- United States

- /

- Electric Utilities

- /

- NYSE:DUK

Duke Energy (DUK): Fresh Analyst Upgrades and Expansion Plans Spark New Valuation Debate

Reviewed by Simply Wall St

Duke Energy (DUK) is seeing renewed investor interest after several major institutions reaffirmed their favorable outlook and raised expectations for the stock. The company's ongoing $87 billion expansion plans, particularly its moves into data center markets, are driving this positive sentiment.

See our latest analysis for Duke Energy.

Momentum has been building for Duke Energy, with its share price climbing 18.1% year-to-date and sitting at $127.37. Its 12.7% one-year total shareholder return and new dividend affirmations highlight the stock’s resilience and solid income profile. Recent executive changes and the ongoing $87 billion expansion into data center markets have also contributed to the sense that Duke is positioning itself for both steady returns and structural growth over the long run.

If Duke’s growth ambitions have you thinking bigger, now’s a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

That momentum sets the stage for the key question investors face now: is Duke Energy undervalued with room to run, or is the market already pricing in its future growth and transformation?

Most Popular Narrative: 7.4% Undervalued

Duke Energy’s fair value according to the most closely followed narrative sits above the last close price, implying investors could be missing hidden upside. With improved growth projections and a higher earnings outlook, fresh optimism is fueling this story.

Major economic development wins, paired with accelerated migration and manufacturing demand in Duke's service territory, are expected to drive robust, multi-year load and volume growth. This would support higher revenues and long-term EPS growth. Supportive state and federal legislation, such as the Power Bill Reduction Act in NC and the Energy Security Act in SC, streamlines cost recovery for new generation and grid investments. This could reduce regulatory lag and improve cash flow and earnings stability over the next decade.

Want to know what’s fueling this optimism? The numbers behind this narrative hint at rising profit margins, new growth engines, and aggressive future assumptions. Intrigued by what’s driving such a bullish call? Dive into the details to see which projections make up the real bull case and just how ambitious those targets really are.

Result: Fair Value of $137.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, greater adoption of customer-owned solar or rising capital costs could slow Duke’s growth and challenge expectations for earnings and valuation improvements.

Find out about the key risks to this Duke Energy narrative.

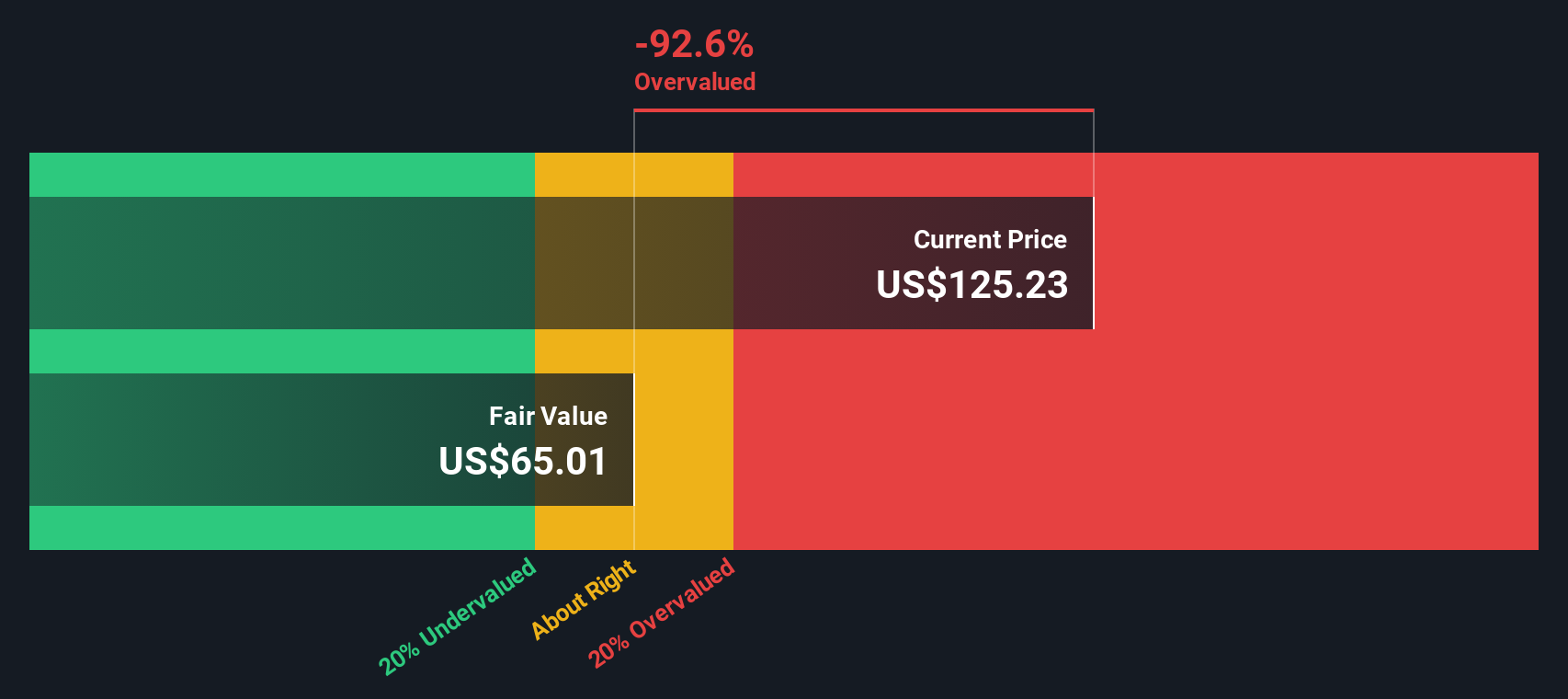

Another View: SWS DCF Model Challenges the Optimism

While the consensus view sees Duke Energy as undervalued based on earnings growth and multiples, our SWS DCF model presents a different perspective. According to this method, the stock is currently trading above estimated fair value, which suggests future cash flows may not fully justify the current price. Could the market be a little too enthusiastic, or is something important being missed?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Duke Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Duke Energy Narrative

If you see the story differently or want to dig into the numbers on your own, you can start building your own take on Duke Energy in just a few minutes. Do it your way.

A great starting point for your Duke Energy research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Take your next step with confidence. Handpick compelling stocks that match your interests and stay a step ahead of the crowd by using these powerful tools:

- Supercharge your portfolio with reliable income by targeting companies offering strong yields via these 17 dividend stocks with yields > 3%.

- Catch the wave of artificial intelligence innovation, as industry leaders race ahead. See which businesses are breaking ground through these 27 AI penny stocks.

- Capitalize on value by identifying hidden gems trading below their intrinsic worth, all with the help of these 876 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DUK

Duke Energy

Through its subsidiaries, operates as an energy company in the United States.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives