- United States

- /

- Electric Utilities

- /

- NYSE:ETR

R. Lewis Ropp Joins Entergy (ETR) Board, Expanding To 11 Directors

Reviewed by Simply Wall St

Entergy (ETR) has made recent headlines with the election of R. Lewis Ropp as an independent director, expanding the board's expertise in finance and governance. Over the past month, Entergy's shares rose by 5.09%, a move that falls in line with the broader market trends, with the market up 1.5% over the last week. This suggests that any significant impact from Entergy's board changes and dividend announcement would have complemented the general market optimism rather than drastically altering its course alone. Overall, the company's performance can be seen as part of a larger trend of investor confidence amid strong corporate results.

We've spotted 3 possible red flags for Entergy you should be aware of, and 1 of them is significant.

Find companies with promising cash flow potential yet trading below their fair value.

The appointment of R. Lewis Ropp as an independent director, with his expertise in finance and governance, could bolster Entergy's strategic decision-making, potentially enhancing operational efficiencies and governance structures. Over the past five years, the company's total shareholder return, including share price appreciation and dividends, reached a substantial 104.09%, indicating a strong performance over this period. This performance surpasses the one-year return of 16.5% for the US Electric Utilities industry and 17.3% for the overall US market, showcasing Entergy's ability to generate shareholder value in the longer term.

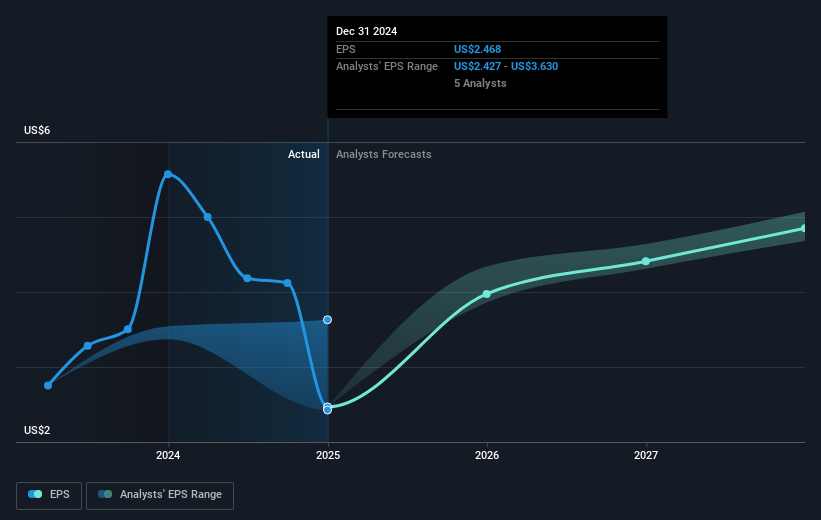

Looking forward, Entergy's recent board changes and dividend announcement may influence investor sentiment and align with the company's focus on industrial sales growth, regulatory approvals, and tax incentives, potentially impacting future revenue and earnings positively. Analysts expect revenues to grow by 8.7% annually, with earnings reaching US$2.3 billion by 2028, assuming project executions proceed as planned. However, reliance on large projects introduces execution risks, which might affect these forecasts if delays occur. Currently, Entergy's share price of US$86.68 is marginally below the consensus price target of US$90.95, indicating room for a slight appreciation if the company meets growth expectations. Tracking these movements against the backdrop of the analyst price target suggests Entergy's shares might be moderately undervalued given its projected growth trajectory and market conditions.

Assess Entergy's future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Entergy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ETR

Entergy

Engages in the production and retail distribution of electricity in the United States.

Average dividend payer low.

Similar Companies

Market Insights

Community Narratives