- United States

- /

- Electric Utilities

- /

- NYSE:NEE

NextEra Energy (NEE): Valuation Check After Major Google AI Data Center and Duane Arnold Restart Deal

Reviewed by Simply Wall St

NextEra Energy (NEE) just put a bigger flag in the ground with Google, expanding their collaboration to build gigawatt scale data center campuses and restart Iowa’s Duane Arnold plant, a combination that directly reshapes its long term growth story.

See our latest analysis for NextEra Energy.

Those moves sit on top of a 90 day share price return of 13.77% and a 12.93% year to date share price gain. The 1 year total shareholder return of 19.52% suggests momentum has been quietly rebuilding as investors re rate its growth profile.

If this kind of infrastructure plus AI story has your attention, it is worth scanning fast growing stocks with high insider ownership to spot other fast growing names that insiders clearly believe in.

With shares still trading at a discount to Wall Street targets despite accelerating AI and data center tailwinds, investors now face a key question: Is NextEra quietly undervalued, or is the market already pricing in this next growth wave?

Most Popular Narrative Narrative: 11.3% Undervalued

With NextEra Energy last closing at $80.87 against a narrative fair value near $91.14, the story leans toward upside if its growth thesis delivers.

Declining costs and rapid deployment timelines of renewables (solar, wind, and especially battery storage), along with NextEra's unrivaled supply chain and perpetual construction capabilities, allow the company to extract significant pricing and operational advantages over competitors, helping to expand margins and accelerate earnings as cost pressures mount elsewhere in the sector.

To understand how this cost and scale edge could translate into higher earnings and a richer multiple, the narrative maps out an aggressive path that might surprise you.

Result: Fair Value of $91.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent higher rates or tougher permitting that delays key renewables and nuclear projects could quickly challenge the growth assumptions underpinning this upside case.

Find out about the key risks to this NextEra Energy narrative.

Another Lens on Value

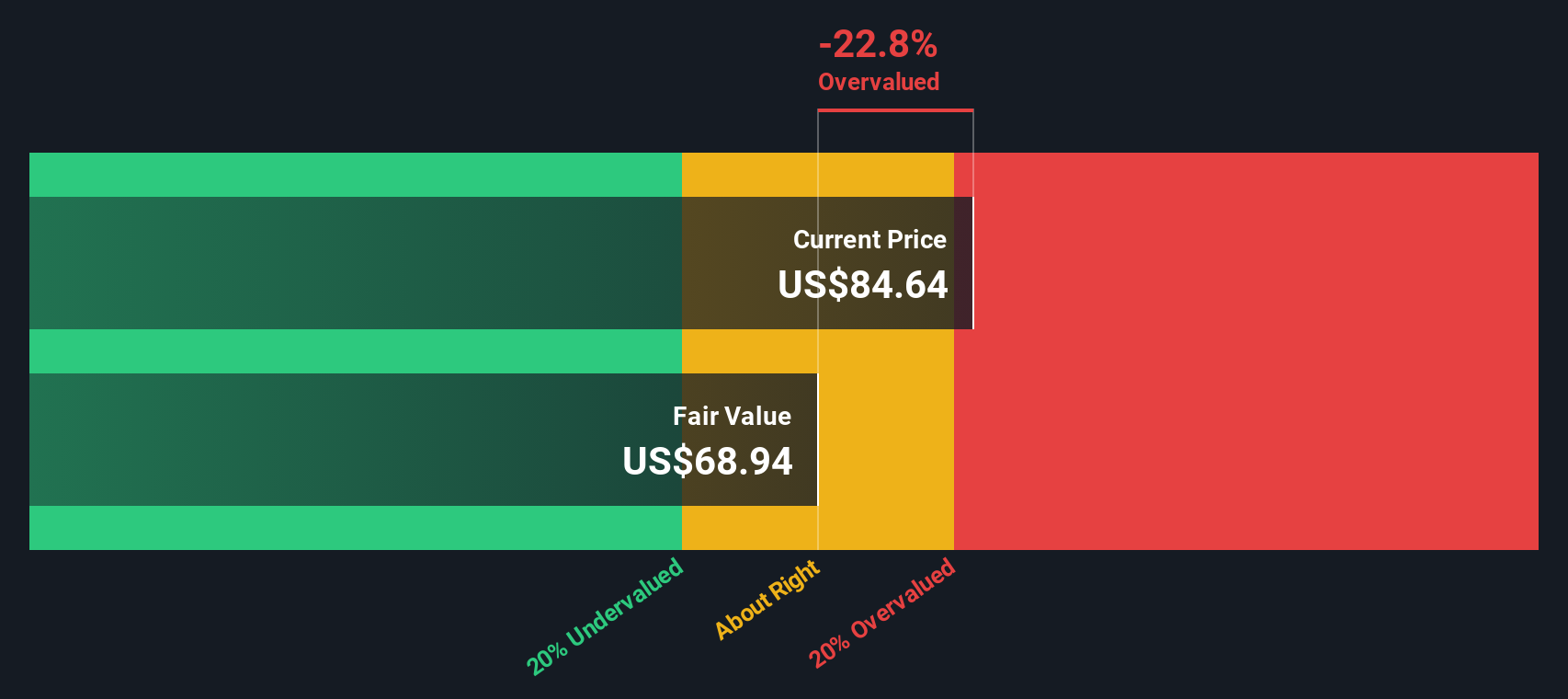

Our SWS DCF model paints a cooler picture, with fair value closer to $68.92, implying NextEra is trading above its intrinsic value rather than at an 11.3 percent discount. If cash flows fall short of AI driven hopes, today’s price could prove a stretch.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NextEra Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 916 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NextEra Energy Narrative

If you want to dig into the numbers yourself or see the story differently, you can build a custom view in minutes: Do it your way.

A great starting point for your NextEra Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before markets move on without you, put Simply Wall Street to work and hunt for fresh opportunities that match your strategy in minutes.

- Target higher income potential by reviewing these 13 dividend stocks with yields > 3% that may strengthen your portfolio’s cash flow.

- Capitalize on innovation by scanning these 24 AI penny stocks that could benefit most from the AI adoption wave.

- Seize potential bargains by reviewing these 916 undervalued stocks based on cash flows trading below their estimated cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NextEra Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NEE

NextEra Energy

Through its subsidiaries, generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion