- United States

- /

- Electric Utilities

- /

- NYSE:EIX

Edison International (EIX): Evaluating Valuation as Analysts Project Higher Revenue Ahead of Earnings Release

Reviewed by Simply Wall St

Edison International (EIX) is drawing investor focus this week as the company prepares to announce its quarterly earnings on October 28. Analysts expect an 8% revenue boost compared to last year, which is fueling optimism about ongoing growth.

See our latest analysis for Edison International.

Despite this earnings optimism, Edison International's share price has slipped 1.3% in the past week and remains down nearly 29% year-to-date, reflecting ongoing market caution. Still, the stock has delivered a 24.6% total return over five years. This underscores its resilience over the long haul even as near-term momentum has yet to fully recover.

If you're watching how utilities weather shifts in sentiment, it could be a great time to broaden your perspective and discover fast growing stocks with high insider ownership

With shares down this year but analysts projecting strong revenue growth and a sizable upside to their price target, investors are left to wonder if this is a compelling entry point, or if the market has already factored in future gains.

Most Popular Narrative: 15.5% Undervalued

The prevailing narrative sees Edison International as notably undervalued compared to its last close, with the perceived fair value almost $10 above the current market price. Recent increases in revenue growth and earnings projections appear to be tipping the scales.

Policy-driven increases in electrification, particularly accelerated electric vehicle adoption and grid-dependent building decarbonization, are expected to drive sustained long-term load growth within SCE's service area. This would support higher grid usage and long-term revenue expansion. Significant state and federal investment, along with policy momentum for decarbonization, will underwrite large-scale grid modernization and renewable energy integration projects. This is expected to provide Edison International with stable, above-inflation capital expenditure opportunities and grow its regulated rate base, supporting earnings and rate base-driven revenue growth.

Curious what ambitious financial targets are fueling this premium price tag? The crux of the narrative hinges on aggressive expansion assumptions and a controversial profit outlook. Want to discover which specific earnings and revenue benchmarks analysts are counting on? Analyze the numbers driving this call for yourself.

Result: Fair Value of $67.37 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent wildfire liabilities or sudden regulatory setbacks could quickly undermine Edison International's growth outlook and challenge the current valuation narrative.

Find out about the key risks to this Edison International narrative.

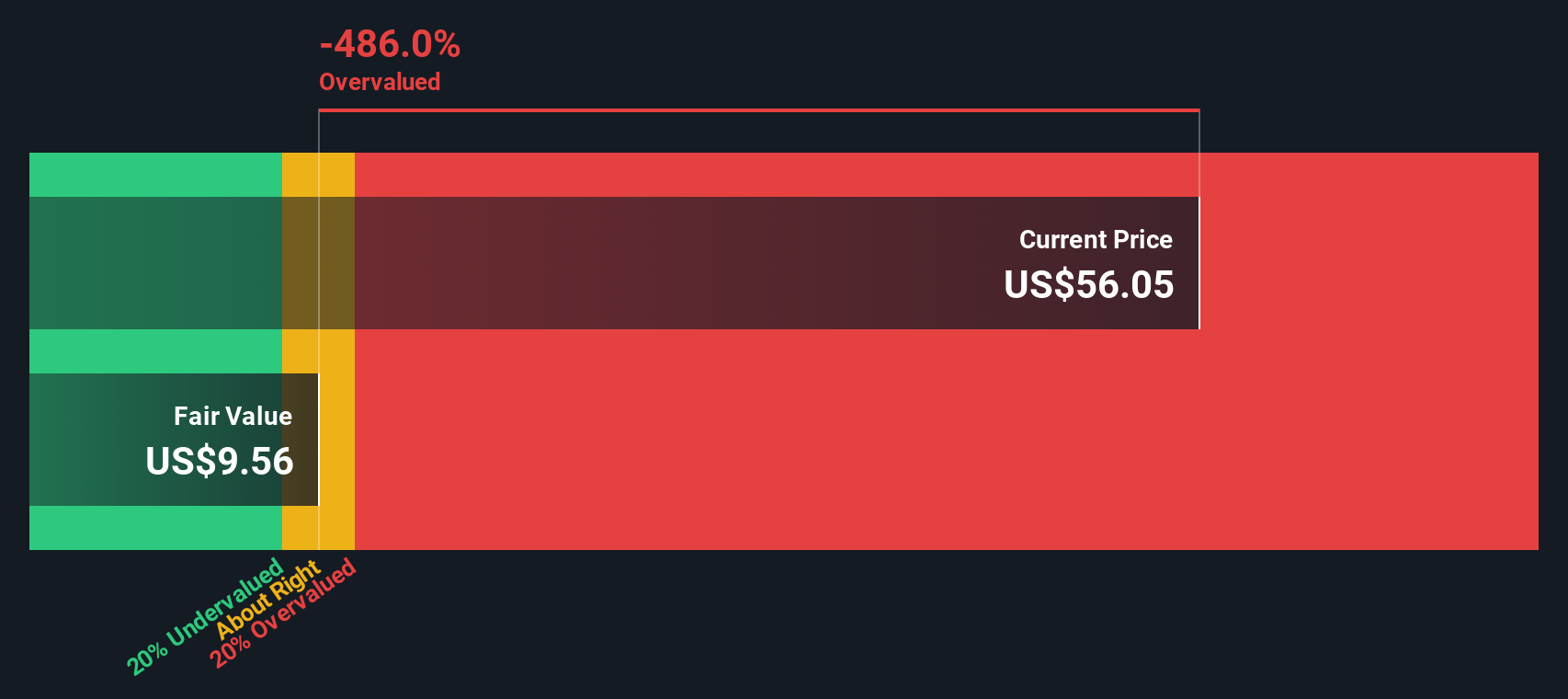

Another View: SWS DCF Model Suggests a Cautious Stance

While the market narrative sees Edison International as undervalued, our SWS DCF model actually indicates the shares trade well above fair value, with a large gap between the share price and discounted cash flow value. This casts doubt on whether market optimism could be putting investors at risk if future growth falls short.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Edison International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Edison International Narrative

If you see things differently, or want to delve deeper on your own terms, it's quick and easy to build your own perspective in just a few minutes. Do it your way

A great starting point for your Edison International research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great opportunities slip past you. Tap into smart, data-driven stock ideas handpicked by Simply Wall Street and give yourself the edge.

- Uncover reliable income streams by checking out these 19 dividend stocks with yields > 3% with consistent yields that outpace the market average.

- Spot tomorrow’s tech standouts when you size up the potential of these 27 AI penny stocks driving automation and artificial intelligence innovation worldwide.

- Secure an advantage by scoping out these 869 undervalued stocks based on cash flows that others are overlooking. This can help you position yourself for potential upside as value emerges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Edison International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EIX

Edison International

Through its subsidiaries, engages in the generation and distribution of electric power.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives