- United States

- /

- Water Utilities

- /

- NYSE:AWK

Did a $1.2 Billion Infrastructure Rate Hike Just Shift American Water Works Company's (AWK) Investment Narrative?

Reviewed by Sasha Jovanovic

- Earlier this month, American Water Works Company announced that its subsidiary, Pennsylvania-American Water, filed a request with the Pennsylvania Public Utility Commission to increase water and wastewater rates to support roughly US$1.2 billion in infrastructure investments from June 2025 through mid-2027.

- This request, which includes a proposed US$14 monthly increase for typical customers and a pilot program to aid low-income renters, could meaningfully affect the company's future capital allocation and service reliability if approved.

- We'll now explore how this significant rate filing, aimed at funding infrastructure modernization, may shape American Water Works Company's investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

American Water Works Company Investment Narrative Recap

Being a shareholder in American Water Works Company means believing in the long-term value of regulated water utilities and their steady, infrastructure-driven growth, but also recognizing the importance of timely regulatory rate approvals. The latest Pennsylvania rate filing is significant, as success here could affect the most important short-term catalyst: achieving adequate rate relief to fund higher capital investments. However, it also spotlights the ongoing risk that delays or denials in regulatory approvals could constrain future earnings; this news is material to both.

The company's recent announcement of 2026 earnings guidance, with an 8% growth target at the midpoint, stands out, particularly as it assumes constructive regulatory outcomes. This guidance is intertwined with the outcome of the Pennsylvania rate case, as the ability to effectively execute planned infrastructure investments supports the company’s earnings trajectory and margin expansion efforts.

Yet, in contrast to the growth narrative, investors should stay alert to the potential for revenue pressure arising if regulatory approvals are slower or less favorable than expected...

Read the full narrative on American Water Works Company (it's free!)

American Water Works Company's narrative projects $6.0 billion revenue and $1.4 billion earnings by 2028. This requires 6.6% yearly revenue growth and a $0.3 billion earnings increase from $1.1 billion.

Uncover how American Water Works Company's forecasts yield a $143.78 fair value, a 8% upside to its current price.

Exploring Other Perspectives

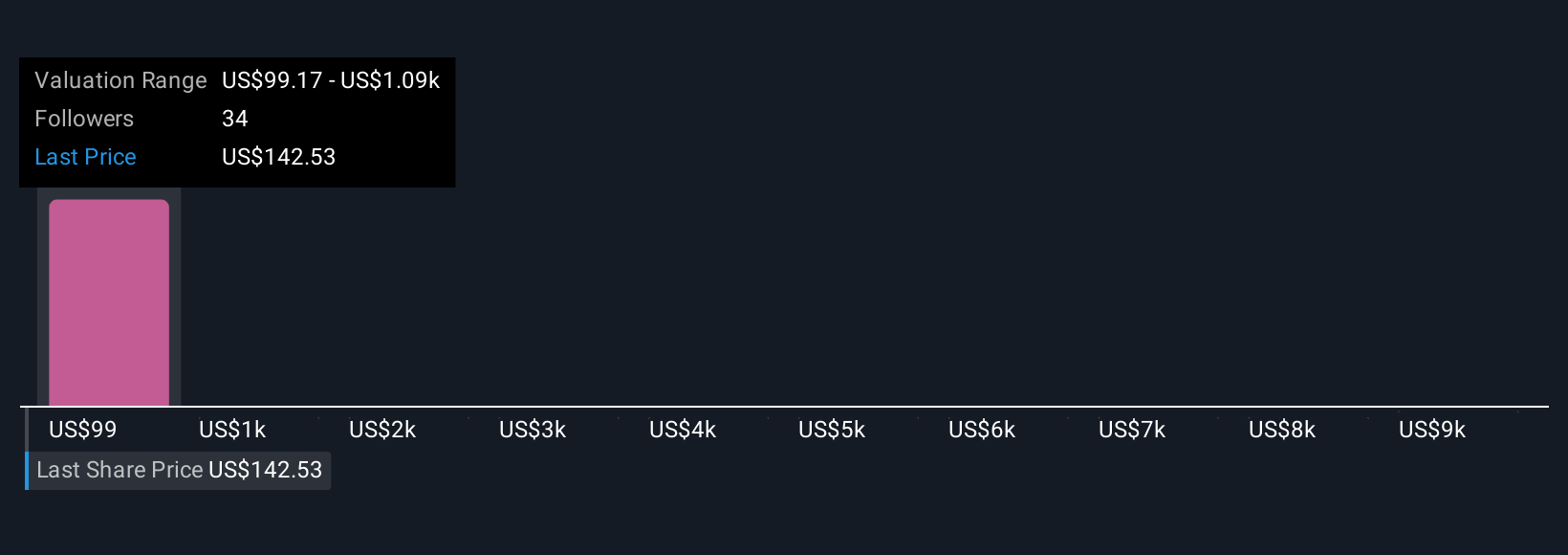

Four members of the Simply Wall St Community set fair value targets from US$101.15 to US$9,999. Timely rate relief approvals remain a key consideration shaping future growth and capital returns, so explore alternative viewpoints and compare your expectations.

Explore 4 other fair value estimates on American Water Works Company - why the stock might be a potential multi-bagger!

Build Your Own American Water Works Company Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Water Works Company research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free American Water Works Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Water Works Company's overall financial health at a glance.

No Opportunity In American Water Works Company?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AWK

American Water Works Company

Through its subsidiaries, provides water and wastewater services in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives