- United States

- /

- Other Utilities

- /

- NYSE:D

Is Dominion Energy’s Share Price Justified After 9.7% Jump in 2025?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Dominion Energy’s current share price is really a bargain, you are not alone, and you are in the right place.

- After climbing 9.7% since the start of the year, Dominion Energy’s stock has shown modest momentum. However, it is still contending with a 2.9% dip over the past month.

- Recently, the market’s focus has shifted to major regulatory updates and sector-wide changes in the utilities space. Both have sparked renewed interest in Dominion and fueled ongoing debate among investors about the stock’s value and what the future might bring.

- On a purely numbers basis, Dominion Energy scores a 2 out of 6 on our quick valuation checklist. Let’s explore what these valuation checks mean, see how various valuation approaches compare, and finally, consider an alternative way to assess whether Dominion is genuinely undervalued.

Dominion Energy scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Dominion Energy Dividend Discount Model (DDM) Analysis

The Dividend Discount Model, or DDM, estimates the fair value of a stock by projecting all future dividends and discounting them to today's value. The underlying idea is that a company's worth comes from the cash returns it can provide directly to shareholders over time.

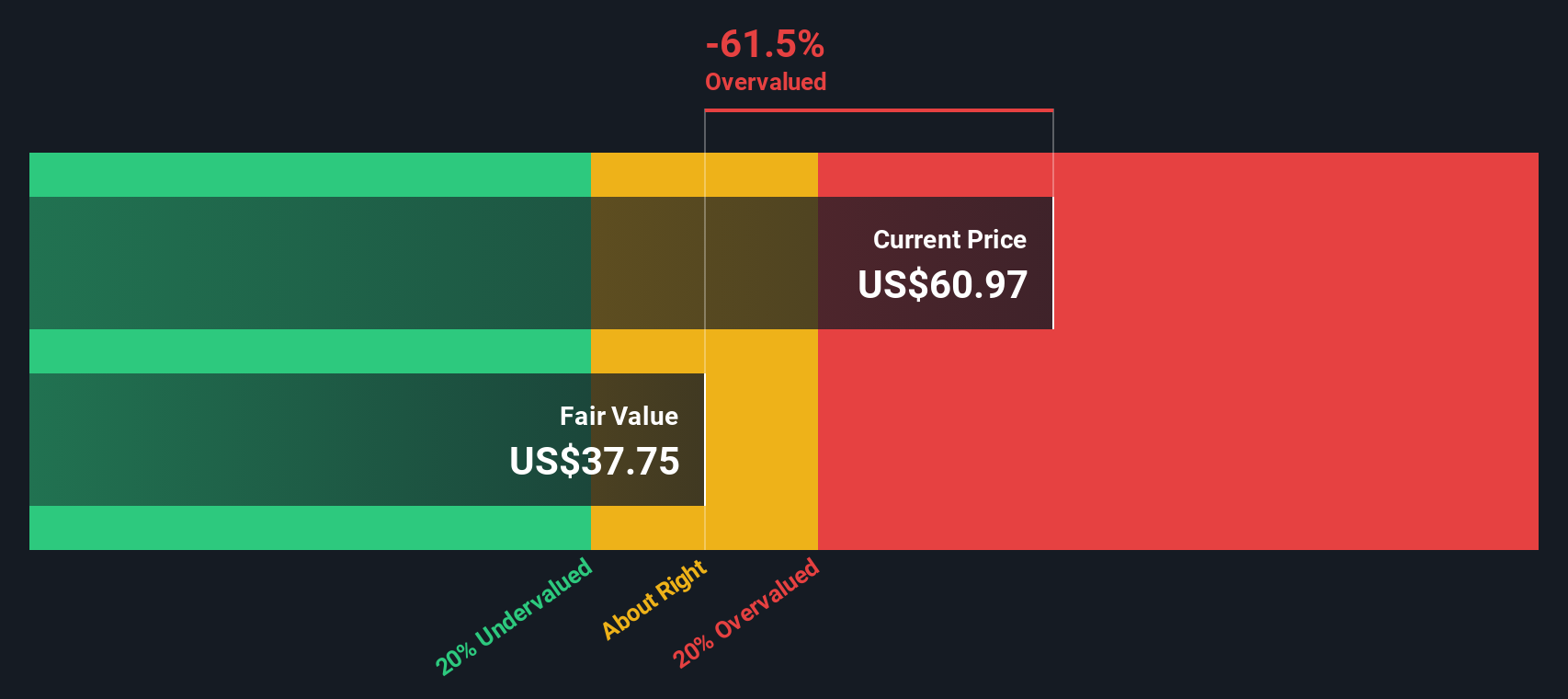

For Dominion Energy, the DDM calculation uses a current annual dividend per share of $2.69, a return on equity of approximately 6.72%, and a dividend payout ratio that notably exceeds 100% (specifically, 105%). This high payout typically points to a situation where the company is distributing more in dividends than it is earning, raising questions about how sustainable these payouts are in the long run. In fact, the DDM growth rate used here is slightly negative at -0.36%, mainly driven by this unsustainable payout ratio.

Based on these projections and the company's dividend policy, the DDM yields an estimated intrinsic value of $37.65 per share. Compared to Dominion Energy’s current share price, this model suggests the stock is about 58.5% above its fair value and therefore appears substantially overvalued by this approach.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests Dominion Energy may be overvalued by 58.5%. Discover 844 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Dominion Energy Price vs Earnings

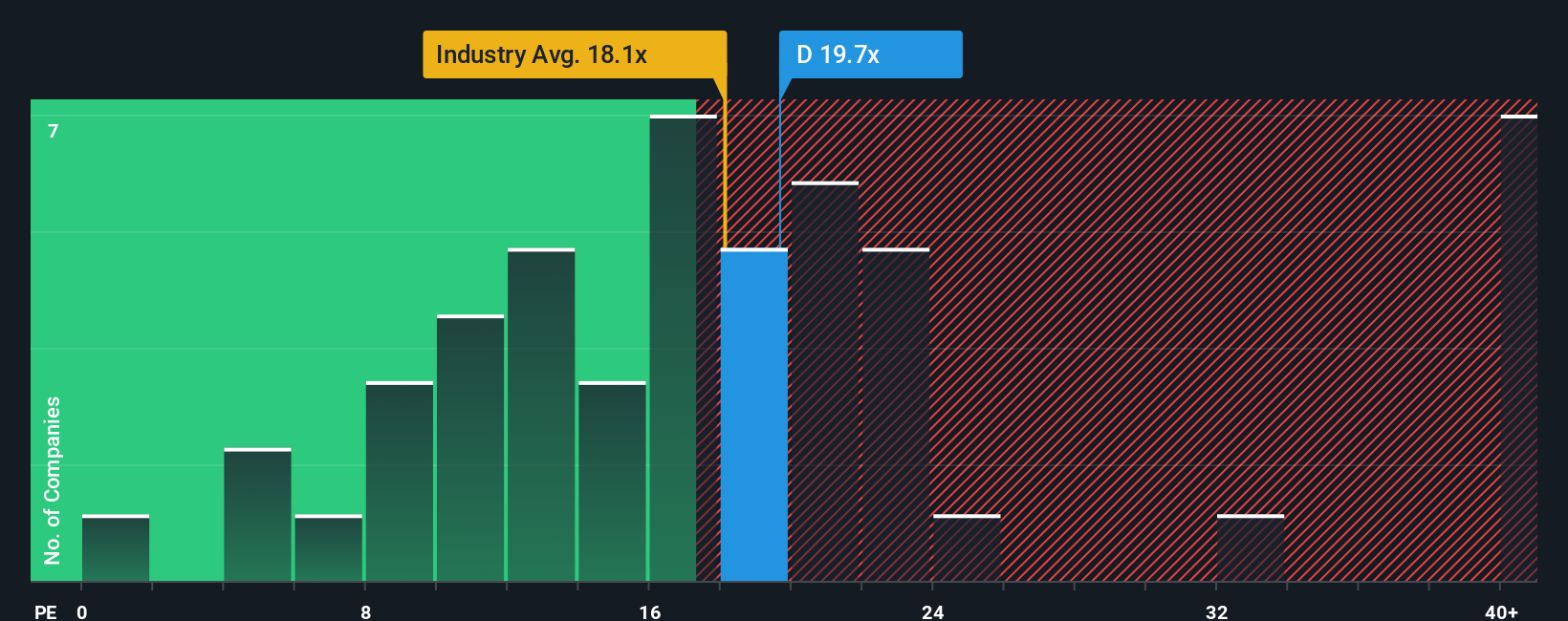

For profitable companies such as Dominion Energy, the Price-to-Earnings (PE) ratio is often a preferred valuation metric because it directly relates the company’s share price to its earnings power. The PE ratio gives investors a sense of how much they are paying for each dollar of earnings and provides insight into whether a stock is trading at a reasonable price based on its profitability.

What constitutes a “normal” or “fair” PE ratio depends on several factors, including a company’s expected earnings growth, its stability, and the risks it faces. Faster-growing, less risky companies often justify higher PE ratios. In contrast, those with slower growth or more uncertainty typically command lower ones.

Dominion Energy is currently trading at a PE ratio of 19.53x. This is slightly below the industry average of 18.27x and also a bit below the peer group average of 20.28x. However, relying only on these benchmarks can miss important context around Dominion’s specific growth, profit margin, and risk profile.

This is where the Simply Wall St Fair Ratio comes in. Calculated using a proprietary formula, the Fair Ratio considers Dominion’s unique growth expectations, profitability, industry position, market cap, and risk factors to estimate what an appropriate PE multiple should be for this company. In Dominion’s case, the Fair Ratio is 23.19x, suggesting the market is pricing the company’s earnings at a discount compared to what its fundamentals might justify. Because this Fair Ratio is meaningfully higher than the current PE, Dominion Energy screens as undervalued by this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Dominion Energy Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your own story or thesis about Dominion Energy, which outlines the reasons you believe its fair value, future revenue, earnings, and margins will unfold in a certain way based on your perspective of the business and industry outlook.

Think of Narratives as a bridge that connects the company’s story to a financial forecast and then to a target fair value. This approach makes investing more dynamic and personal, allowing you to anchor your investment decision in the context of what matters most to you rather than relying only on ratios or analyst figures.

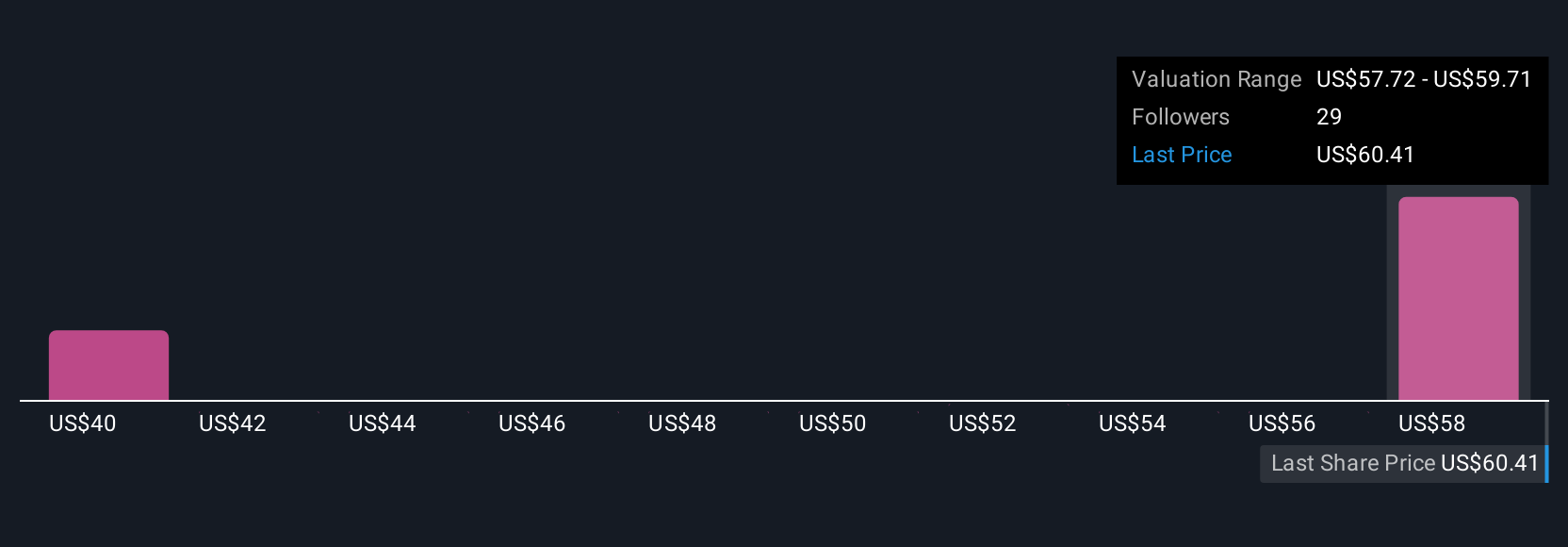

Narratives on Simply Wall St’s Community page are easy and accessible for all investors, and used by millions globally. They help you decide when to buy or sell by showing the gap between your Fair Value and today’s share price, so you can act when your view and the market’s price differ substantially.

What makes Narratives uniquely powerful is their flexibility. When new information such as earnings reports or news arrives, the model updates your Narrative in real time, ensuring your ongoing thesis is reflected accurately in your fair value.

For example, one investor might forecast Dominion’s revenue will grow robustly with successful renewables projects and see a fair value near $67. Another could emphasize regulatory and cost risks and argue for a value closer to $54. Narratives showcase this full range of possible perspectives.

Do you think there's more to the story for Dominion Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:D

Dominion Energy

Provides regulated electricity and natural gas services in the United States.

Solid track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives