- United States

- /

- Other Utilities

- /

- NYSE:BKH

Black Hills (BKH): A Fresh Look at Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

Black Hills (BKH) has captured attention this month as its stock posted a 5% climb over the past month and delivered a 15% total return over the past year. Investors are taking a closer look at what is driving this steady momentum.

See our latest analysis for Black Hills.

Momentum for Black Hills appears to be building, as the share price has stacked up a solid 5.4% return over the past month and the one-year total shareholder return sits at more than 15%. These gains suggest investor confidence is trending upward, supported by recent positive sentiment and ongoing operational growth.

If you’re curious where else clear growth momentum might be brewing, it could be a good time to expand your watchlist and check out fast growing stocks with high insider ownership.

With strong returns and a share price still around 10% below analyst targets, is Black Hills offering investors a compelling undervalued opportunity, or has the market already priced in all of its future growth potential?

Most Popular Narrative: 9.1% Undervalued

At $63.43, Black Hills trades below what the narrative considers fair value, hinting at untapped upside. This sets the stage for why analysts see room for a higher price target if projected catalysts play out.

The combination of grid modernization, enhanced resiliency initiatives, and the ability to attract tech customers in regulated territories positions Black Hills to benefit from sustainable financing advantages. This could potentially lower capital costs and further improve capital efficiency and future earnings generation.

Want to know the growth blueprint behind this high valuation? The key element of this narrative is record-breaking earnings and a future profit multiple usually associated with tech leaders. Intrigued by which ambitious financial forecasts are powering that price? Dive deeper to discover the precise projections driving this fair value story.

Result: Fair Value of $69.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing heavy infrastructure spending and exposure to large tech customers mean that delays or volatility could threaten the optimistic growth outlook for Black Hills.

Find out about the key risks to this Black Hills narrative.

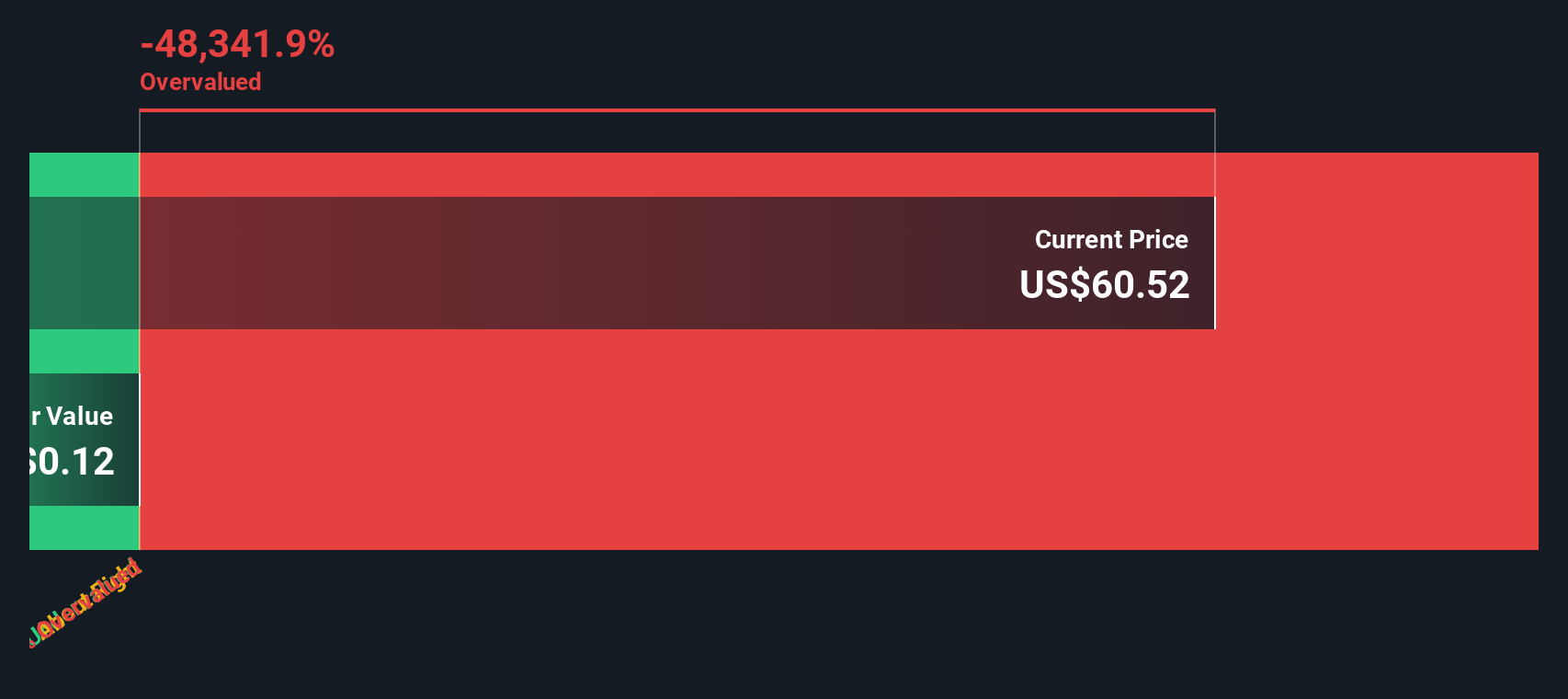

Another View: How Does DCF Stack Up?

While the current narrative leans on earnings forecasts and profit multiples for Black Hills, our SWS DCF model comes at valuation from a different angle by projecting future cash flows to estimate fair value. The result? It suggests a very different picture, raising questions about which approach truly captures the company's long-term potential.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Black Hills for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 845 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Black Hills Narrative

If you’re eager to dig deeper or come to your own conclusions, crafting your own Black Hills narrative is quick and easy. See for yourself with Do it your way.

A great starting point for your Black Hills research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Every smart investor knows that fresh insights can uncover tomorrow’s winners. Don’t let incredible opportunities slip away. Tap into some of the market’s most compelling trends right now:

- Uncover strong yield potential when you check out these 20 dividend stocks with yields > 3% that deliver consistently impressive returns above 3%.

- Catch the next wave of innovation by scouting these 27 AI penny stocks poised to transform industries with artificial intelligence-driven breakthroughs.

- Capitalize on value gaps and growth potential by reviewing these 845 undervalued stocks based on cash flows for standout stocks trading below their worth based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Black Hills might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKH

Black Hills

Through its subsidiaries, operates as an electric and natural gas utility company in the United States.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives