- United States

- /

- Water Utilities

- /

- NYSE:AWK

Assessing American Water Works (AWK) Valuation After Recent Sector Fluctuations and Share Price Dip

Reviewed by Simply Wall St

American Water Works Company (AWK) shares have been moving modestly in recent sessions, catching the attention of investors interested in steady utility stocks. Over the past month, the stock has declined about 6% as a result of broader sector fluctuations.

See our latest analysis for American Water Works Company.

AWK’s recent share price dip fits into a year of muted momentum for the utility sector, with the 1-year total shareholder return at -0.95% despite some brief upticks. At the same time, the stock’s steady performance and current price at $132.74 keep it on many long-term investors’ watchlists. Fundamentals remain resilient, even if near-term excitement has faded.

If you’re curious about what’s out there beyond the usual names, broaden your search and discover fast growing stocks with high insider ownership

But with shares now at a discount to the average analyst price target and solid fundamentals in place, investors are left wondering if this is a rare value window or if future gains are already baked in.

Most Popular Narrative: 7.7% Undervalued

With American Water Works Company's fair value pegged at $143.78, the most popular narrative sees upside from the last close of $132.74. This suggests that expectations for long-term earnings and steady expansion are outpacing recent market caution.

Persistent population growth and urbanization across key U.S. states are fueling organic customer additions (for example, a 2% customer growth target and multiple acquisitions adding approximately 87,000 connections). This underpins long-term revenue growth as American Water expands its service footprint and taps into rising water demand.

Want to know what is behind this upside call? There is a pivotal growth figure powering the fair value, and it is paired with a bold earnings target. The supporting assumptions could change how you see this water utility’s entire growth story. Intrigued by the drivers that have analysts predicting a higher share price? Take a closer look at the full narrative for the surprising details.

Result: Fair Value of $143.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost pressures or unfavorable regulatory decisions could still challenge earnings growth and reduce the optimism driving American Water's valuation.

Find out about the key risks to this American Water Works Company narrative.

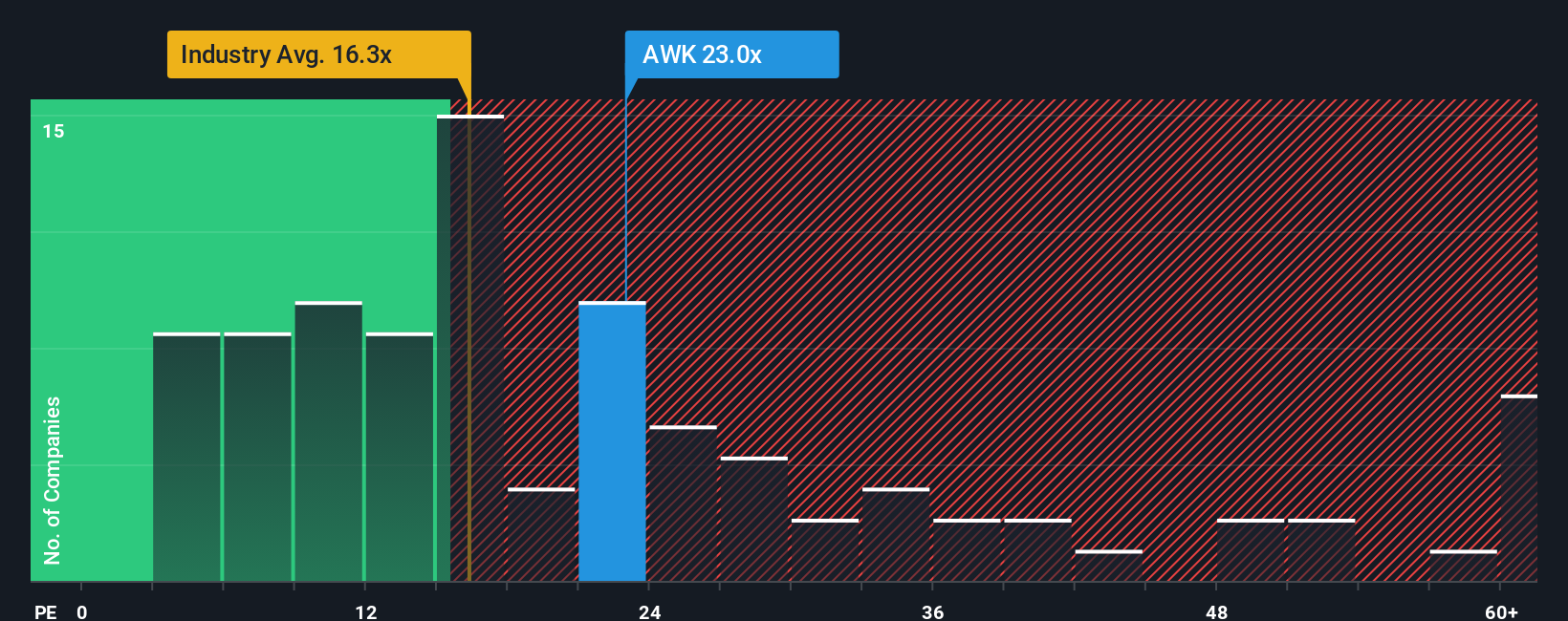

Another View: Gauging Value Through Multiples

Taking a different approach, if we look at American Water Works Company’s price-to-earnings ratio of 23.3x, it sits above both the fair ratio of 22x and the peer average of 18.4x. This means investors are paying a clear premium for AWK, raising questions about how much further the share price can climb versus industry benchmarks.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own American Water Works Company Narrative

If you would rather do your own digging or have a different take, you can explore the numbers and build your own narrative in just a few minutes with Do it your way.

A great starting point for your American Water Works Company research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Set yourself up for smarter investing by tapping into fresh opportunities you might be overlooking. These stock lists provide a shortcut to standout options waiting for you now:

- Boost your portfolio’s income by tapping into steady payers with these 16 dividend stocks with yields > 3% offering yields above 3% and reliable returns.

- Accelerate your exposure to breakthrough sectors by targeting innovation leaders among these 26 AI penny stocks who are harnessing artificial intelligence to reshape industries.

- Get ahead of the curve with these 81 cryptocurrency and blockchain stocks pioneering progress in blockchain, digital assets, and financial technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AWK

American Water Works Company

Through its subsidiaries, provides water and wastewater services in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives