- United States

- /

- Water Utilities

- /

- NYSE:AWK

American Water (AWK) Earnings Beat 5-Year Trend, Reinforcing Bullish Growth Narrative

Reviewed by Simply Wall St

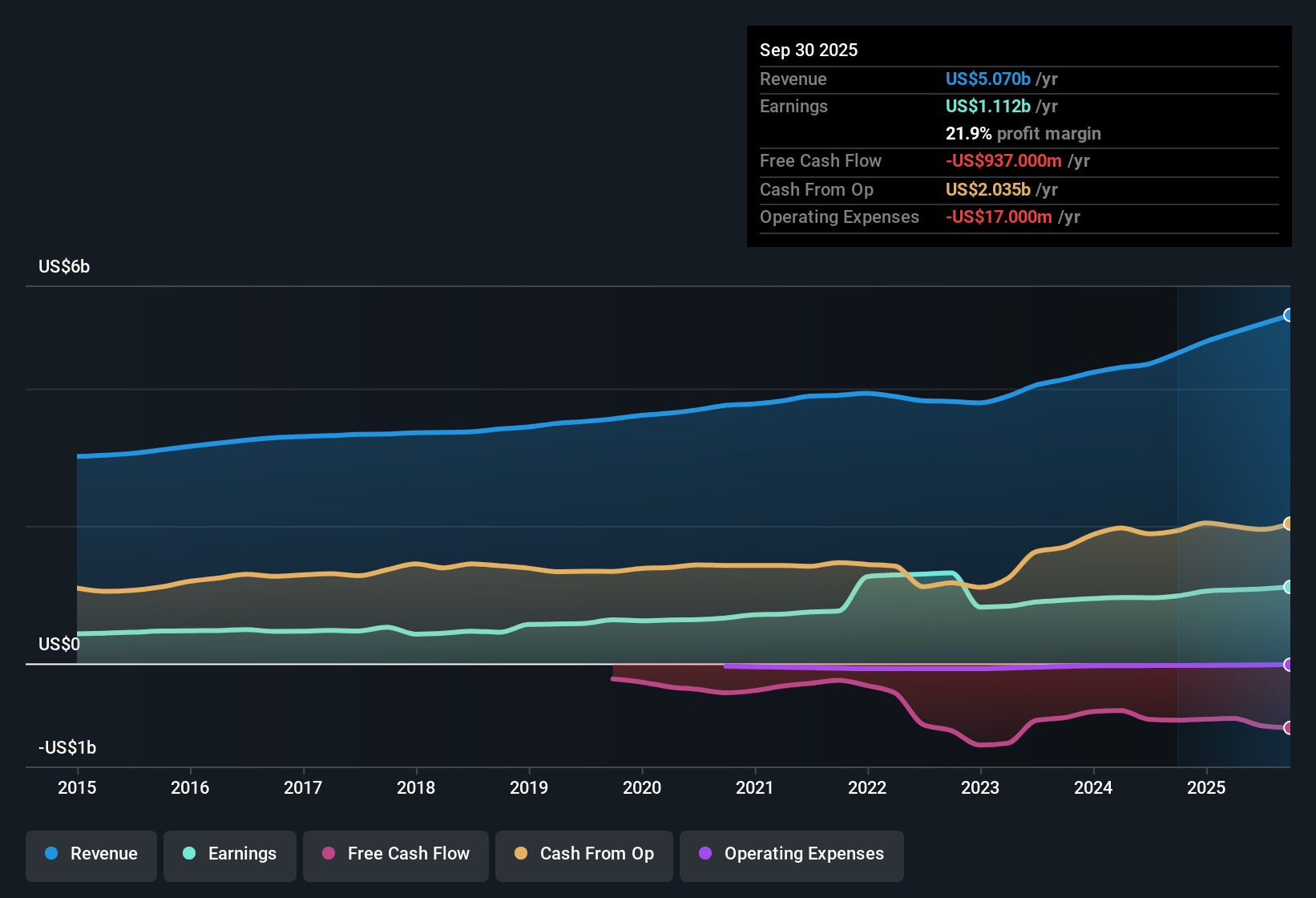

American Water Works Company (AWK) posted earnings growth of 13.1% over the past year, well ahead of its 5-year average annual increase of 5.1%. Net profit margin edged up to 21.9% from last year’s 21.8%, and current forecasts estimate annual earnings growth of 7.91% with revenue projected to grow at 6.7% per year. With shares trading at $126.70, above one fair value estimate of $101.77, and a price-to-earnings ratio of 22.2x, investors are weighing steady profit expansion against valuation concerns, especially as growth rates come in below broader US market averages.

See our full analysis for American Water Works Company.The next section takes those headline numbers and compares them against the most widely followed narratives from the Simply Wall St community, showing where the data reinforces the story and where it pushes back.

See what the community is saying about American Water Works Company

Margin Expansion Forecast Points to Quality Upside

- Analysts expect profit margins to rise from 21.9% today to 22.9% in three years, signaling ongoing efficiency and possibly better operational scale.

- According to the analysts' consensus narrative, continuous investments such as $3.3 billion in planned capex for 2025 and multiple acquisitions are expected to help American Water grow earnings and expand margins despite regulatory and cost headwinds.

- Rate case approvals and modernization initiatives are positioned to enable above-inflation rate increases, reinforcing steady margin gains projected in the forecasts.

- Analysts see digital upgrades and automation, such as enhanced metering, as helping to hold down operational expenses and support this margin expansion even during high investment periods.

See how analysts believe American Water can sustain its edge for the next stage of growth with scale and margin progress. 📊 Read the full American Water Works Company Consensus Narrative.

Regulatory and Infrastructure Pressures Are Still Front and Center

- American Water faces significant ongoing spending needs, such as $3.3 billion in capital outlays for 2025, alongside a net debt-to-capital ratio at 58%, both of which directly impact future returns and financial flexibility.

- The consensus narrative acknowledges that while favorable legislation and decoupling in key markets like California reduce some risk, long-term earnings growth is vulnerable to cost inflation, heavy capex, and uncertainty around timely regulatory approval of rate increases.

- Persistent cost rises for operations, maintenance, and especially interest could undermine net earnings if not matched by commensurate rate relief.

- Any delays or denials in rate cases, particularly in large states, threaten the predictability that investors count on for steady utility returns.

Premium Valuation Relative to Peers

- AWK trades at a price-to-earnings ratio of 22.2x, higher than both its industry average of 17.1x and peer average of 18.5x, yet current analyst price targets imply only modest upside with a consensus target of $143.60 and a share price at $126.70.

- Analysts' consensus view suggests the market is pricing in American Water’s proven revenue and earnings growth, but warns that both projected growth rates and the P/E premium trail US market averages, raising questions about future value creation if growth does not accelerate.

- For the current valuation to hold, investors would need to believe that by 2028 earnings grow to $1.4 billion and that a relatively higher industry P/E is justified by continued quality and reliability in returns.

- The narrow gap between the current share price and analysts’ target signals uncertainty over further upside at these levels unless fundamentals quickly improve versus peers.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for American Water Works Company on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the story behind the figures points another way? Take just a few minutes to dive into the numbers and share your own perspective. Do it your way

A great starting point for your American Water Works Company research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite American Water’s steady margin progress, investors face concerns around its heavy capital spending, elevated debt levels, and uncertainty from relying on regulatory approvals for returns.

Want more confidence in financial resilience? Use solid balance sheet and fundamentals stocks screener (1984 results) to focus on companies with stronger balance sheets and lower debt exposure. This approach can help protect your investments from similar pressures.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AWK

American Water Works Company

Through its subsidiaries, provides water and wastewater services in the United States.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives