- United States

- /

- Electric Utilities

- /

- NYSE:FE

Does FirstEnergy’s 14.5% 2025 Rally Reflect True Value After Grid Modernization Moves?

Reviewed by Bailey Pemberton

- Ever found yourself wondering whether FirstEnergy is actually good value or if the price is just riding recent momentum? You are not alone, and today, we are diving in to get clarity.

- The stock has moved up 14.5% so far this year, with a 38.0% gain over three years and a striking 86.7% return across five years. There is definitely some long-term growth to talk about, even with the stock off a modest 1.5% in the last month.

- Much of the chatter lately traces back to developments in the utilities sector and FirstEnergy's strategic initiatives, including grid modernization efforts and regulatory updates. The attention these moves have attracted helps explain some price fluctuations, as investors respond to shifting perceptions of stability and future upside.

- As for valuation, FirstEnergy scores a 3 out of 6 on our core six-point checklist, highlighting that while some metrics suggest it is undervalued, there are areas that need a closer look. Up next, we will break down how each valuation approach sees the company, and later in the article, we will show you an even smarter way to think about valuation that most investors overlook.

Find out why FirstEnergy's 14.5% return over the last year is lagging behind its peers.

Approach 1: FirstEnergy Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) is a valuation approach that estimates a stock’s intrinsic value based on its future dividend payments. The method works by forecasting how much the company will pay out to shareholders, then discounting those dividends back to today’s dollars to determine what the shares may be worth.

For FirstEnergy, the DDM calculation uses several key inputs: a dividend per share of $1.92, a very high payout ratio of 99.2%, and a return on equity (ROE) of 9.15%. The implied long-term dividend growth rate is just 0.07% per year, according to the model’s formula, which is derived from (1 minus payout ratio) multiplied by ROE. This extremely high payout ratio means the company is distributing the vast majority of its earnings as dividends, leaving little room for organic growth from reinvestment.

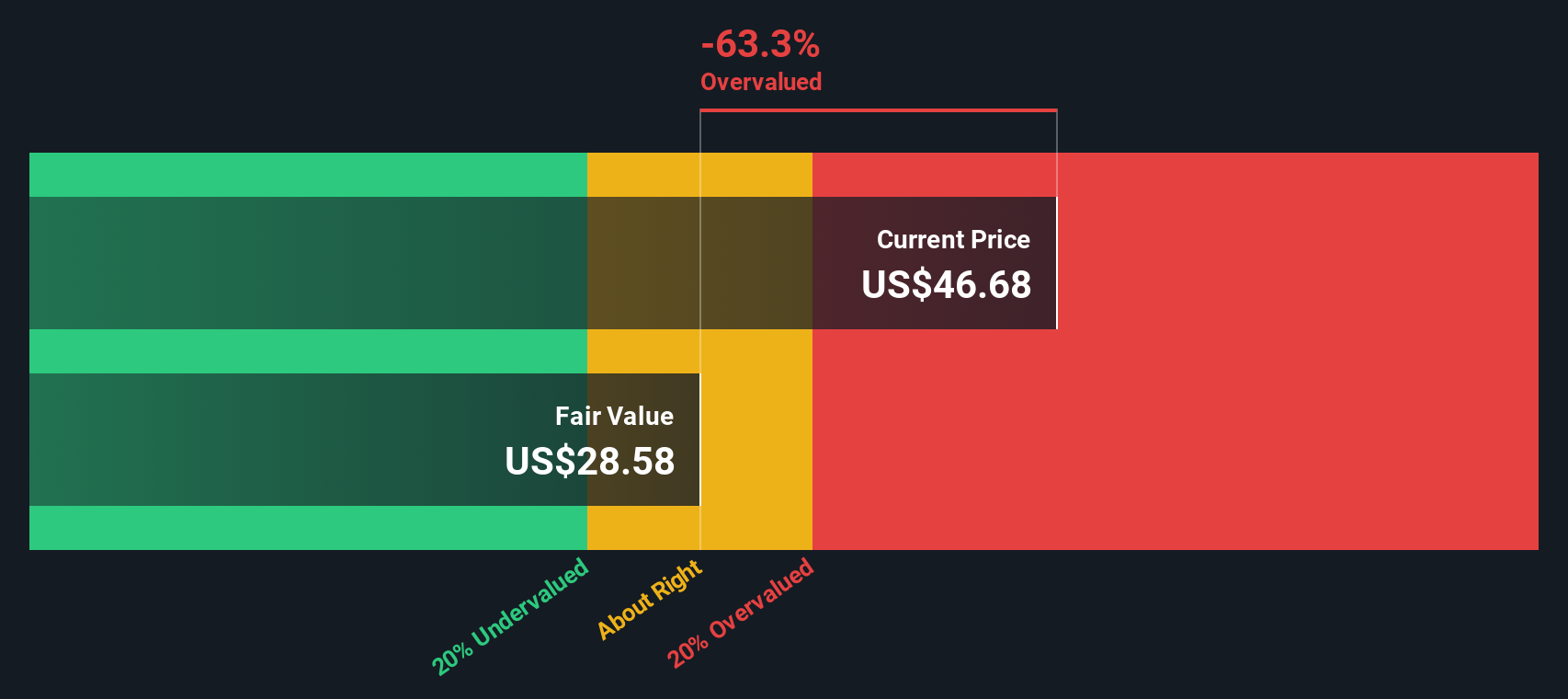

Based on these metrics, the DDM arrives at an intrinsic fair value estimate of $28.61 per share. Comparing this with the current market price, the model finds that FirstEnergy is about 59.7% overvalued on a dividend sustainability basis.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests FirstEnergy may be overvalued by 59.7%. Discover 843 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: FirstEnergy Price vs Earnings

The price-to-earnings (PE) ratio is commonly used to value established, profitable companies like FirstEnergy because it ties a company’s market value to its actual earnings. This makes it a go-to metric for investors aiming to gauge whether a stock is trading at a reasonable price relative to its profit-generating ability.

The definition of what constitutes a "fair" PE ratio can vary, often depending on investor expectations for growth and the perceived risk in the future of the business. Companies with stronger growth prospects or lower risk profiles typically command higher PE multiples, while slower-growing or riskier companies have lower ones.

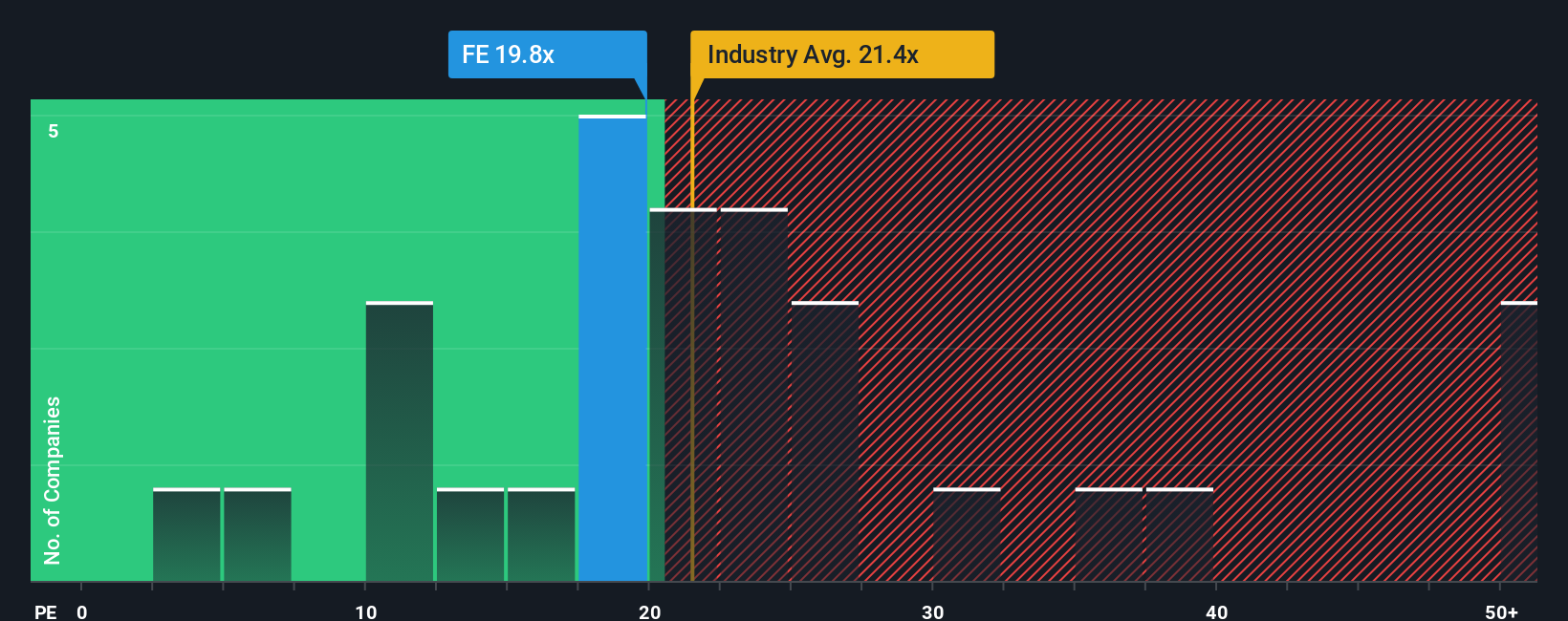

Currently, FirstEnergy trades at a PE ratio of 19.8x. This is just below the peer average of 20.1x and notably below the electric utilities industry average of 21.4x. However, Simply Wall St’s Fair Ratio for FirstEnergy is calculated at 21.9x. The Fair Ratio provides a comparison that incorporates factors like each company’s earnings growth outlook, risk profile, profit margins, industry grouping, and company size, creating a more tailored and reliable benchmark than simple industry or peer averages.

Comparing FirstEnergy’s current PE ratio of 19.8x to its Fair Ratio of 21.9x suggests the stock is offering reasonable value, with current market pricing slightly under the level justified by its underlying strengths and future prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your FirstEnergy Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about a company—it is your perspective on how the business, industry trends, and future performance will play out, grounded in numbers like your own fair value and estimates for future revenues, earnings, and profit margins.

Rather than relying solely on historic ratios or static valuation models, Narratives connect the dots between a company's story, a personalized forecast, and a calculated fair value. This approach puts you in the driver’s seat of your investment decisions. On Simply Wall St’s Community page, this tool is easy to use and trusted by millions of investors, letting you build or browse hundreds of live Narratives for stocks like FirstEnergy.

By comparing your Narrative’s fair value with the current share price, you can quickly see whether you believe it is time to buy or sell. Since these Narratives update dynamically with news and earnings updates, your perspective can always stay current.

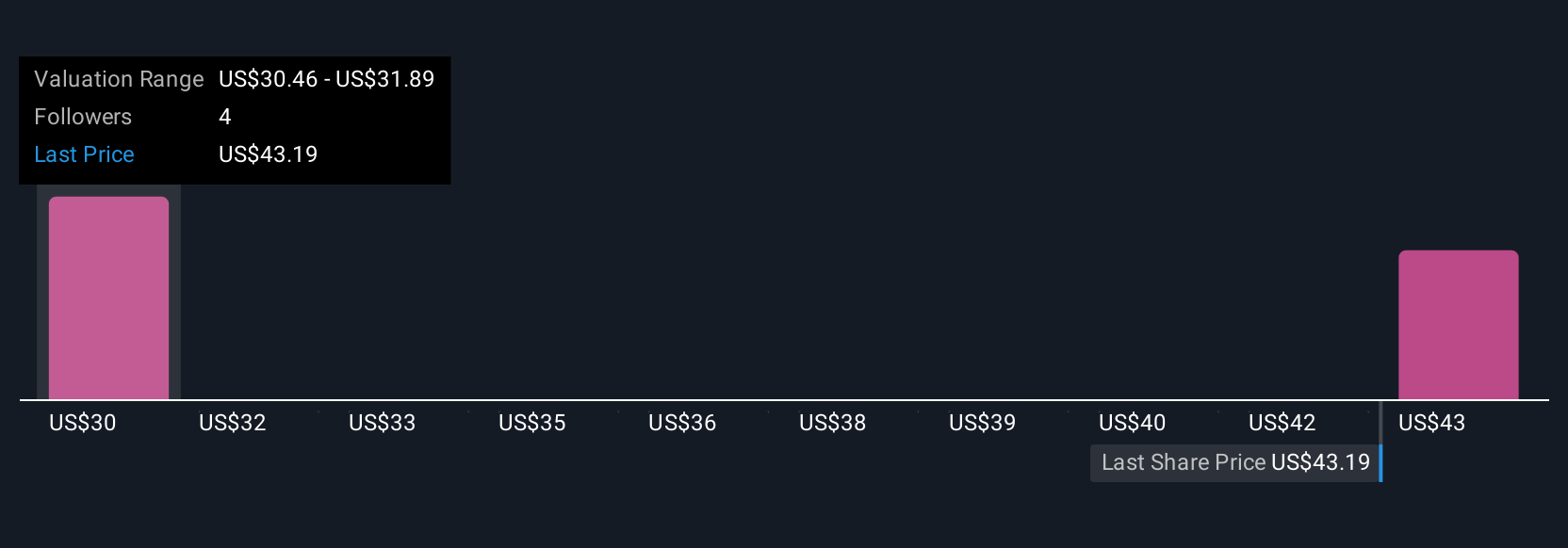

For example, some investors see FirstEnergy’s ambitious infrastructure investment and cash flow discipline setting up for steady profit growth and have projected a fair value as high as $50. Others are more cautious about regulatory, capital, and decarbonization risks, landing closer to $28.61, so the ultimate decision comes down to which story you believe is most likely.

Do you think there's more to the story for FirstEnergy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FE

FirstEnergy

Engages in the generation, distribution, and transmission of electricity in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives