- United States

- /

- Electric Utilities

- /

- NYSE:EIX

Edison International (EIX) Profit Margin Doubles on One-Off Gain, Challenging Recent Bull Narratives

Reviewed by Simply Wall St

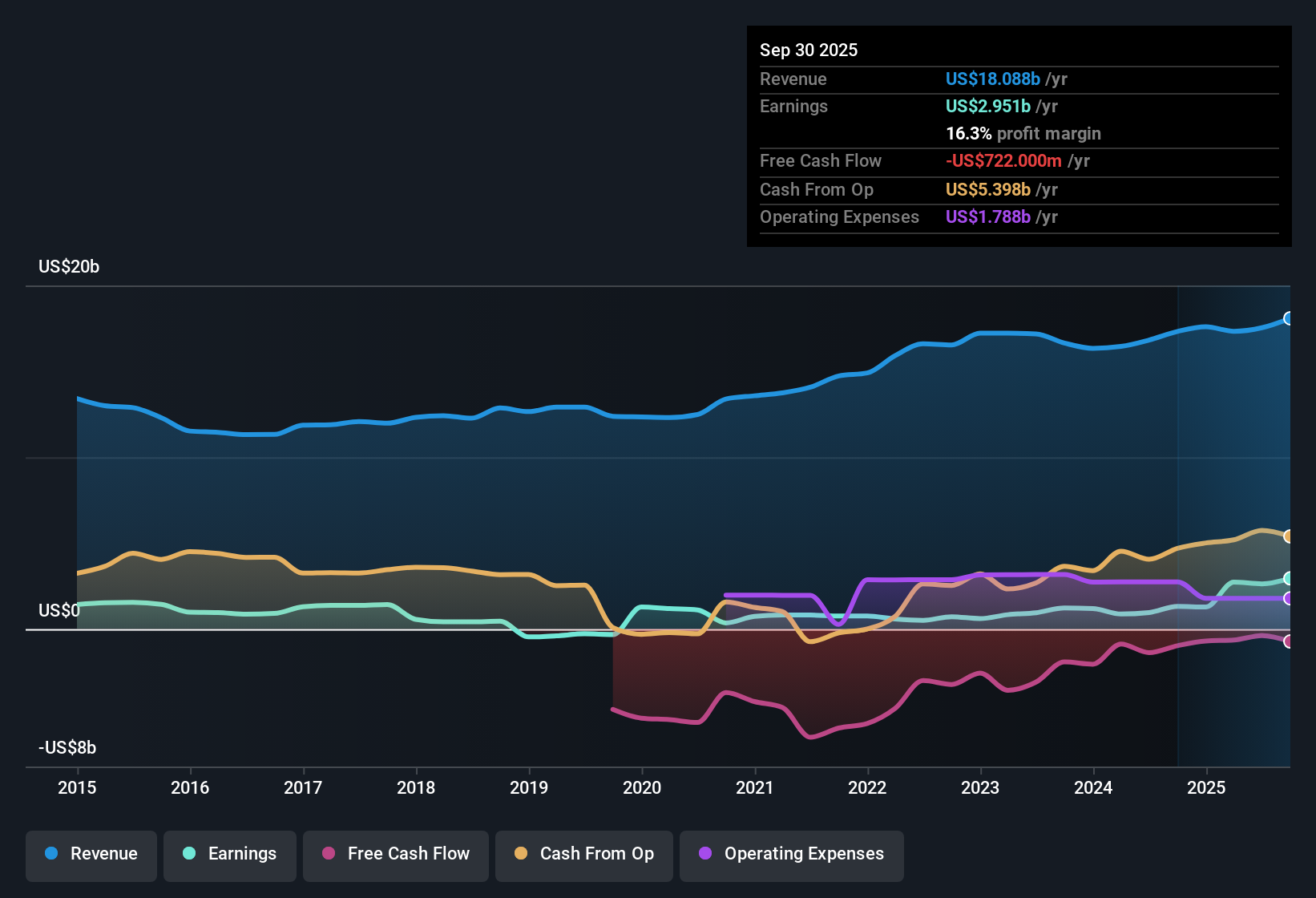

Edison International (EIX) delivered a net profit margin of 16.3% for the most recent period, up sharply from 7.6% last year. EPS surged by 123.2% over the past year, extending a five-year trend of 32.6% annual earnings growth. Results were boosted by a one-off gain of $679.0 million. While revenue is forecast to grow at 4.6% per year, slower than the US market's projected 10.2%, the company faces investor questions about the sustainability of its strong recent performance, as earnings are expected to decline by 3.9% per year over the next three years.

See our full analysis for Edison International.Next up, we’ll see how these headline results measure up against the current narratives in the market. Sometimes the numbers back up the sentiment, and sometimes they flip the story on its head.

See what the community is saying about Edison International

One-Off Gain Drives Margin Spike

- A $679 million one-off gain inflated Edison International's net profit margin to 16.3%, a sharp increase from last year's 7.6%. Going forward, profit margins are forecast to shrink from 15.0% today to 11.8% in three years, indicating that margins may not stay this strong as one-off impacts fade.

- Analysts’ consensus view highlights that, while near-term margins appear impressive, large non-recurring items like the recent gain cast doubt on earnings sustainability.

- Consensus notes that stable cash flows and dividends are supported by regulatory advances. At the same time, persistent wildfire and climate risks still threaten profitability.

- Ongoing investments in wildfire mitigation and modernization could support long-term margins. However, the consensus expects profit margins to gradually decline as these costs rise.

- The current margin spike raises questions among analysts about quality of earnings and long-term profit durability. This fuels debate over how much recent strength can be relied on for future growth.

- Analysts warn that continued use of large one-off items could cloud true operating performance and make future earnings less predictable.

- Rate recovery advances have reduced some liabilities. However, new risks from climate and regulation could offset those gains in coming years.

See how the current margin jump fits into the full Edison International story in our market consensus narrative and detailed breakdown. 📊 Read the full Edison International Consensus Narrative.

Valuation Still Lags Industry Peers

- Edison International’s P/E ratio of 7.2x is far below the US electric utilities industry (21.3x) and its peer average (23.5x). It is also below the forward P/E multiple analysts expect (13.0x) for 2028, even as the company’s growth is projected to slow.

- Consensus narrative points out that, despite this low multiple and a share price of $55.39, analysts believe the stock is undervalued and have set a price target of $66.55, 20% above its current level.

- The current valuation suggests investors may be underestimating long-term earnings resilience amid heavy investment and decarbonization trends.

- On the other hand, consensus notes that lower valuations may reflect justified caution due to slower expected growth and persistent wildfire risks.

Revenue Growth Under Policy Tailwinds

- Revenue is forecast to grow 4.6% annually, less than half the overall US market’s 10.2% outlook. However, policy-driven electrification—including EV adoption and grid-dependent building upgrades—keeps growth positive and supports large-scale investment in modernization and renewables.

- Consensus narrative states grid investment and decarbonization policy provide Edison International clear, inflation-protected revenue opportunities.

- Population and urbanization trends in Southern California may drive sustained demand. This supports the company’s multi-year EPS guidance and ability to modernize.

- However, analysts also caution that affordability reforms could challenge allowable returns, and that high capital spending may outpace cost recovery if regulatory momentum stalls.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Edison International on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on these results? Craft your version of the narrative in just a few minutes and share your view. Do it your way

A great starting point for your Edison International research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Although Edison International’s recent profits were boosted by one-off gains, analysts expect earnings and margins to decline as regulatory and wildfire costs mount.

If you want to focus on companies delivering steady and consistent results, use our stable growth stocks screener (2122 results) to find those with reliable revenue and earnings expansion across different cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Edison International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EIX

Edison International

Through its subsidiaries, engages in the generation and distribution of electric power.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives