- United States

- /

- Electric Utilities

- /

- NYSE:EIX

Edison International (EIX): Evaluating the Latest Valuation After Legal Pressures and Wildfire Liability Concerns

Reviewed by Simply Wall St

Edison International (EIX) finds itself in the spotlight as investors brace for the company’s upcoming quarterly earnings, increased legal scrutiny over wildfire liabilities, and a new class action lawsuit challenging its wildfire risk disclosures.

See our latest analysis for Edison International.

After a tough few months of legal and operational headwinds, Edison International’s stock price has clawed back some ground in recent weeks, up more than 10% over the last 90 days. Even with that short-term momentum, the year-to-date share price return stands at -28%. The total shareholder return over five years has managed to stay in positive territory at roughly 26%. This suggests that, despite ongoing risks and uncertainties, long-term investors have still come out ahead. Sentiment remains cautious as the market digests news around wildfires and litigation.

If all this action around utilities has you watching for fresh opportunities, now’s the perfect time to check out fast growing stocks with high insider ownership.

This raises the question: Is Edison International trading at a bargain given recent setbacks, or has the market already adjusted for future risks and opportunities, leaving little room for upside?

Most Popular Narrative: 13% Undervalued

With Edison International closing at $57.65 and the most widely followed narrative fair value set at $66.44, some analysts see a notable gap between price and potential. This difference centers on assumptions of robust long-term demand, infrastructure growth, and regulatory support that could significantly shape future results.

Significant state and federal investment, along with policy momentum for decarbonization, will underwrite large-scale grid modernization and renewable energy integration projects. These factors provide Edison International with stable, above-inflation capital expenditure opportunities and grow its regulated rate base, supporting earnings and rate base-driven revenue growth.

Want to know how ambitious infrastructure plans and rising demand forecasts could drive Edison’s valuation higher? The narrative is packed with bold projections on revenue expansion, margin trends, and future earnings that challenge current price levels. See which key numbers and forward-looking assumptions power that $66.44 estimate; this analysis could surprise you.

Result: Fair Value of $66.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent wildfire liabilities or shifts in California’s regulatory climate could quickly undermine the optimistic outlook that many analysts project for Edison International.

Find out about the key risks to this Edison International narrative.

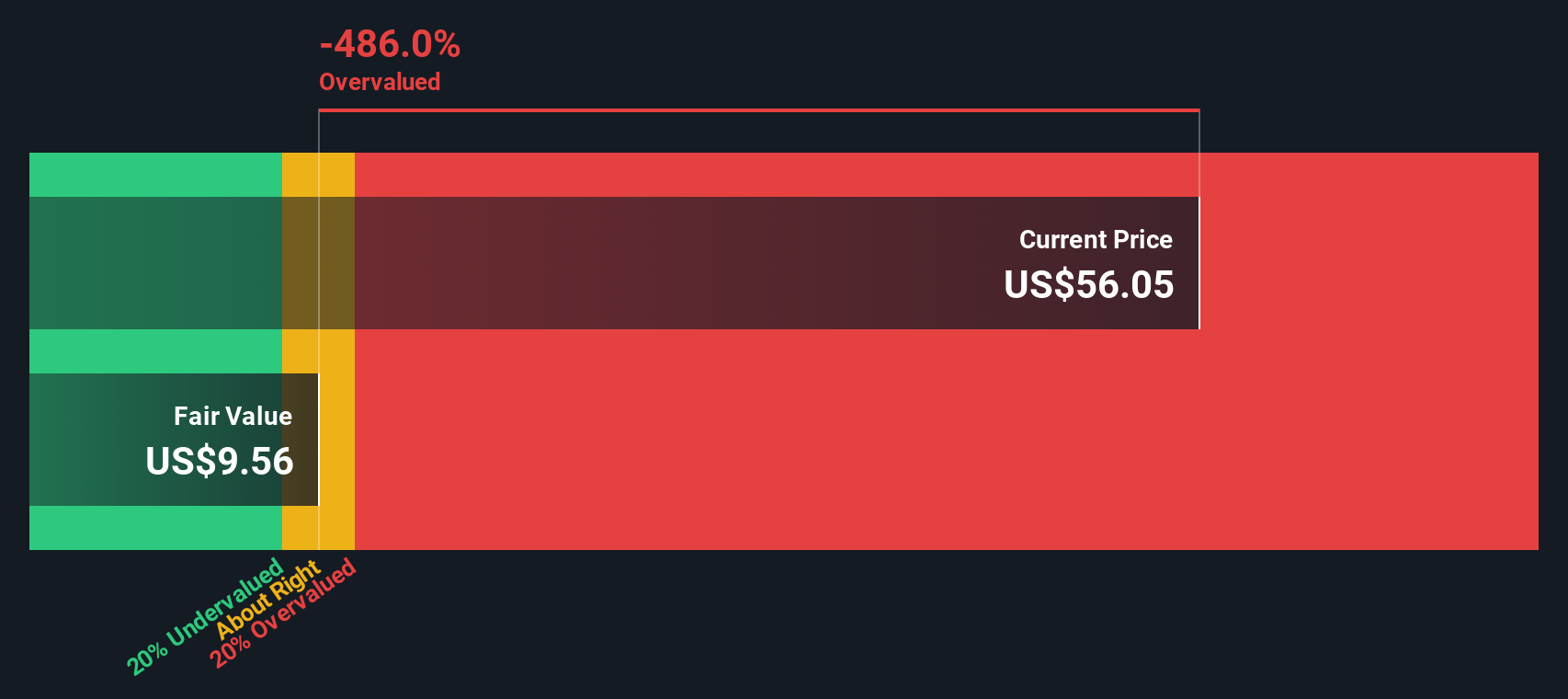

Another View: Our DCF Model Sends a Stark Warning

While traditional valuation suggests Edison International is trading well below its fair value, our SWS DCF model offers a far more conservative perspective. According to this approach, the stock currently sits well above our calculated fair value, hinting at possible overvaluation if future growth falls short. Could the true worth of EIX be much lower than bulls believe?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Edison International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Edison International Narrative

If you see things differently or want to analyze the numbers firsthand, it takes less than three minutes to build your own perspective with Do it your way.

A great starting point for your Edison International research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your search to one company when you could be building smarter, future-ready positions today. Exceptional opportunities are always surfacing for those who take action. Don’t miss your advantage.

- Uncover new potential by reviewing these 874 undervalued stocks based on cash flows that are trading at a discount thanks to strong cash flows and overlooked fundamentals.

- Capture high yields and safeguard your portfolio by examining these 17 dividend stocks with yields > 3% with stable payouts and solid financial footing.

- Tap into breakthrough medical innovation by scanning these 33 healthcare AI stocks powering the future of healthcare and AI integration.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Edison International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EIX

Edison International

Through its subsidiaries, engages in the generation and distribution of electric power.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives