- United States

- /

- Electric Utilities

- /

- NYSE:FE

Should FirstEnergy’s (FE) Upgraded 2025 Earnings Guidance Prompt Fresh Consideration From Investors?

Reviewed by Sasha Jovanovic

- FirstEnergy Corp. reported its third quarter and nine-month 2025 results in October, posting higher revenues at US$4.15 billion and net income of US$441 million for the quarter, alongside increased full-year earnings guidance of US$2.50–US$2.56 per share.

- The company's decision to raise earnings expectations highlights operational momentum and management's confidence in ongoing transmission and grid modernization investments.

- We’ll look at how FirstEnergy’s raised earnings guidance shapes its updated investment narrative and future growth outlook.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

FirstEnergy Investment Narrative Recap

To be a shareholder in FirstEnergy, you need to believe in the long-term value of grid modernization and the company’s ability to benefit from growing infrastructure investment, despite a slower overall growth profile compared to broader markets. The recent earnings beat and raised 2025 guidance confirm operational stability and management’s confidence, but do not materially alter the main short-term catalyst, ongoing infrastructure upgrades, and the persistent risk tied to legal and regulatory overhang from past scandals.

One of the most relevant announcements this quarter was FirstEnergy’s decision to narrow and lift its 2025 core earnings guidance to US$2.50–US$2.56 per share, reflecting year-to-date performance and outlook. This update bolsters the catalyst around infrastructure investment, as reliable returns from grid projects remain central to supporting both forecasted earnings and investor confidence amidst sector-wide pressures.

However, investors should also be aware that persistent regulatory actions tied to previous legal challenges could impact future earnings and stability...

Read the full narrative on FirstEnergy (it's free!)

FirstEnergy's outlook anticipates $15.6 billion in revenue and $1.7 billion in earnings by 2028. This is based on a 4.1% annual revenue growth rate and a $0.4 billion increase in earnings from the current $1.3 billion.

Uncover how FirstEnergy's forecasts yield a $48.45 fair value, a 6% upside to its current price.

Exploring Other Perspectives

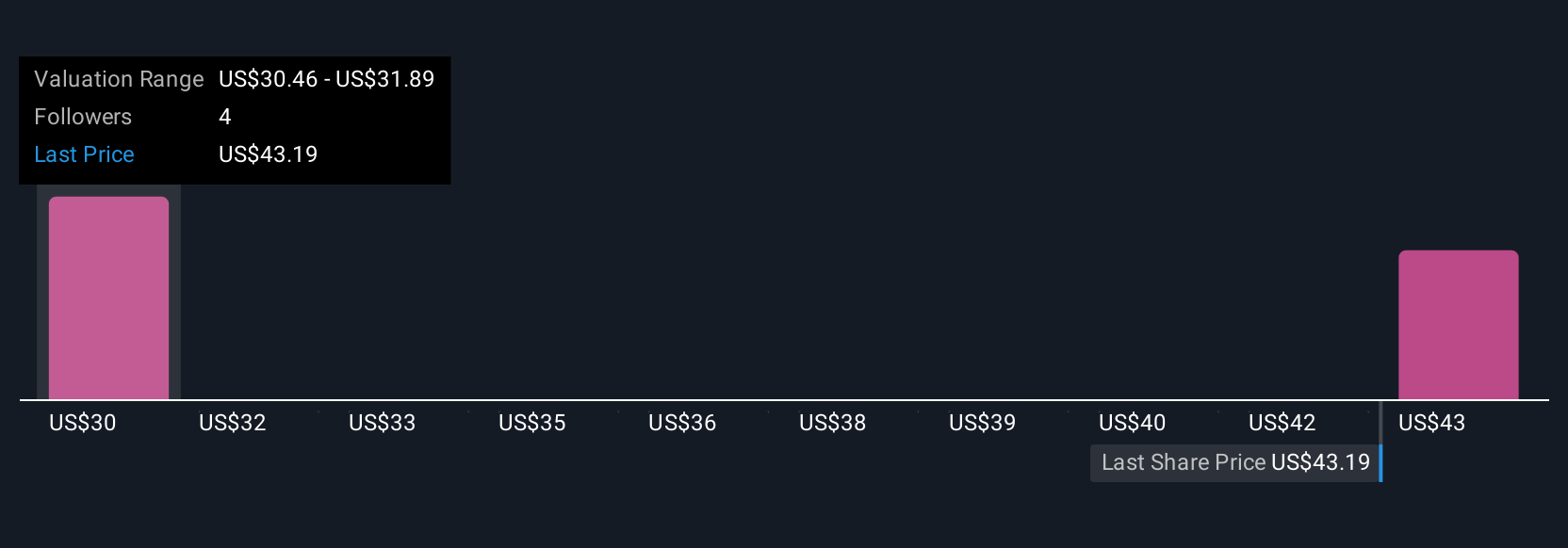

Fair value estimates from the Simply Wall St Community span from US$28.64 to US$48.45, with just two contributors reflecting wide-ranging opinions. While many see growth from FirstEnergy’s grid investments as a driver, community perspectives show sharply different views on future performance, explore several viewpoints before forming your own.

Explore 2 other fair value estimates on FirstEnergy - why the stock might be worth as much as 6% more than the current price!

Build Your Own FirstEnergy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FirstEnergy research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free FirstEnergy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FirstEnergy's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FE

FirstEnergy

Engages in the generation, distribution, and transmission of electricity in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives