- United States

- /

- Electric Utilities

- /

- NYSE:ETR

Entergy (ETR) Margin Decline Raises Questions for Growth Narratives

Reviewed by Simply Wall St

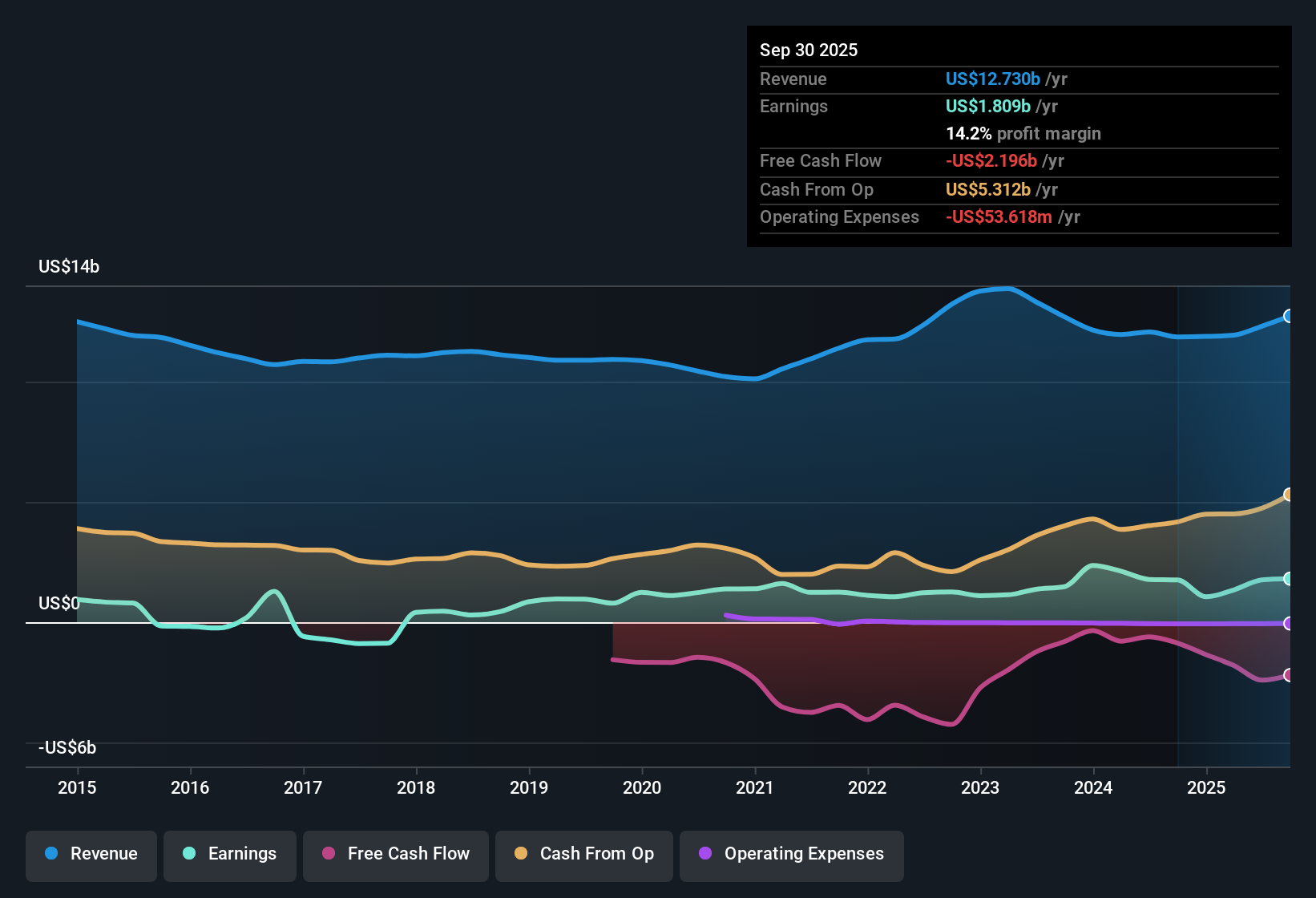

Entergy (ETR) posted earnings growth of 3% in its latest results, bringing its annual earnings growth forecast to 11.59% and revenue growth to 7.1% per year. While these reflect continued gains, both are expected to trail the broader US market’s faster pace, with average annual growth rates of 15.7% for earnings and 10.3% for revenue. Net profit margins slipped slightly to 14.2% compared to 14.8% a year ago, and over the past five years, earnings have grown at an average rate of 6.7% annually.

See our full analysis for Entergy.Next up, we’ll see how these headline numbers stand when measured against the market’s prevailing narratives, with some stories confirmed and others possibly up for debate.

See what the community is saying about Entergy

Profit Margins Set to Rise Despite Heavy Spending

- Analysts are projecting profit margins will grow from 14.3% today to 16.0% in three years, even as Entergy deploys $40 billion in capital investments for grid upgrades and renewables.

- According to the analysts' consensus view, Entergy’s long-term investments are seen as supporting above-average earnings growth and stronger margins, but

- this is offset by concerns about potential financing risks if tax credits or operating cash flow underperform. This could lead to dilution or higher interest costs, both of which could put pressure on the improving margin outlook.

- a history of increasing operational efficiency via technology and cost management suggests Entergy may hold onto margin gains even as overall spending ramps up.

- Curious how analysts see both the promise and pressure in Entergy’s margin story? 📊 Read the full Entergy Consensus Narrative.

Regulatory Support Meets Climate and Cost Risks

- Entergy’s multi-billion-dollar capital plan relies on expedited regulatory frameworks in Arkansas, Louisiana, and Texas to recover storm costs and earn infrastructure returns. However, its heavy asset concentration in the Gulf South exposes the company to major weather and environmental risks.

- Analysts' consensus view notes Entergy is well positioned to capture upside from accelerating industrial expansion and decarbonization policies. At the same time,

- chronic exposure to hurricanes and policy shifts for carbon reduction could result in asset write-downs or increased costs, threatening earnings stability and long-term growth prospects.

- unexpected regulatory or rate case outcomes, especially in core states, could slow investment recovery and inject volatility into both revenue and profits.

Valuation: Premium to Industry, Discount to Peers

- At a price-to-earnings ratio of 23.7x, Entergy trades above the US electric utility industry average of 21.2x, but below the 32.1x average for its peers. This reflects a valuation that straddles industry caution and relative peer optimism.

- The analysts' consensus view suggests the current share price of $96.05 sits just below their consensus price target of $102.46, signaling that while Entergy appears fairly valued, future upside may depend on hitting aggressive revenue and margin expansion targets, especially in an environment where policy or financing headwinds could quickly erode these advantages.

- the $72.33 DCF fair value underlines the importance of verifying whether Entergy's premium is justified by its long-term growth and risk balance.

- the narrow gap between consensus target and share price shows that analysts are divided on whether market optimism is well-placed, given the company’s aggressive capital plans.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Entergy on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the numbers? Share your unique perspective and shape your narrative in just a few minutes. Do it your way

A great starting point for your Entergy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Entergy faces uncertainty from aggressive capital spending, tight margin forecasts, and exposure to policy or financing headwinds that could undermine its growth and valuation.

If you’re looking for sustainable earnings with less drama, take a look at stable growth stocks screener (2112 results) for companies consistently delivering stable results year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Entergy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ETR

Entergy

Engages in the production and retail distribution of electricity in the United States.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion