- United States

- /

- Other Utilities

- /

- NYSE:BKH

Can Black Hills’ (BKH) Dividend Strategy Reveal More About Its Growth Ambitions?

Reviewed by Sasha Jovanovic

- On October 28, 2025, Black Hills Corp.'s board declared a quarterly dividend of $0.676 per share for common shareholders of record as of November 17, 2025, payable on December 1, 2025.

- This dividend decision comes as analysts expect Black Hills to report a 10.9% year-over-year quarterly revenue increase and maintain positive ratings with no sell recommendations.

- We'll examine how analyst optimism and the affirmed dividend combine to shape Black Hills' current investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Black Hills Investment Narrative Recap

To be a Black Hills shareholder right now, you need to believe in the company’s ability to deliver reliable earnings and dividend growth by managing large infrastructure investments and maintaining strong relationships with both regulators and rapidly growing tech-sector customers. The recent dividend-affirmation does not materially alter the central short-term catalyst, which is the company’s exposure to the success of new data center and blockchain projects, though it may offer some reassurance around near-term cash flow stability. The largest risk remains the potential for regulatory lag or overruns in major capital projects, which could impact earnings growth if not controlled.

Among the most relevant announcements to this news event is the continued expansion of large-scale capital projects, such as the Lange II generation facility. This project’s recent regulatory approval is directly linked to Black Hills’ stated growth strategy, as it supports increased load from new large industrial clients. Execution risks and regulatory responses connected to this expansion remain central to the company’s ability to meet its growth targets.

By contrast, some investors may be less focused on dividend sustainability and more concerned with how unexpected capital cost overruns could affect future results, especially if...

Read the full narrative on Black Hills (it's free!)

Black Hills' outlook anticipates $3.0 billion in revenue and $375.9 million in earnings by 2028. This requires a 10.3% annual revenue growth rate and a $91.7 million earnings increase from current earnings of $284.2 million.

Uncover how Black Hills' forecasts yield a $69.75 fair value, a 8% upside to its current price.

Exploring Other Perspectives

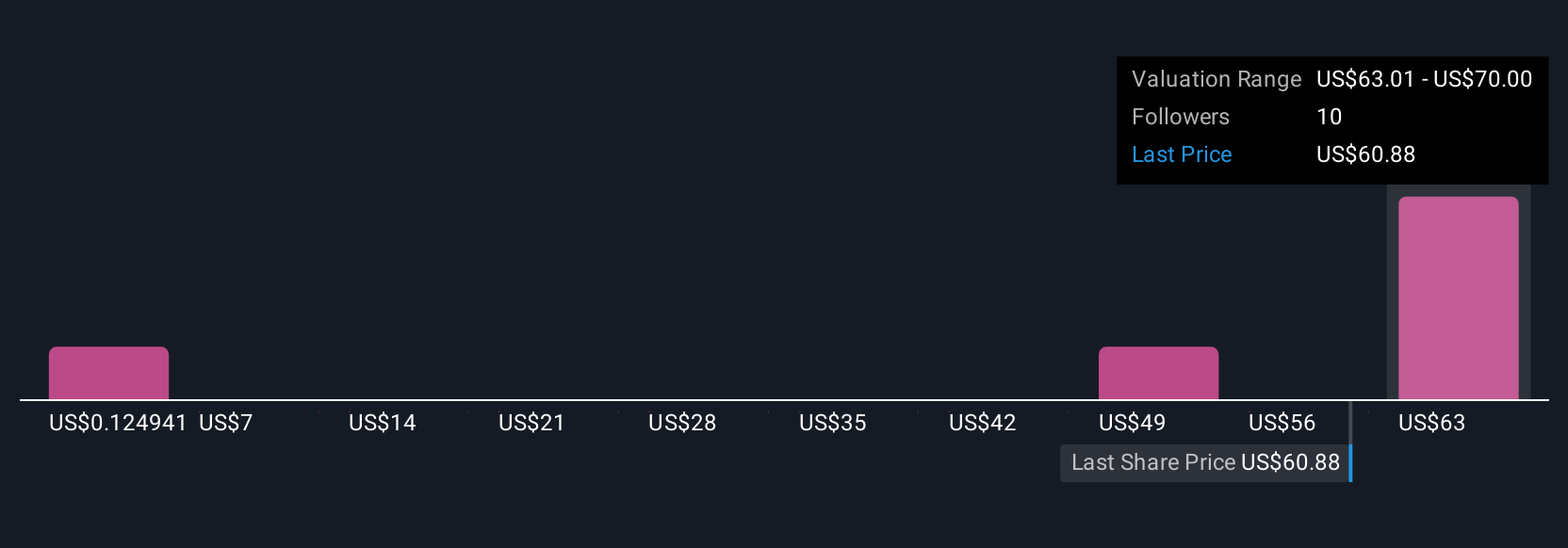

Community fair value estimates for Black Hills range widely, from as low as US$0.12 up to US$70, based on six different perspectives from the Simply Wall St Community. While some expect strong, sustained growth from hyperscale customers and regional expansion, there is also broad recognition among members that cost overruns and regulatory lag could alter the earnings outlook.

Explore 6 other fair value estimates on Black Hills - why the stock might be worth less than half the current price!

Build Your Own Black Hills Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Black Hills research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Black Hills research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Black Hills' overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Black Hills might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKH

Black Hills

Through its subsidiaries, operates as an electric and natural gas utility company in the United States.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives