- United States

- /

- Electric Utilities

- /

- NYSE:DUK

Duke Energy (DUK): Assessing Valuation After AI-Driven Power Demand, NC Rate Hike Requests and Planned Utility Merger

Reviewed by Simply Wall St

Duke Energy (DUK) just gave investors a lot to chew on, pairing sizable North Carolina rate hike requests with a planned utility merger and tax driven margin boosts, all amid accelerating AI data center demand.

See our latest analysis for Duke Energy.

At a share price of $115.56, Duke’s roughly 7 percent year to date share price return and 10 percent one year total shareholder return suggest steady, not euphoric, momentum as investors weigh AI driven demand, pending rate cases and recent finance leadership changes.

If this AI driven power story has your attention, it could be a good moment to scan other high growth tech and AI stocks through high growth tech and AI stocks and see what else fits your watchlist.

Yet with revenue and earnings steadily climbing, shares still trading at a sizable discount to analyst targets, and AI linked demand reshaping Duke’s outlook, is this a rare value entry point or is future growth already priced in?

Most Popular Narrative: 15.1% Undervalued

With Duke Energy’s fair value pegged near $136 against a $115.56 last close, the dominant narrative frames today’s price as lagging its long term earnings power.

Supportive state and federal legislation such as the Power Bill Reduction Act in NC and the Energy Security Act in SC streamlines cost recovery for new generation and grid investments, reducing regulatory lag and improving cash flow and earnings stability over the next decade. Significant infrastructure and grid modernization investment, for example over $4 billion incremental CapEx in Florida, is positioned to capitalize on growing needs for digitalization and grid resilience, enabling Duke to enhance operational efficiency and reliability, which benefits both net margins and future rate base growth.

Curious how steady, mid single digit growth projections and richer future margins can still justify a premium style multiple for a regulated utility heavyweight, even before AI demand fully lands? The narrative reverse engineers that higher fair value from a detailed earnings runway and a surprisingly ambitious profit profile. Want to see the assumptions that connect today’s price to that destination?

Result: Fair Value of $136.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, faster than expected distributed solar adoption or tougher rate decisions could cap Duke’s load growth, squeeze returns, and challenge today’s upbeat valuation assumptions.

Find out about the key risks to this Duke Energy narrative.

Another Lens On Value

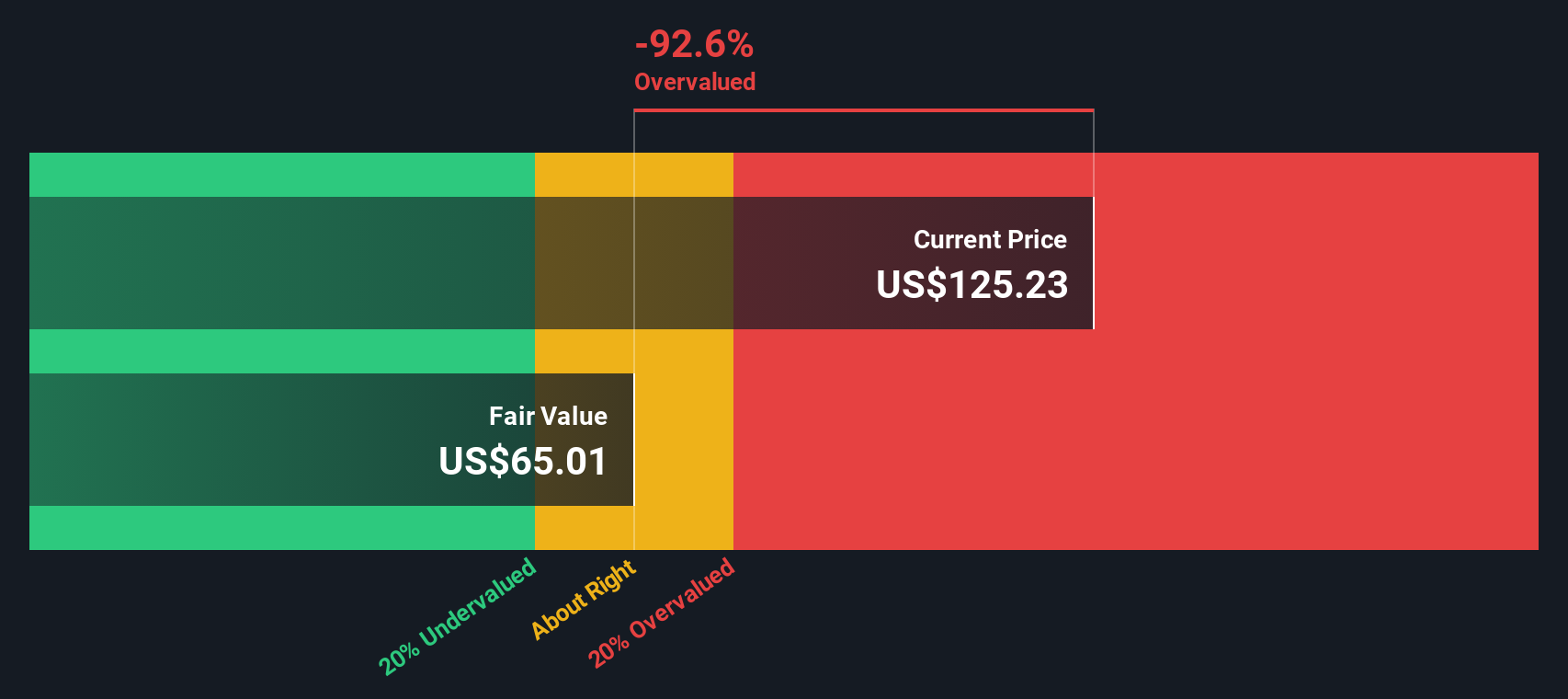

Our SWS DCF model paints a far cooler picture, putting fair value near $63 per share, well below Duke’s $115.56 price. That implies the market might already be baking in richer growth and AI upside than conservative cash flow math supports, or it raises the question of whether the model is too harsh on a long lived utility.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Duke Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Duke Energy Narrative

If the current story does not quite line up with your own view, dive into the numbers yourself and build a personalized thesis in minutes: Do it your way.

A great starting point for your Duke Energy research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, lock in your next watchlist candidates by scanning powerful screeners that surface opportunities most investors overlook and position you ahead of the crowd.

- Capture early stage potential by targeting quality up and comers using these 3632 penny stocks with strong financials with stronger balance sheets than typical speculative names.

- Capitalize on accelerating digital transformation by focusing on these 29 healthcare AI stocks that blend resilient demand with cutting edge innovation.

- Grow your income stream by zeroing in on these 12 dividend stocks with yields > 3% that combine meaningful yields with solid underlying fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DUK

Duke Energy

Through its subsidiaries, operates as an energy company in the United States.

Proven track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion