- United States

- /

- Electric Utilities

- /

- NYSE:HE

Hawaiian Electric Industries (HE): Assessing Valuation After Profitability Returns and Wildfire Litigation Progress

Reviewed by Simply Wall St

Hawaiian Electric Industries (HE) posted third-quarter results that marked a shift from last year's losses back to profitability. This update came alongside continued progress on wildfire litigation and safety improvements across the business.

See our latest analysis for Hawaiian Electric Industries.

Hawaiian Electric Industries’ return to profitability, together with renewed dividends and continued wildfire liability progress, has helped restore confidence. This renewed confidence is finally showing in the share price. Although the stock is still far off its historic highs, its recent 23% year-to-date share price return and 13% total shareholder return over the past year suggest that momentum is rebuilding after a turbulent stretch.

If you’re considering what else is starting to regain ground, now’s a great moment to broaden your horizons and discover fast growing stocks with high insider ownership

With momentum returning, investors might be wondering if Hawaiian Electric Industries is still trading at a discount or if the recent rebound means that future growth is already factored into the market price.

Most Popular Narrative: 8.4% Overvalued

The narrative’s fair value estimate is $10.75, which is 8.4% below the recent close of $11.65. This places Hawaiian Electric Industries in the overvalued camp according to the most widely followed perspective. This sets the stage for a deeper look at the key drivers and assumptions that shape this conclusion.

Recent Hawaii legislation enabling wildfire liability caps, state funding for settlements, and securitization of wildfire safety investments significantly reduces legal and financial risk exposure while supporting large-scale infrastructure upgrades. This is likely to stabilize earnings and improve net margins.

Curious what’s fueling this surprising valuation? The narrative is loaded with ambitious projections, bracing for major operational pivots, higher future margins, and a bold path to stronger profits as regulatory tailwinds take hold. Find out what financial leaps, and potential stumbling blocks, underpins this controversial fair value and what it could mean for future returns.

Result: Fair Value of $10.75 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing wildfire liabilities and rising insurance costs continue to threaten margins and may challenge the company's path back to stable, long-term growth.

Find out about the key risks to this Hawaiian Electric Industries narrative.

Another View: Market Multiples Tell a Different Story

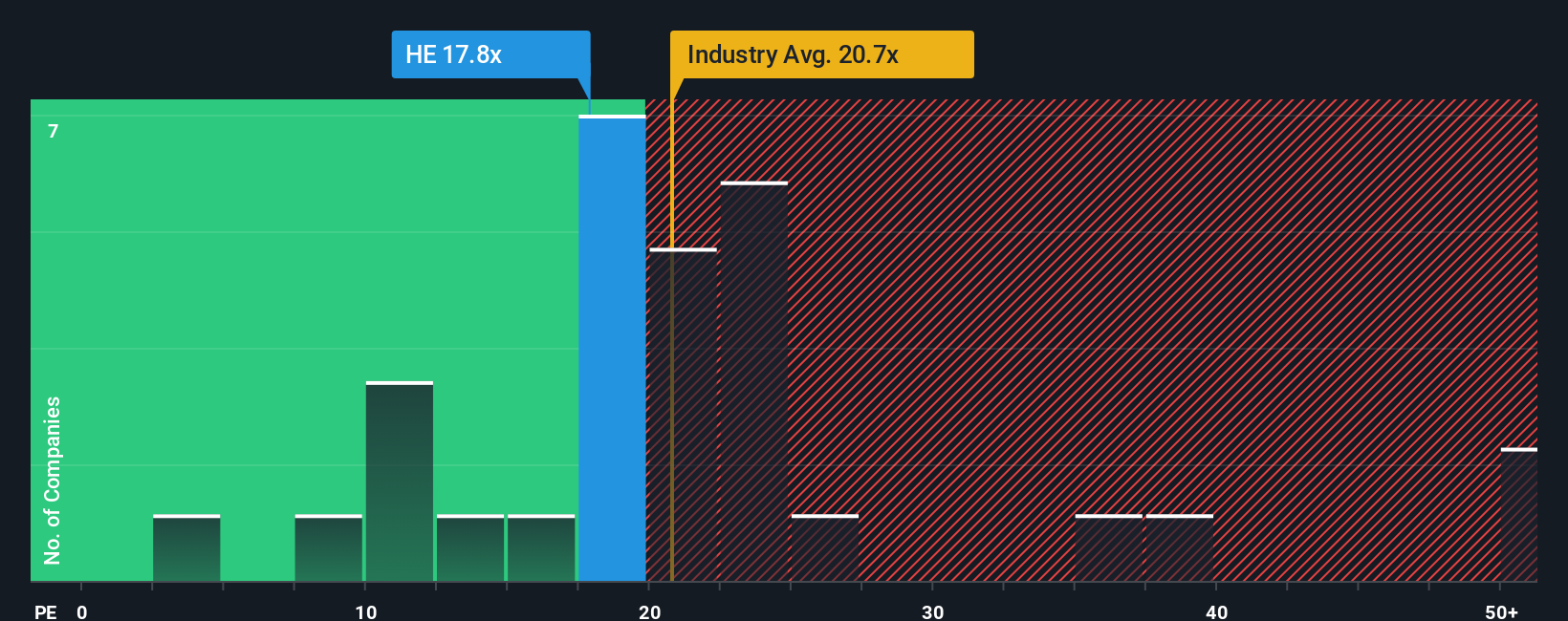

Looking at traditional valuation ratios, Hawaiian Electric trades at a price-to-earnings of 17.8x, comfortably below both its industry average of 20.7x and even the fair ratio of 20.4x that the market could move towards. This suggests the shares could actually offer good value relative to peers and challenges the idea that the stock is fully priced in.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hawaiian Electric Industries Narrative

If the current analysis does not match your perspective, or you are inclined to dig deeper into the numbers yourself, you can quickly build your own view with Do it your way.

A great starting point for your Hawaiian Electric Industries research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Step ahead of the crowd by targeting opportunities with real momentum. Great ideas are out there, so don't let them slip by while you wait. Here are three ways to uncover fresh prospects now:

- Tap into steady income streams by reviewing these 16 dividend stocks with yields > 3% that consistently deliver yields above the norm for greater peace of mind.

- Uncover powerful trends in technology when you check out these 25 AI penny stocks that are shaping tomorrow’s industries through artificial intelligence breakthroughs.

- Maximize value potential by screening for these 878 undervalued stocks based on cash flows where market mispricings could translate into outsized gains for insightful investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hawaiian Electric Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HE

Hawaiian Electric Industries

Engages in the electric utility business in the United States.

Fair value with questionable track record.

Similar Companies

Market Insights

Community Narratives