- United States

- /

- Other Utilities

- /

- NYSE:CMS

Is CMS Energy’s (CMS) Expanded Convertible Note Issue a Signal About Its Long-Term Capital Flexibility?

Reviewed by Sasha Jovanovic

- Earlier this week, CMS Energy Corporation completed an upsized private placement of US$850 million in 3.125% convertible senior notes due 2031, expanded from an initial US$750 million with an additional option for US$150 million more.

- This large-scale fixed income transaction highlights CMS Energy’s proactive approach to managing debt maturities and providing additional capital for operational flexibility.

- We’ll explore how this increased convertible note issuance could affect CMS Energy’s financing costs, balance sheet, and long-term investment outlook.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

CMS Energy Investment Narrative Recap

To be a CMS Energy shareholder, you need to believe in Michigan’s enduring electricity demand growth and the company’s ability to execute on a massive grid and renewables buildout, all while managing regulatory, operational, and financing risks. The recent US$850 million upsized convertible note issue is intended to address near-term debt maturities, so it does not materially alter the short-term demand or regulatory catalysts, nor does it resolve longer-term balance sheet pressures from aggressive capital spending.

The Q3 2025 earnings announcement is particularly relevant, as it reinforced the top-line revenue momentum that underpins CMS Energy’s growth outlook. However, the sustainable expansion of profits and margins will ultimately depend on how new capital, like that raised this week, supports investment while offsetting rising debt-servicing and operational costs.

In contrast, investors should be mindful that if CMS Energy faces headwinds in securing constructive regulatory approvals for future project cost recovery…

Read the full narrative on CMS Energy (it's free!)

CMS Energy's outlook points to $9.2 billion in revenue and $1.4 billion in earnings by 2028. This scenario is based on a 4.6% annual revenue growth rate and a $0.4 billion earnings increase from the current earnings of $1.0 billion.

Uncover how CMS Energy's forecasts yield a $78.31 fair value, a 8% upside to its current price.

Exploring Other Perspectives

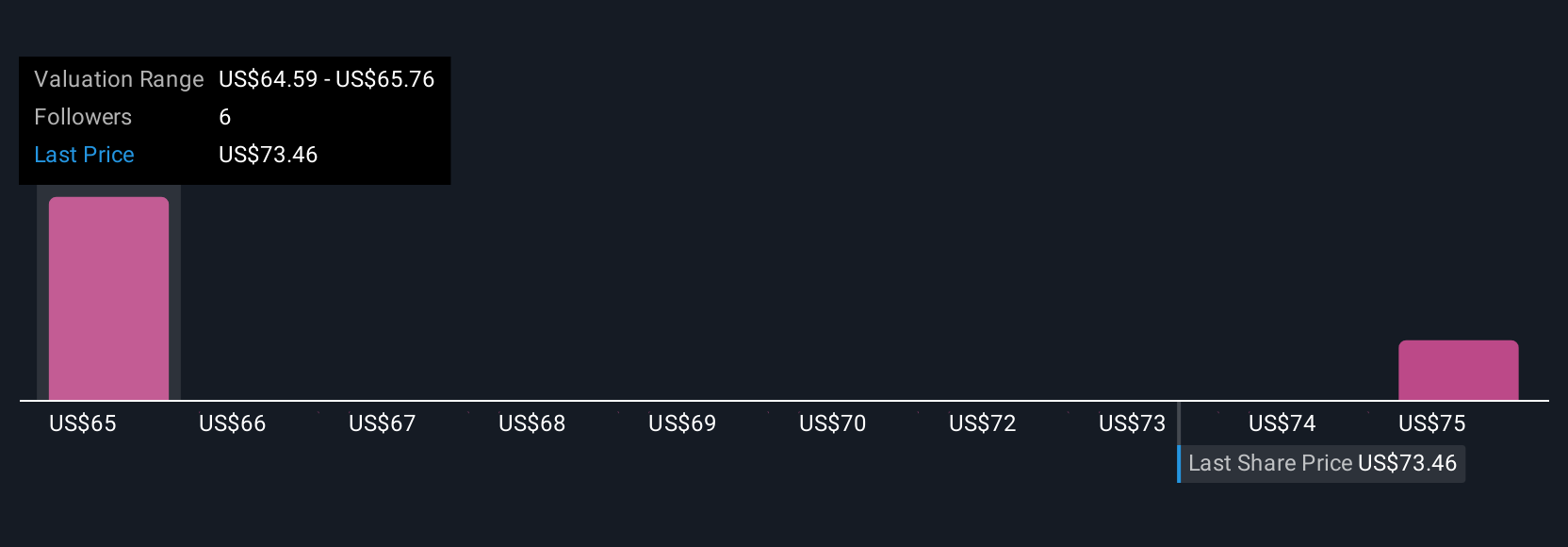

Community members at Simply Wall St pegged CMS Energy’s fair value between US$64.76 and US$78.31, with just two perspectives represented. Yet, concerns over higher net debt from ambitious grid upgrades could weigh on future returns, highlighting the importance of understanding all sides of the story.

Explore 2 other fair value estimates on CMS Energy - why the stock might be worth as much as 8% more than the current price!

Build Your Own CMS Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CMS Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free CMS Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CMS Energy's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMS

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives