- United States

- /

- Electric Utilities

- /

- NYSE:IDA

Here's Why We Think IDACORP (NYSE:IDA) Is Well Worth Watching

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in IDACORP (NYSE:IDA). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for IDACORP

How Fast Is IDACORP Growing Its Earnings Per Share?

Even when EPS earnings per share (EPS) growth is unexceptional, company value can be created if this rate is sustained each year. So it's easy to see why many investors focus in on EPS growth. In previous twelve months, IDACORP's EPS has risen from US$5.15 to US$5.36. That's a fair increase of 4.0%.

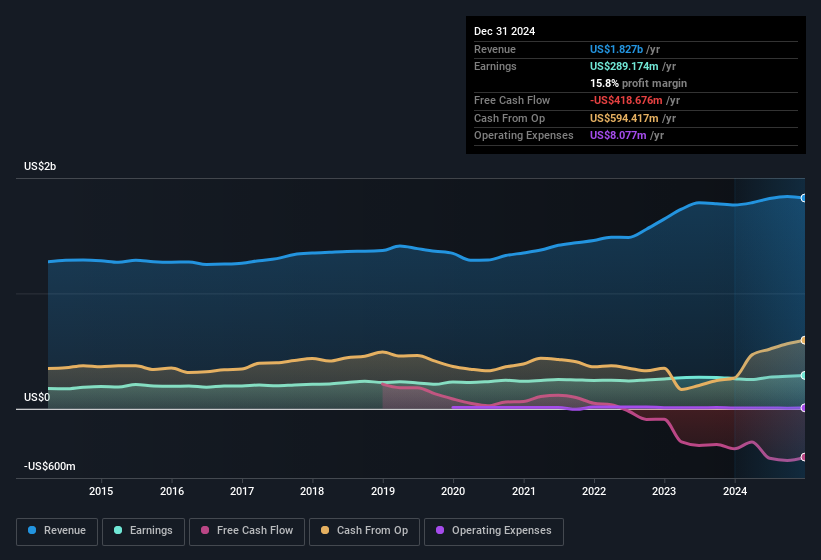

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. IDACORP maintained stable EBIT margins over the last year, all while growing revenue 3.4% to US$1.8b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of IDACORP's forecast profits?

Are IDACORP Insiders Aligned With All Shareholders?

Owing to the size of IDACORP, we wouldn't expect insiders to hold a significant proportion of the company. But we are reassured by the fact they have invested in the company. As a matter of fact, their holding is valued at US$25m. This considerable investment should help drive long-term value in the business. While their ownership only accounts for 0.4%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Is IDACORP Worth Keeping An Eye On?

One positive for IDACORP is that it is growing EPS. That's nice to see. To add an extra spark to the fire, significant insider ownership in the company is another highlight. That combination is very appealing. So yes, we do think the stock is worth keeping an eye on. However, before you get too excited we've discovered 2 warning signs for IDACORP (1 is significant!) that you should be aware of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in the US with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:IDA

IDACORP

Engages in the generation, transmission, distribution, purchase, and sale of electric energy in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives