- United States

- /

- Water Utilities

- /

- NYSE:AWR

Does the Recent 6% Dip Reveal a Value Opportunity in American States Water?

Reviewed by Bailey Pemberton

- Ever wondered if American States Water could be trading at a bargain or if its price tags are justified? Let's dig in and see what lies beneath the sticker price.

- The stock has recently dipped, dropping 4.3% over the last week and sliding 6.0% in the past month. This brings its one-year total return to -12.3%. These moves might have investors questioning whether this is a value opportunity or a warning sign.

- Fresh headlines have focused on the water utility sector's stability amidst rising interest rates and regulatory updates shaping investor sentiment. For American States Water, recent news has centered around new infrastructure investments and ongoing discussions about water resource management. Both of these factors could influence long-term expectations.

- Right now, the company scores just 2 out of 6 on our undervaluation checks. We will explain how this score is calculated using different valuation methods. At the end of this article, we will reveal an additional approach that may provide a fuller valuation picture.

American States Water scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: American States Water Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the intrinsic value of a company based on projections of how much free cash it will generate in the future, with those cash flows discounted back to today's dollars. This method relies on two main steps: forecasting the company's free cash flow and then applying a discount rate to reflect the risk and time value of money.

For American States Water, the latest reported Free Cash Flow stands at $42.1 Million. Analysts typically provide estimates for up to five years, but in this analysis, projections have been extrapolated further by Simply Wall St, estimating continued growth over a decade. By 2035, American States Water’s free cash flow is forecast to reach $422.4 Million, illustrating a substantial growth trajectory from current levels.

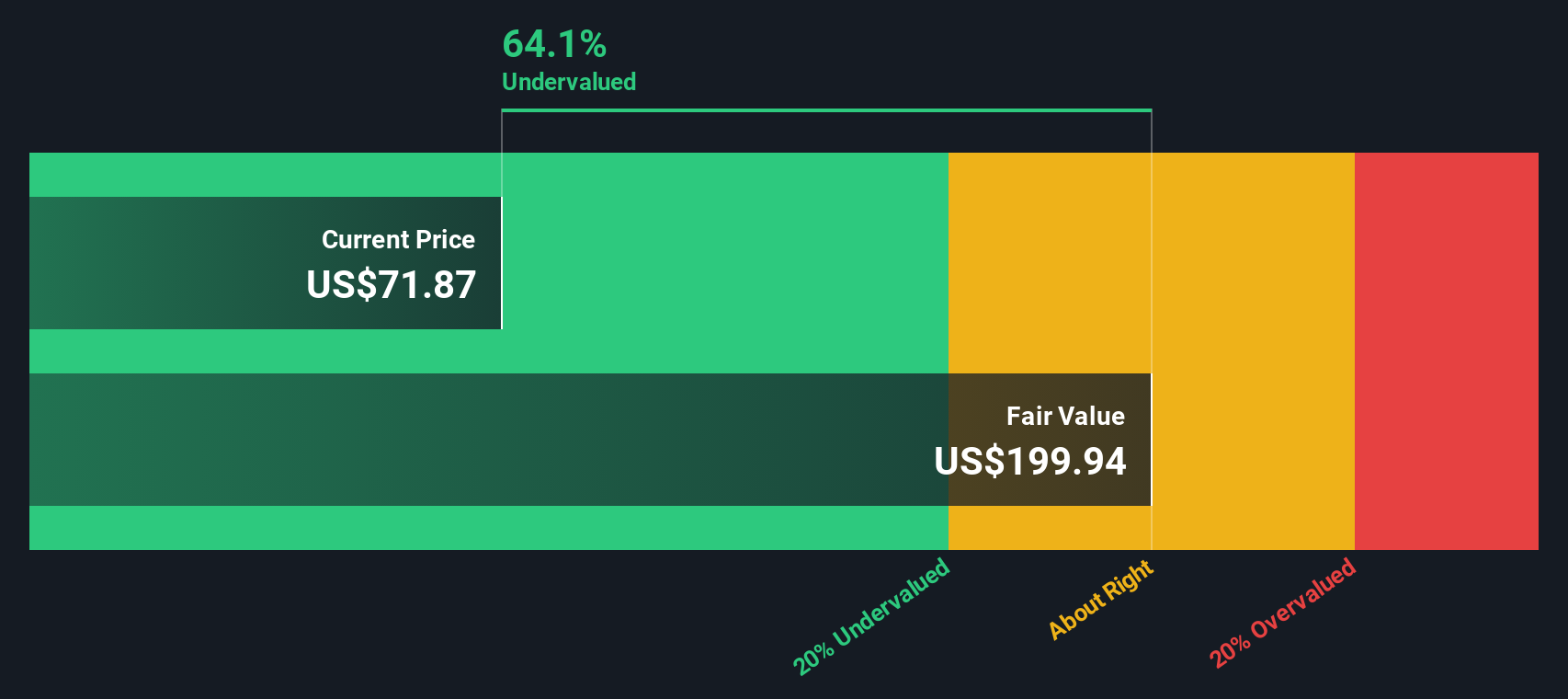

Based on these projections using the 2 Stage Free Cash Flow to Equity model, the intrinsic value of American States Water comes out to $199.94 per share. This value implies the stock is trading at a 64.1% discount to its fair value. This suggests it is significantly undervalued compared to where its price could reasonably be expected to sit, based on future cash flows.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests American States Water is undervalued by 64.1%. Track this in your watchlist or portfolio, or discover 921 more undervalued stocks based on cash flows.

Approach 2: American States Water Price vs Earnings

For profitable companies like American States Water, the Price-to-Earnings (PE) ratio is a widely recognized valuation tool. It helps investors assess how much they are paying for each dollar of earnings, making it especially useful when a company consistently reports positive profits.

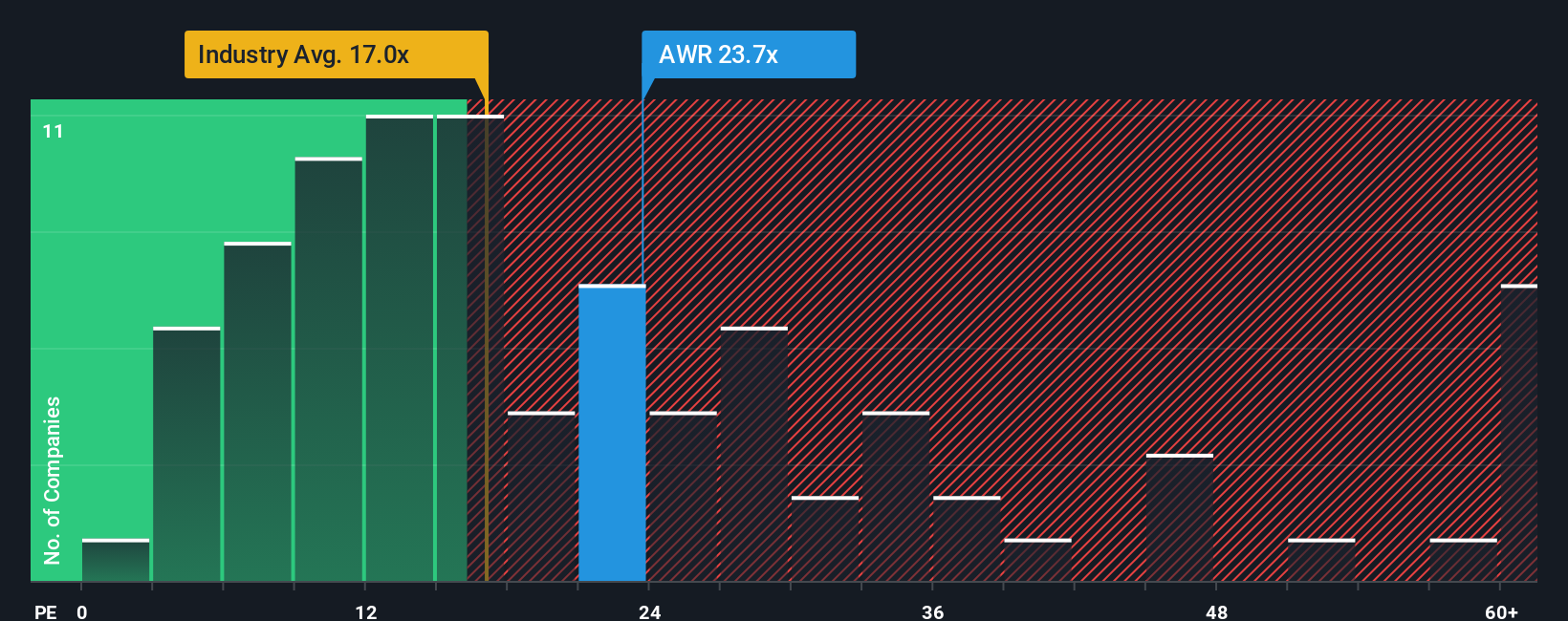

The "right" PE ratio for a stock depends on several factors, including expectations for future growth, risk profile, profitability, and how it compares to similar businesses. A high-growth company usually commands a higher PE, while companies in more stable or lower-growth sectors tend to trade at lower ratios. American States Water currently trades at a PE of 21.5x, which is higher than both the water utilities industry average of 15.9x and the peer average of 17.8x. At first glance, this might make the stock seem expensive compared to its sector peers.

However, Simply Wall St's proprietary "Fair Ratio" offers a more nuanced view. The Fair Ratio, calculated at 17.3x for American States Water, takes into account more than just industry averages. It blends fundamentals such as earnings growth, profit margins, risk, size, and broader market context. This makes it a more tailored benchmark for valuation than generic peer or industry comparisons.

Comparing the Fair Ratio (17.3x) to the actual PE (21.5x) suggests that American States Water is trading above what would be considered fair value based on its underlying characteristics. This indicates the stock is currently overvalued relative to the factors that matter most.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1421 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your American States Water Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, approachable way to capture your story or perspective on a company. It connects what you expect for future revenue, earnings, and margins to an estimated fair value of the stock.

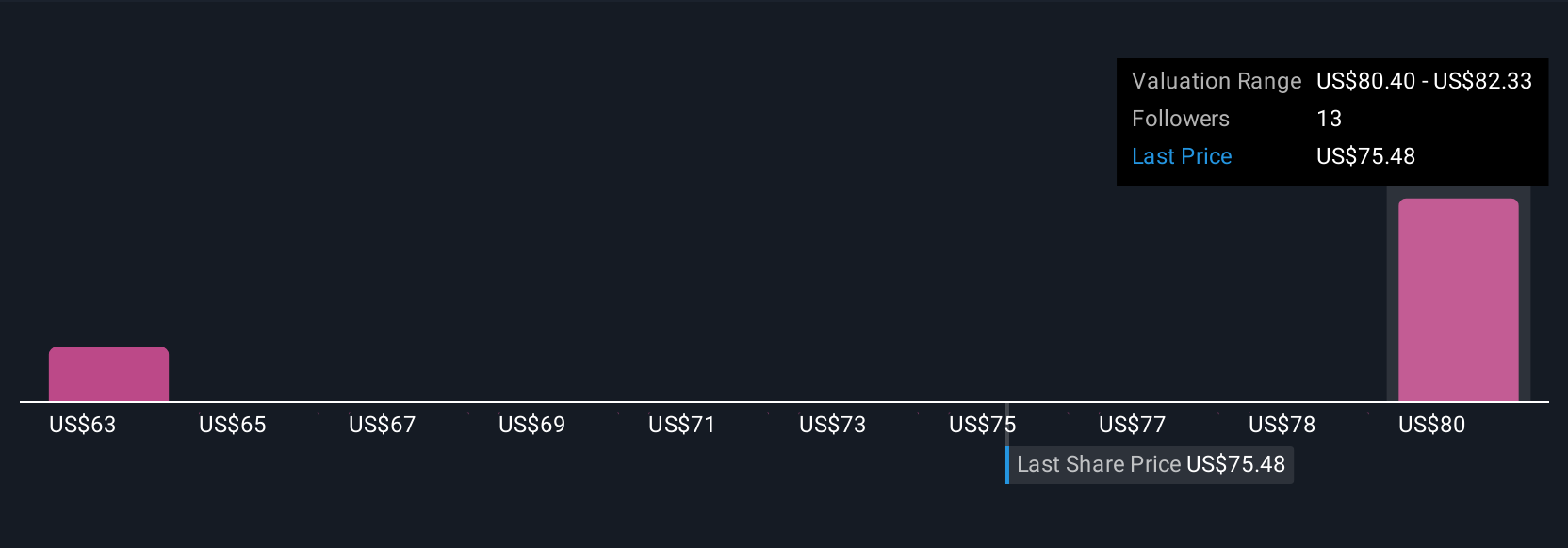

Narratives link the company's outlook and business drivers directly to a forecast and then to a fair value, making it easy for any investor to see how their assumptions translate into a price target. Available on Simply Wall St's Community page, millions of investors use Narratives as an accessible tool to align their investment view with the latest numbers.

This approach helps you decide when to buy or sell by directly comparing your own Fair Value to the current share price. Narratives are dynamic and automatically update when new news or earnings emerge, so your story always stays current.

For American States Water, for example, some investors build an optimistic Narrative based on rapid California expansion and robust infrastructure spending, arriving at a fair value of $91.0. Others highlight regulatory uncertainty and higher costs, estimating a more cautious fair value of $72.0.

Do you think there's more to the story for American States Water? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AWR

American States Water

Through its subsidiaries, provides water and electric services to residential, commercial, industrial, and other customers in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives