- United States

- /

- Water Utilities

- /

- NYSE:AWR

Assessing American States Water (AWR) Valuation After Recent Share Price Declines

Reviewed by Simply Wall St

American States Water (AWR) shares have struggled recently, slipping around 7% over the past month and down 13% over the past year. Investors are weighing company performance, broader utilities sector trends, and current market sentiment as they assess their next steps.

See our latest analysis for American States Water.

This past year has been tough for American States Water, with a 1-year total shareholder return of -13.1%, reflecting both the pullback in utilities and shifting market sentiment. With recent price momentum fading, many investors are watching for signs of renewed growth potential or an improving risk outlook.

If this turn in momentum has you curious about other sectors, now is a great time to broaden your view and discover fast growing stocks with high insider ownership

The real question now is whether current share prices reflect a discounted opportunity for long-term investors or if the market has already accounted for any future rebound in American States Water's growth prospects.

Most Popular Narrative: 12.3% Undervalued

American States Water closed at $71.5, with the most popular narrative suggesting fair value sits at $81.5. That implies notable upside, and this view hinges on a few bold drivers that support earnings growth.

Heightened regulatory and societal focus on water reliability and sustainability, alongside persistent water scarcity in the Western U.S., increases the value of professionally managed water infrastructure. This favors American States Water's ability to justify ongoing rate increases and capital deployment, positively impacting long-run revenue and earnings stability.

Curious what fuels this valuation call? The secret lies in several aggressive growth assumptions, such as recurring revenue, wider profit margins, and a future earnings multiple more often seen in high-flying growth stocks. Analysts see a blueprint for long-term expansion, but the real numbers that set that $81.5 target might surprise you. Unlock the details behind these bullish projections in the full narrative.

Result: Fair Value of $81.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory changes and rising costs could threaten American States Water's earnings stability. This casts doubt on the optimistic long-term outlook.

Find out about the key risks to this American States Water narrative.

Another View: Multiples Paint a Different Picture

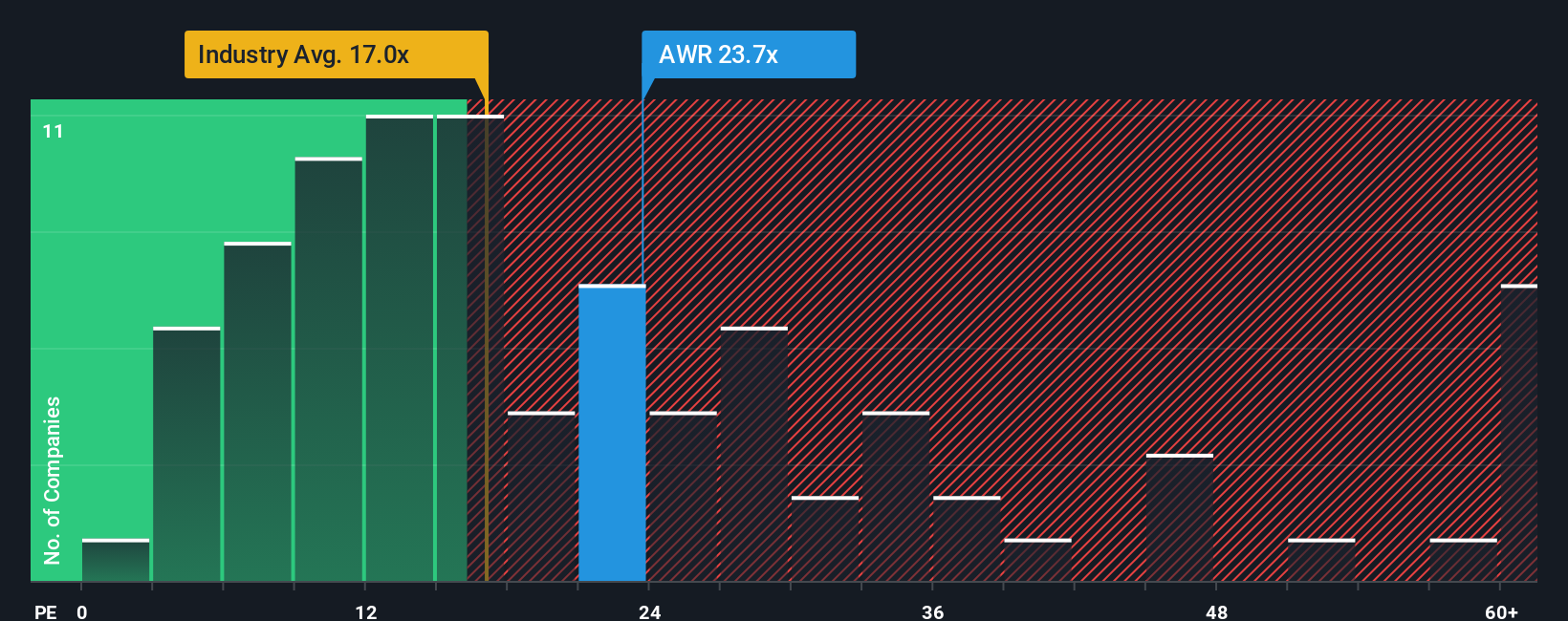

While the most popular narrative points to American States Water being undervalued, our look at the price-to-earnings ratio tells a different story. Compared to an industry average of 16x and a peer average of 17.7x, American States Water trades at a steeper 21.4x. Even our fair ratio model indicates a lower figure of 17.3x. This sizable gap means investors may currently be paying a premium, raising questions about whether future growth can justify it or if there is real valuation risk hiding in plain sight.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own American States Water Narrative

If this perspective does not match your own thinking or you want to dig into the details yourself, you can shape your own narrative in just a few minutes. Do it your way.

A great starting point for your American States Water research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock your edge with strategies that go beyond the obvious. The Simply Wall Street Screener makes it easy to spot the next standout, and these top picks will keep you a step ahead.

- Uncover high-potential opportunities by reviewing these 3589 penny stocks with strong financials packed with companies breaking new ground.

- Capture passive income trends and steady growth by checking out these 15 dividend stocks with yields > 3% with yields that stand out from the market average.

- Ride the AI wave by browsing these 26 AI penny stocks, where innovation is reshaping entire industries and future winners can emerge quickly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AWR

American States Water

Through its subsidiaries, provides water and electric services to residential, commercial, industrial, and other customers in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives