmatched scale and pre-2029 safe harbor approach let it secure a bigger share of upcoming demand. With these new capital commitments, now is the time to consider how far expectations may shift.

Explore 11 other fair value estimates on NextEra Energy - why the stock might be worth 17% less than the current price!

Build Your Own NextEra Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NextEra Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free NextEra Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NextEra Energy's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NextEra Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NEE

NextEra Energy

Through its subsidiaries, generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives