- United States

- /

- Electric Utilities

- /

- NYSE:ETR

Entergy (ETR): Evaluating Valuation After Securing Google Data Center Power Deal

Reviewed by Kshitija Bhandaru

Entergy's recent market momentum appears closely tied to its announcement that it will supply electricity to Google’s upcoming $4 billion data center in Arkansas. This move highlights how regulated utilities like Entergy are tapping into new growth, fueled by rising demand from large-scale AI infrastructure projects.

See our latest analysis for Entergy.

Momentum has clearly been picking up for Entergy, with the share price advancing 26% year-to-date and total shareholder return hitting nearly 49% over the past year. Recent announcements, such as the Google data center partnership and ongoing talks around innovative nuclear technology, have reinforced optimism about Entergy’s future growth potential. This has positioned the company in the spotlight for investors seeking dependable returns.

If the surge in utility stocks has you searching for other bright spots, now is a great time to discover fast growing stocks with high insider ownership

Yet with shares at all-time highs and growing optimism around data center partnerships, investors must ask whether Entergy is undervalued relative to its future prospects or if the market has already priced in the next leg of growth.

Most Popular Narrative: Fairly Valued

Entergy’s most followed narrative sees its fair value coming in just above the last closing price. That suggests the market is largely aligned with analysts’ outlook, but a slight premium is built in as investors weigh emerging growth levers against underlying risks.

Substantial long-term electricity demand growth is expected from industrial development, population migration to the Gulf South, and large-scale data center expansions in Entergy's service territory. This could potentially drive robust load growth and higher regulated revenues.

How are analysts getting to this number? Their blueprint is built on aggressive investment, expanding profit margins, and a projected pricing power that is not typical in the sector. Want to see which financial levers and growth assumptions shape this valuation? Unpack the drivers behind Entergy's fair value and decide if the consensus matches your expectations.

Result: Fair Value of $95.08 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a sudden spike in regulatory hurdles or unplanned capital needs could quickly test investors’ optimism and shift sentiment around Entergy’s growth outlook.

Find out about the key risks to this Entergy narrative.

Another View: What About the SWS DCF Model?

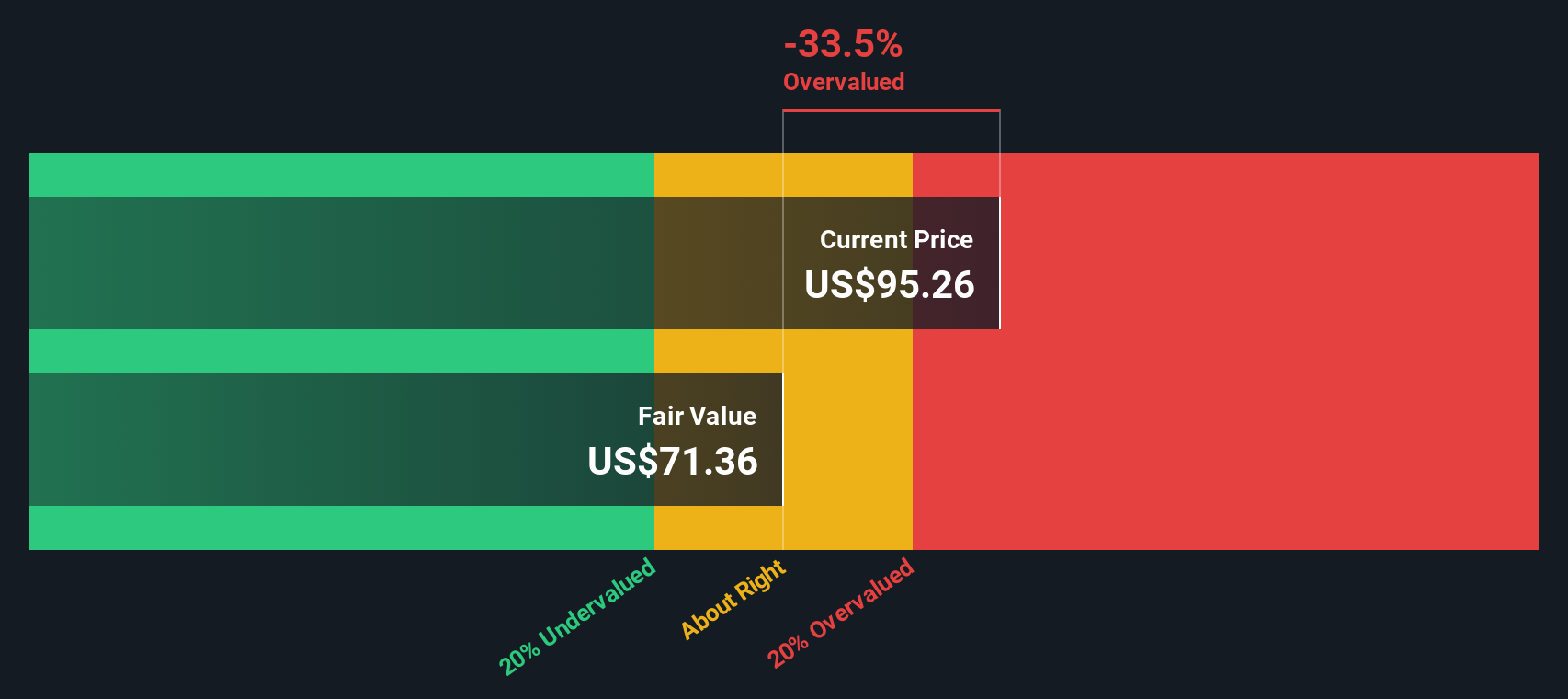

While multiples suggest Entergy is fairly valued, the SWS DCF model takes a different approach by forecasting future cash flows. According to this method, Entergy appears overvalued at its current price. Does this cash flow calculation point to hidden risks, or does it miss upcoming growth drivers?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Entergy Narrative

If you want to take a different view or prefer to dig into the numbers on your own, you can build a personalized narrative in just a few minutes, Do it your way

A great starting point for your Entergy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take charge of your portfolio and seek out tomorrow’s winners. Don’t let the next big opportunity slip by while others make the move first.

- Unlock potential high-yield opportunities with these 19 dividend stocks with yields > 3%, offering reliable income streams in a shifting market.

- Spot major innovation trends as you tap into these 24 AI penny stocks, pushing boundaries in artificial intelligence and automation.

- Secure long-term growth by jumping on these 891 undervalued stocks based on cash flows, where smart investors find companies the market may be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Entergy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ETR

Entergy

Engages in the production and retail distribution of electricity in the United States.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion