- United States

- /

- Electric Utilities

- /

- NYSE:ETR

Entergy (ETR): Valuation Spotlight After Rare Insider Share Purchase By Director

Reviewed by Simply Wall St

On November 12, Ralph Ropp, a Director at Entergy (ETR), purchased 1,000 shares of the company according to a recent SEC filing. This stands out as the only insider buy among 25 transactions in the past year, raising some eyebrows on Wall Street and among shareholders.

See our latest analysis for Entergy.

Entergy's share price has enjoyed a robust 26% return year-to-date, with momentum especially visible in the last quarter as shares climbed 8.2%. Alongside a standout total shareholder return of 31% over the past year and more than 100% over five years, it is clear the market has been warming up to Entergy, even amid leadership changes and strategic capital moves such as two recent $600M and $700M fixed-income offerings. With a fresh director on the board and ongoing participation at major utility conferences, investor sentiment appears to be shifting in a positive direction for the long term.

If you're looking to expand your search beyond utilities, now is a great time to discover fast growing stocks with high insider ownership.

With all eyes on Entergy's impressive returns and a rare insider buy, investors are left wondering whether the stock is still undervalued or if the market has fully priced in the company's future growth prospects.

Most Popular Narrative: 7.2% Undervalued

The most popular narrative places Entergy’s fair value at $102.46 per share, about 7.2% above its last close of $95.05. This points to a modest undervaluation, but it’s the assumptions driving this view and not just the upside that warrant attention.

Capital investment of $40 billion over four years (with an expanded pipeline for renewables, grid modernization, and resilience upgrades) is expected to grow the company's rate base and support above-average EPS and earnings growth for several years. Expedited regulatory frameworks and legislative support for economic development, storm cost recovery, and infrastructure riders (especially in Arkansas, Louisiana, and Texas) are likely to accelerate cash flow and enhance earnings consistency, limiting regulatory lag and improving overall credit metrics.

Want to know the growth ingredients powering that bullish price? Future returns hinge on aggressive capital outlays, regulatory tailwinds, and a leap in core financial performance. What are the bets behind these bold figures? Explore what’s driving this narrative’s fair value now. The most surprising numbers are hidden just beneath the surface.

Result: Fair Value of $102.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the picture could shift quickly. Unexpected rate decisions or severe climate events in Entergy’s Gulf South region may challenge even the most bullish outlook.

Find out about the key risks to this Entergy narrative.

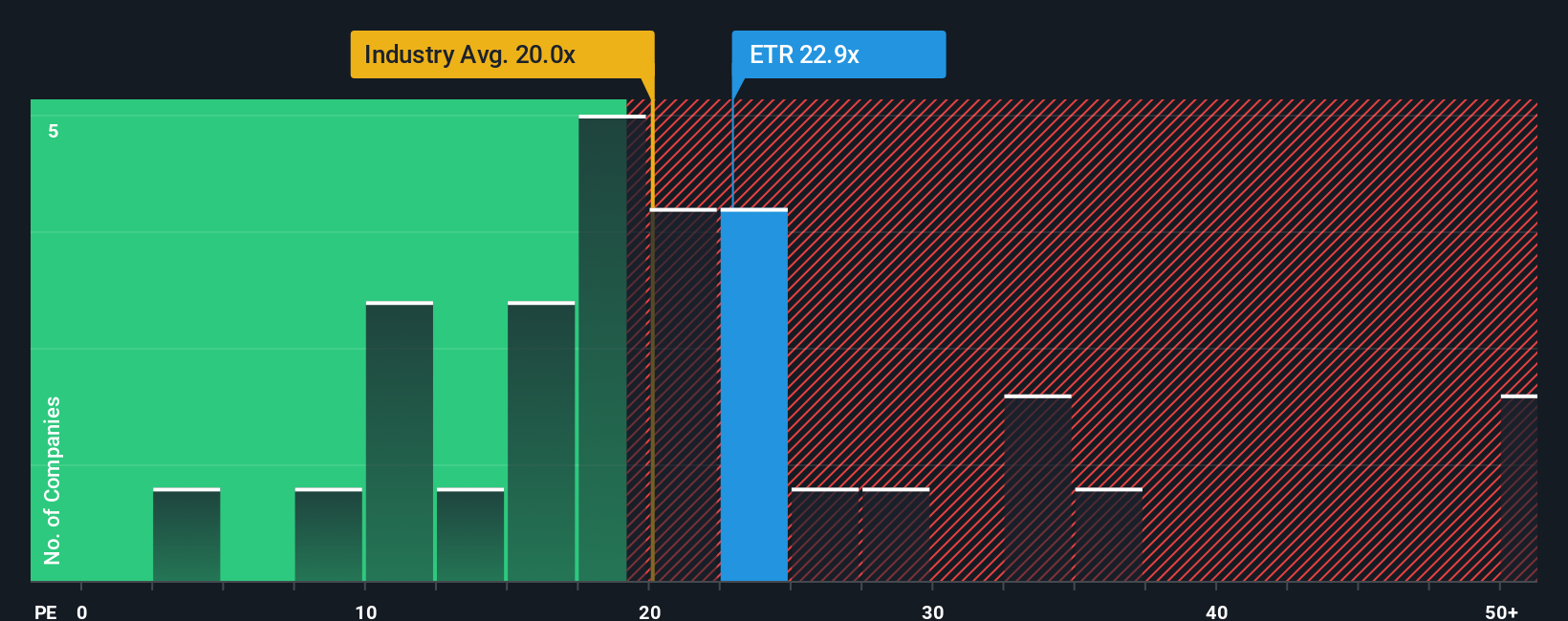

Another View: What Do Earnings Multiples Say?

Looking beyond the narrative-driven fair value, Entergy trades at a price-to-earnings ratio of 23.8x. This level is above its peer average of 19.6x and the US electric utility sector average of 20.7x, and matches its own calculated fair ratio of 23.8x. This suggests limited upside if the market shifts back toward those lower peer or sector levels. Is there enough growth or defensive strength to justify staying at the top end of valuation?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Entergy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 886 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Entergy Narrative

If you'd rather dig deep into the numbers and shape your own perspective, you can craft a personal narrative with all the latest data in just a few minutes. Do it your way

A great starting point for your Entergy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Supercharge your portfolio by acting on the hottest trends. Grab these opportunities before the list fills up and you miss this investment window.

- Unlock high yields and reliable income by tapping into these 16 dividend stocks with yields > 3% with yields over 3% for stable cash flow potential.

- Ride the wave of technological disruption and stay ahead of the curve by accessing these 25 AI penny stocks reshaping industries with artificial intelligence.

- Capitalize on undervalued businesses. Start your search with these 886 undervalued stocks based on cash flows to spot stocks trading below their intrinsic cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Entergy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ETR

Entergy

Engages in the production and retail distribution of electricity in the United States.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives