- United States

- /

- Water Utilities

- /

- NYSE:AWK

Is American Water Works a Bargain After Recent Strategy Shifts and Price Drop?

Reviewed by Bailey Pemberton

- Curious if American Water Works Company is a hidden bargain or just treading water? Let's dive in and uncover what the numbers are really saying.

- The stock has seen a 5.0% drop over the past week and is down 7.0% over the last month, although it is up 3.4% year-to-date. These swings may reflect changing market sentiment about its future prospects.

- Recent discussions among analysts and utility sector news have put a spotlight on company strategy shifts and regulatory developments. These factors have added both uncertainty and anticipation to the share price. Upgrades and downgrades from major brokerages have also occurred throughout the month, contributing to fresh volatility in trading.

- Currently, American Water Works Company scores just 0 out of 6 on our valuation checks. We will break down what that means using different valuation approaches next, so be sure to stick around for a smarter way to interpret valuation at the end of this article.

American Water Works Company scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: American Water Works Company Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) estimates a company's fair value by forecasting future dividends and discounting them to present value. This valuation approach is especially relevant for companies like American Water Works Company that have established records of regular dividend payments.

For American Water Works Company, recent data reveals an annual dividend per share (DPS) of $3.74, with a payout ratio of 56.2%. The company’s return on equity (ROE) stands at 10.4%, suggesting stable profitability. Based on DDM methodology, dividend growth is projected at 3.08%. This figure has been capped to account for sustainability and is slightly more conservative than previous higher forecasts. The model weighs these growth expectations alongside current dividends to project future payouts.

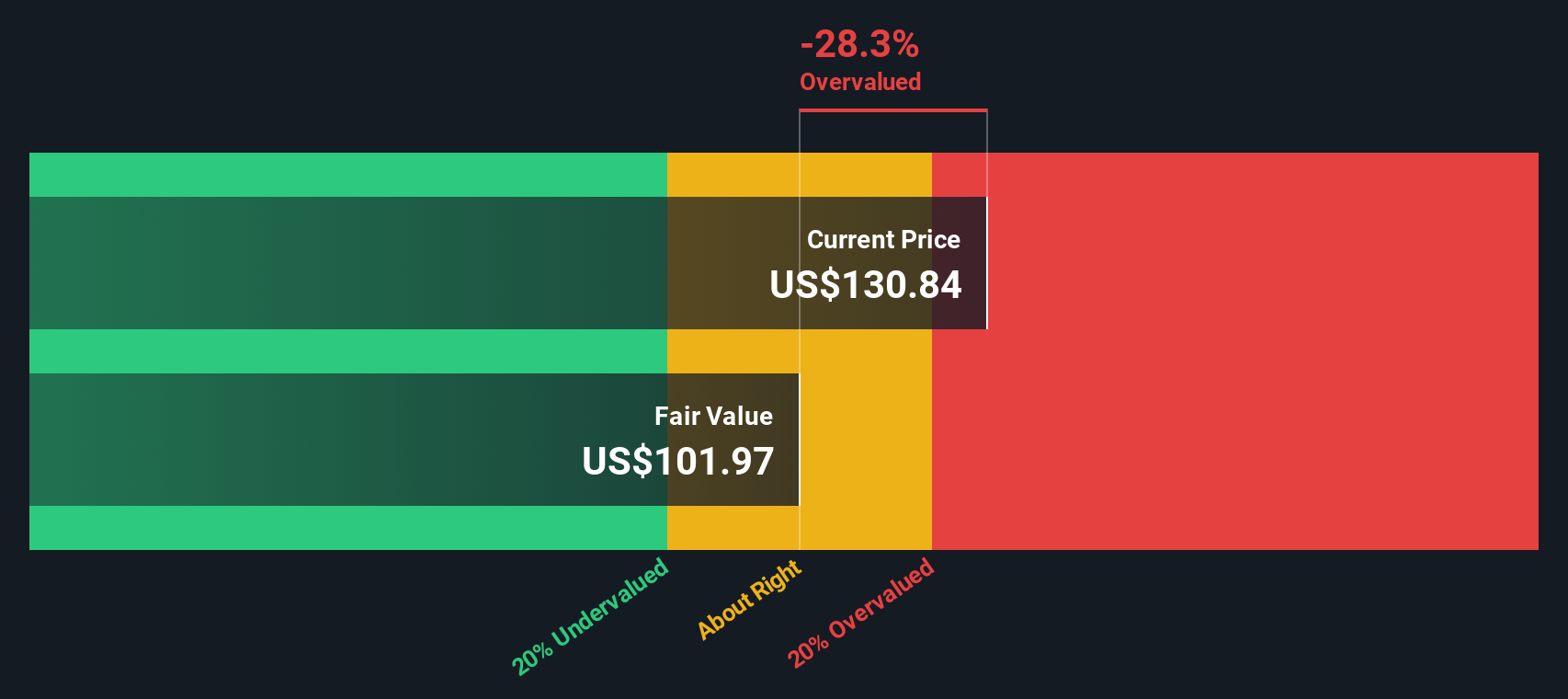

Using these inputs, the DDM calculation yields an intrinsic value per share of $101.20. When this is compared to the current share price, the stock appears to be 26.6% overvalued according to this model. In other words, investors are paying a premium above where future dividend growth and sustainability would typically justify the price.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests American Water Works Company may be overvalued by 26.6%. Discover 842 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: American Water Works Company Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most widely used valuation tools for profitable companies like American Water Works Company because it provides a clear picture of how much investors are paying for each dollar of earnings. In established, consistently profitable firms, PE ratios can help highlight whether the stock price already reflects future growth expectations or carries a premium for relative stability.

However, what qualifies as a “normal” or “fair” PE ratio can vary based on factors such as expected earnings growth and risk. Higher growth potential typically justifies a higher PE ratio, while greater uncertainty or sector volatility can push investors to demand a discount.

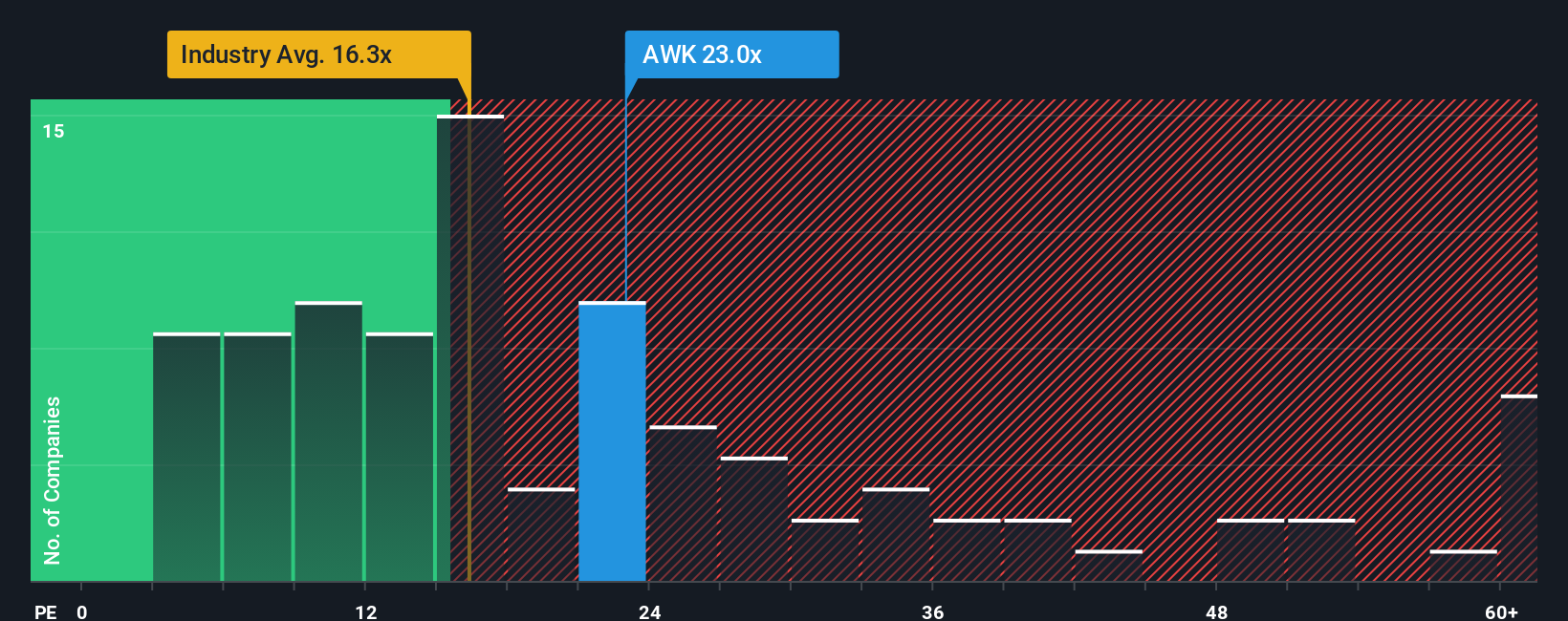

Currently, American Water Works Company trades at a PE ratio of 22.5x. This is noticeably above the average for the water utilities industry of 16.5x and its peer group average of 19.0x. Simply Wall St’s “Fair Ratio” for the company stands at 21.7x. This is calculated specifically for American Water Works Company by factoring in its growth outlook, profitability, industry characteristics, and market cap. As a result, the Fair Ratio provides a more tailored benchmark than a simple comparison to industry averages or peers because it accounts for nuances such as risk and profitability.

Since American Water Works Company’s actual PE multiple is very close to its Fair Ratio, the stock appears to be trading at about fair value on this metric.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1409 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your American Water Works Company Narrative

Earlier, we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is a simple, approachable way to describe your perspective on a company by combining the business story you believe in with concrete financial assumptions, such as future revenue, earnings, and margins, to arrive at your personal fair value estimate.

Narratives connect a company’s story with a financial forecast and then directly link that outlook to a fair value, offering a more dynamic and tailored view than traditional ratios alone. On Simply Wall St’s Community page, millions of investors use Narratives to quickly visualize how their expectations compare to market prices and analyst forecasts, helping them decide whether it is the right time to buy, hold, or sell in an interactive and user-friendly way.

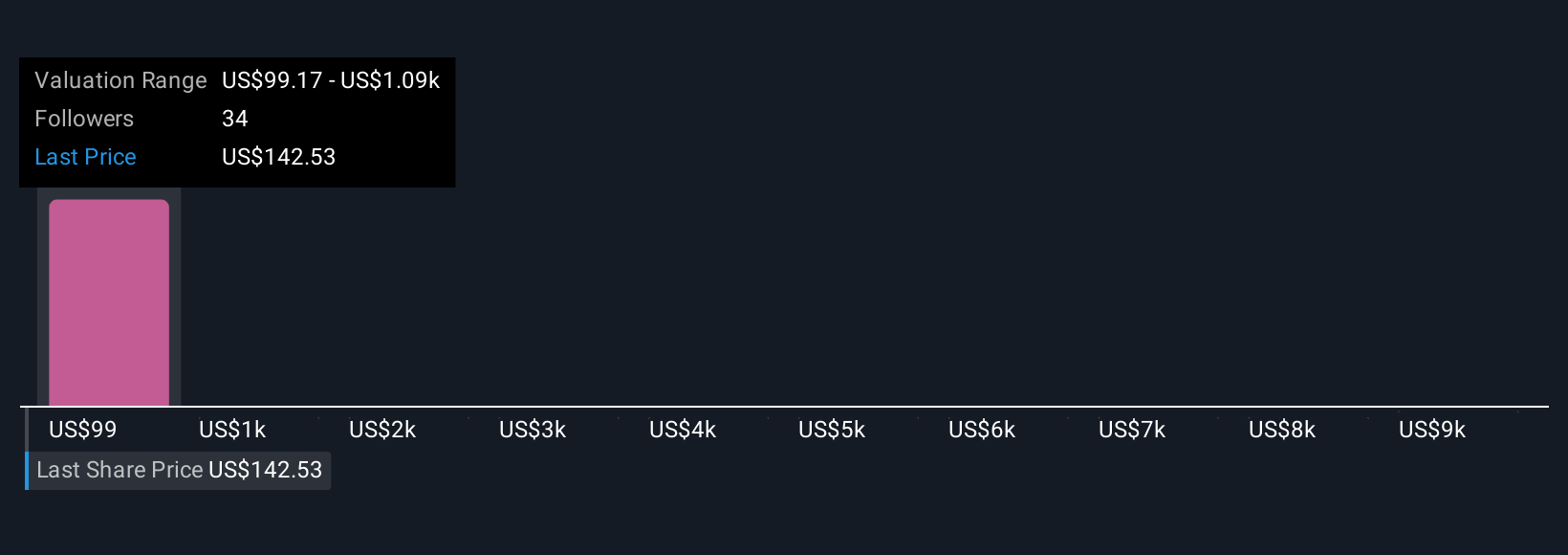

What makes Narratives uniquely powerful is that they update automatically as new information, such as earnings or news, becomes available. This helps ensure your perspective stays relevant. For example, while some investors expect American Water Works Company to top $159 per share by 2028 due to robust revenue growth and favorable regulation, others see higher risks, such as debt levels or weather disruptions, and set a fair value closer to $116. Whichever story fits your view, Narratives help you make smarter investment decisions rooted in your own reasoning.

Do you think there's more to the story for American Water Works Company? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AWK

American Water Works Company

Through its subsidiaries, provides water and wastewater services in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives