- United States

- /

- Other Utilities

- /

- NYSE:DTE

DTE Energy (DTE): Assessing Valuation as Long-Term Growth Meets Recent Share Price Shift

Reviewed by Simply Wall St

See our latest analysis for DTE Energy.

DTE Energy’s share price has taken a small dip in the past month, but that follows a solid rally earlier in the year. While momentum has cooled a bit lately, DTE still boasts a year-to-date share price return of 13.2 percent and a one-year total shareholder return of 16.5 percent, reflecting durable long-term growth.

If you’re keeping an eye out for more steady performers or new opportunities, why not broaden your search and discover fast growing stocks with high insider ownership

With DTE Energy maintaining healthy growth metrics and trading close to analysts’ targets, the key question is whether the current valuation leaves room for upside or if the market has already factored in future gains.

Most Popular Narrative: 8.3% Undervalued

Compared to DTE Energy's last close at $137.08, the most-followed narrative points to a fair value nearly $12 higher. This reflects upbeat long-term financial assumptions and sector tailwinds.

A major upcoming catalyst for DTE is the rapid expansion in electricity demand being driven by hyperscale data centers. There are 3 gigawatts of advanced negotiations and an additional 4 gigawatts in the pipeline. These loads, operating at nearly 90% capacity factors, will materially increase revenues and provide significant headroom for rate growth while improving overall system load factor and grid utilization.

Want to know which financial levers power that higher fair value? The narrative hides a growth story built on expanding profit margins and a future earnings multiple that rivals industry leaders. The precise numbers behind these projections might surprise you. See exactly what makes analysts so optimistic about the road ahead.

Result: Fair Value of $149.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, major grid investments or unexpected regulatory hurdles could curb margin improvement and slow earnings growth. This could shift investor sentiment despite recent optimism.

Find out about the key risks to this DTE Energy narrative.

Another View: Discounted Cash Flow Perspective

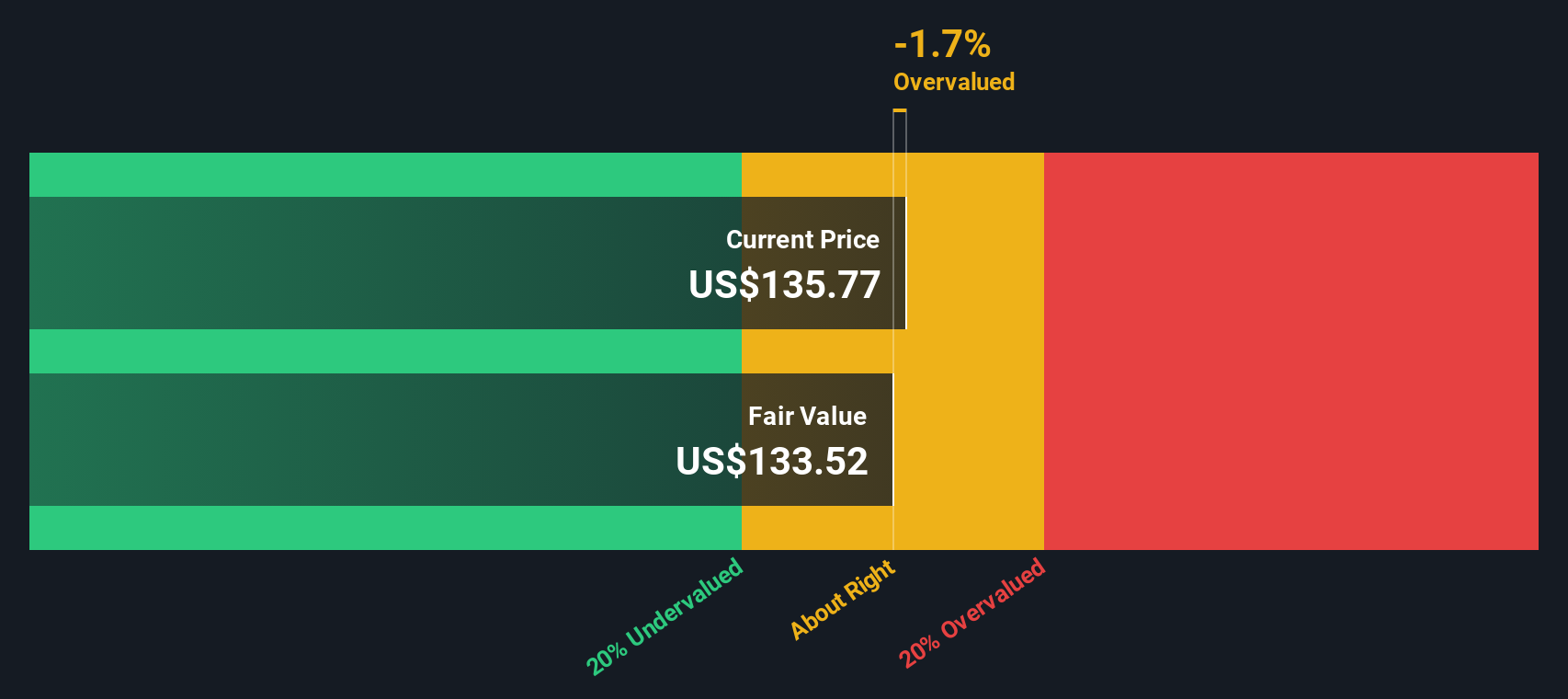

Taking a step back from analyst-driven fair values, our SWS DCF model suggests DTE is trading slightly above its estimated fair value of $133.52. This method, which weighs future cash flows, points to DTE being modestly overvalued at present. Do future growth assumptions fully justify today’s price? Could expectations need revisiting?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out DTE Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own DTE Energy Narrative

If you have a different perspective or want to crunch the numbers your own way, you can build a unique take on DTE Energy in just minutes. Do it your way

A great starting point for your DTE Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Winning Stock Ideas?

Smart investors move early on new trends and sectors. Don’t just stop with DTE Energy. Spot future outperformers before the crowd shifts its focus elsewhere.

- Capitalize on strong, steady income by seeking out these 18 dividend stocks with yields > 3% offering robust yields and reliable payouts in today's evolving market.

- Join the AI revolution by evaluating these 27 AI penny stocks shaping the way we analyze data, automate processes, and unlock disruptive new opportunities.

- Boost your portfolio’s growth potential with these 908 undervalued stocks based on cash flows set to rebound as the market recognizes their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DTE

Second-rate dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives