- United States

- /

- Electric Utilities

- /

- NYSE:NEE

NextEra Energy (NEE): A Fresh Look at Valuation as Utilities Rebound

Reviewed by Simply Wall St

NextEra Energy (NEE) has captured investor attention lately, with shares recently changing hands around $84. Over the past 3 months, the stock has risen 11%, which suggests renewed interest in the utility sector.

See our latest analysis for NextEra Energy.

NextEra Energy’s strong 90-day share price return of 10.8% signals gathering momentum and reflects a broader rebound in utilities, even as the sector faces shifting sentiment. The company’s one-year total shareholder return stands at 13.3% and highlights steady progress despite some short-term volatility and changing growth expectations among investors.

If the renewed momentum in utilities has you curious about other opportunities, consider broadening your search and discover fast growing stocks with high insider ownership

But with shares hovering just below their average analyst price target and valuation metrics near historical norms, the question is whether NextEra is now trading at a compelling discount or if the market is already factoring in its future growth potential.

Most Popular Narrative: 7.9% Undervalued

With NextEra Energy last closing at $83.88 and the fair value in the most popular narrative landing at $91.05, analysts see notable upside from here. The underlying narrative is built on more than just rising optimism, hinting at substantial drivers supporting this higher target.

Accelerating and sustained demand growth for electricity, driven by AI, data center expansion, and electrification of sectors like transportation and heating, positions NextEra to grow volumes and capture higher average revenue per MWh as utilities compete to provide essential infrastructure for hyperscalers and traditional customers. This is expected to support robust revenue growth.

Want to know the growth blueprint behind this high valuation? The key element of this narrative is high-stakes future demand and ambitious profit margin expansion, driven by the electrification boom. Intrigued about the projections and assumptions that justify this price? Click through and see what shapes analysts’ confidence in NextEra’s future.

Result: Fair Value of $91.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory shifts and higher financing costs could weigh on long-term returns. As a result, execution risk is a crucial factor to watch.

Find out about the key risks to this NextEra Energy narrative.

Another View: A Look at Market Multiples

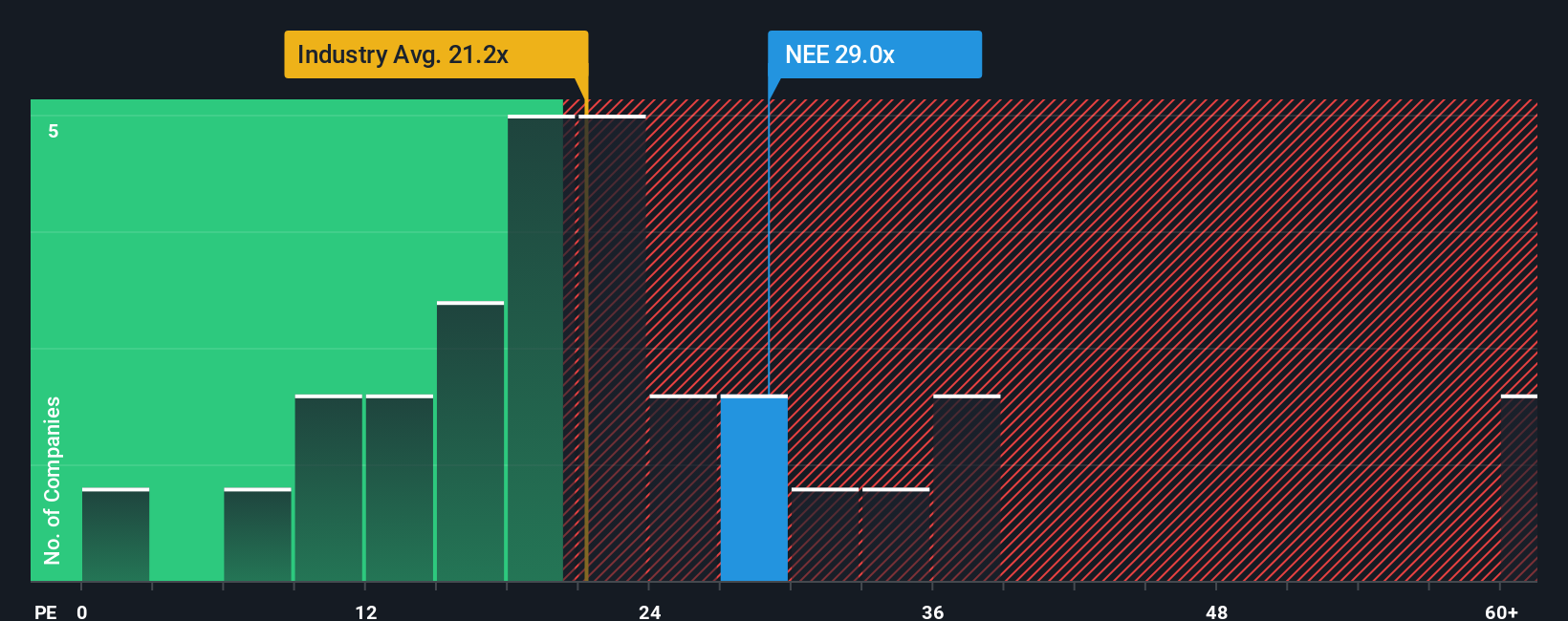

While narratives suggest NextEra Energy is undervalued compared to its fair value, market multiples offer a different perspective. The company's current price-to-earnings ratio of 26.9x is noticeably higher than the industry average of 20.7x and its peer group at 24.5x, indicating premium pricing. The fair ratio, which the market could potentially move toward, is 28.7x, suggesting only a modest upside. Does this premium reflect justified optimism, or could it signal risk if growth does not meet expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NextEra Energy Narrative

If you’re not convinced by these conclusions or want to dig deeper on your own, you can build a personalized view in just a few minutes, and Do it your way.

A great starting point for your NextEra Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity slip by while markets shift. Use these handpicked screens to quickly spot different types of market winners and keep your edge.

- Supercharge your search with these 25 AI penny stocks, tapping into the explosive growth in artificial intelligence and automation across industries.

- Unlock potential for high returns by targeting these 82 cryptocurrency and blockchain stocks, at the forefront of blockchain innovation and digital finance trends.

- Boost your income strategy and gain steady cash flow through these 16 dividend stocks with yields > 3%, featuring established businesses with attractive yields over 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NextEra Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NEE

NextEra Energy

Through its subsidiaries, generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives