- United States

- /

- Renewable Energy

- /

- NYSE:CWEN.A

Will Expanding Tax-Credit Projects Reshape Clearway Energy's (CWEN.A) Clean Power Growth Narrative?

Reviewed by Sasha Jovanovic

- In recent days, Clearway Energy has experienced increased investor optimism, supported by its expanding pipeline of renewable and battery storage projects that qualify for federal tax credits through 2029.

- An interesting takeaway is that these projects position the company favorably to benefit from the accelerating demand for clean energy, although risks remain from rising financing costs and potential changes in government incentives.

- We'll explore how Clearway Energy's robust renewable and battery storage pipeline could influence its investment narrative and growth outlook.

Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

Clearway Energy Investment Narrative Recap

To be a shareholder in Clearway Energy means believing in the future of clean energy and the company's ability to expand its renewable and battery storage pipeline, capitalizing on federal incentives through 2029. The recent share price gains reflect excitement around these projects, yet the most important short-term catalyst, growth in renewables and tax credit eligibility, remains essentially unchanged. However, the primary risk also stands firm: higher financing costs or shifting government incentives could impact returns.

The October announcement to acquire an 833 MWdc solar portfolio from Deriva Energy is particularly relevant, underscoring Clearway's commitment to project growth that fits with tax credit eligibility and sector trends. This move adds tangible scale to the pipeline, aligning well with investor attention on clean energy expansion and tax incentive benefits discussed in the recent news, while reinforcing the company’s visibility around future growth.

By contrast, investors should be mindful of how rising interest rates could increase financing costs and threaten...

Read the full narrative on Clearway Energy (it's free!)

Clearway Energy's outlook anticipates $1.8 billion in revenue and $166.6 million in earnings by 2028. This scenario is built on an annual revenue growth rate of 8.4% and an increase in earnings of $90.6 million from the current $76.0 million.

Uncover how Clearway Energy's forecasts yield a $36.11 fair value, a 18% upside to its current price.

Exploring Other Perspectives

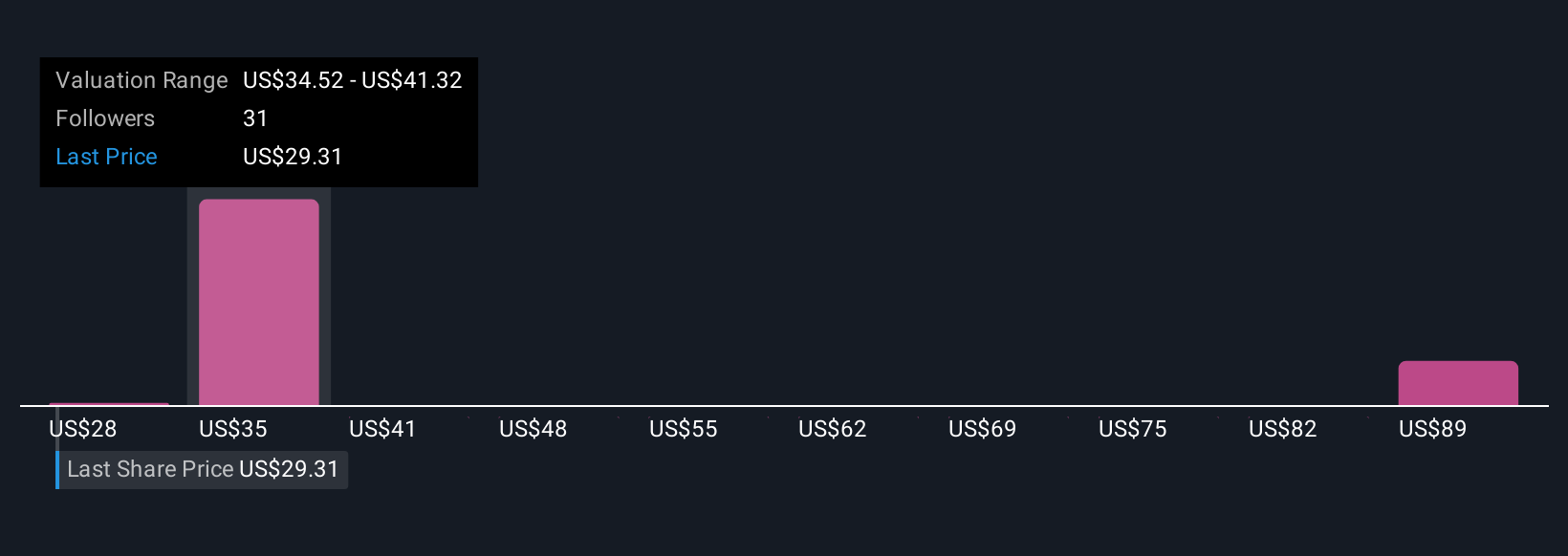

Five community members on Simply Wall St have posted fair value estimates across a wide range from US$27.72 to US$72.06 per share. With such diverse valuations, keep in mind that favorable tax credit treatment remains key to Clearway’s efforts to sustain growth.

Explore 5 other fair value estimates on Clearway Energy - why the stock might be worth 10% less than the current price!

Build Your Own Clearway Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Clearway Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Clearway Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Clearway Energy's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CWEN.A

Clearway Energy

Operates in the clean energy generation assets business in the United States.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives