- United States

- /

- Other Utilities

- /

- NYSE:AVA

Avista (AVA): Net Margin Falls to 9.2%, Testing Bullish Narratives on Growth and Valuation

Reviewed by Simply Wall St

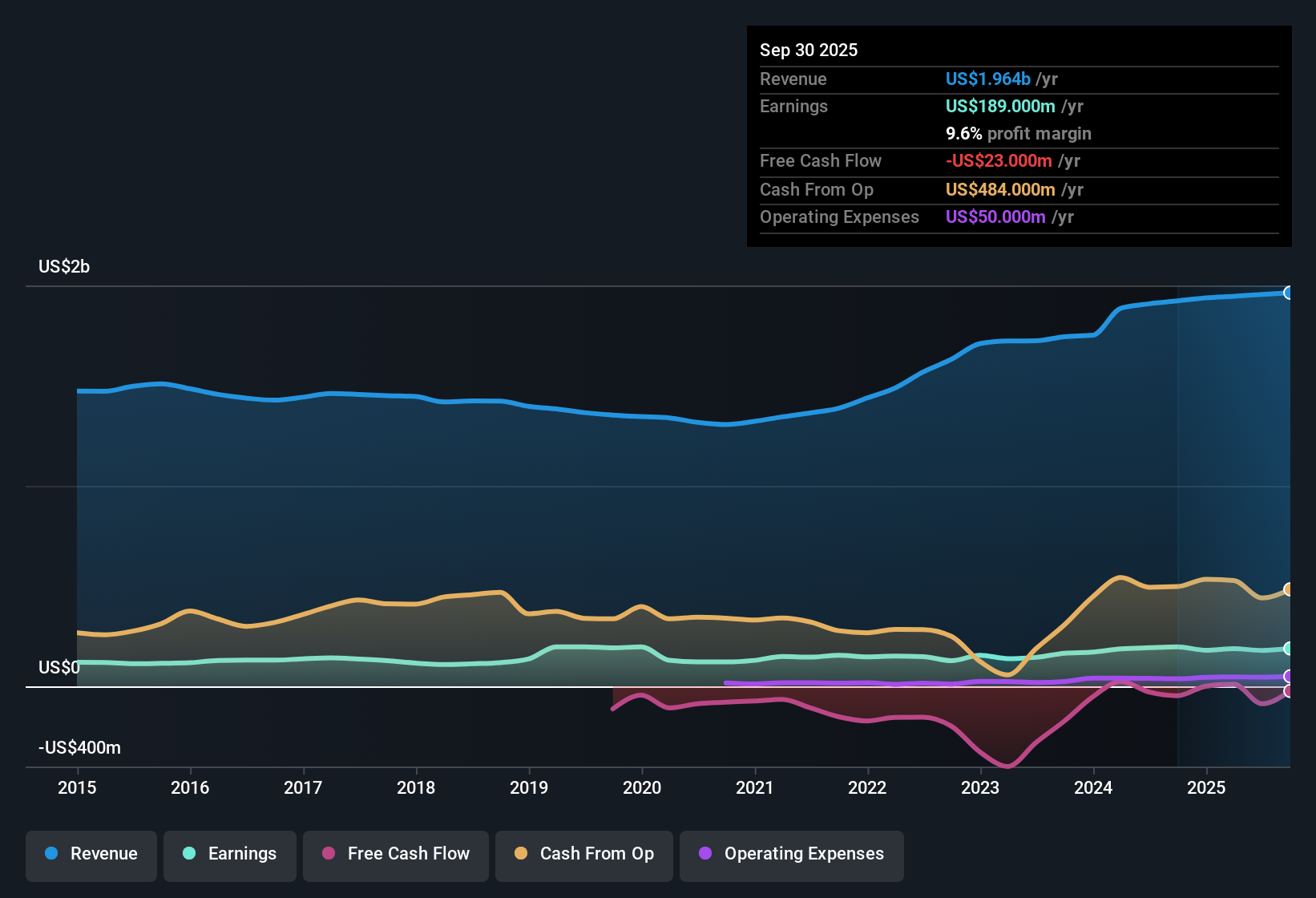

Avista (AVA) reported a net profit margin of 9.2% for the recent period, which is lower than last year's 10.1%. Over the past five years, the company has delivered average annual earnings growth of 8%. However, results for the most recent year show negative growth, breaking with that trend. Looking ahead, Avista is expected to grow earnings at 9.23% per year and revenue at 3.7% per year, a pace that is slower than the broader US market's forecasted growth. The stock closed at $39.74, above its discounted cash flow fair value estimate of $37.45. While margins have compressed and short-term results are mixed, investors may focus on Avista's solid track record and growth outlook, balanced against concerns about its dividend sustainability and overall financial health.

See our full analysis for Avista.Next, we will break down how the numbers measure up to the most widely held market narratives and where those expectations might diverge from reality.

See what the community is saying about Avista

Margin Stability Faces Clean Energy Pressures

- Analysts estimate profit margins will rise from the current 9.2% to 11.4% over the next three years, supported by favorable rate settlements across Oregon, Idaho, and Washington.

- According to the analysts' consensus view, Avista's earnings run into near-term pressure from heavy investments in grid modernization and clean technology.

- As regulatory outcomes turn more constructive, especially with Oregon and Idaho rate settlements, the consensus sees better margin recovery offsetting some clean tech investment burdens.

- Still, consensus acknowledges that sector trends such as increased capital needs for new generation and climate resilience could constrain flexibility if cost recovery lags rate base growth.

- To see whether analysts’ margin optimism holds up against upcoming catalysts, see the full consensus perspective. 📊 Read the full Avista Consensus Narrative.

Capital Spending Drives Both Opportunity and Risk

- Avista plans nearly $3 billion in capital investments from 2025 to 2029, building out the grid to meet a sharp rise in load inquiries totaling over 3,000 megawatts, well above today’s roughly 2,000-megawatt peak load.

- Consensus narrative expects these upgrades to expand the regulated rate base and, in turn, support long-term earnings growth, but flags exposure to regional and climate-related hazards.

- Major new spending is projected to generate regulated returns, yet ongoing investment in wildfire mitigation and modernization could stretch free cash flow if not fully recovered in rates.

- Consensus notes geographic concentration in the Northwest increases exposure to economic and weather-related volatility, making full payback from these investments less certain without continued constructive regulation.

DCF Valuation Gap and Analyst Target Diverge

- Today’s share price of $39.74 trades above the latest DCF fair value estimate of $37.45, while the average analyst target price of $40.60 is just 2.2% higher than current levels.

- Consensus narrative points out that, at a Price-to-Earnings ratio of 18x, Avista looks attractively valued relative to its industry and peer averages, even as the current stock price exceeds modeled fair value.

- Consensus emphasizes that a key challenge is reconciling margin forecasts and long-term investment returns with these tight valuation gaps, especially since modest sector growth and regulatory risks may cap upside.

- Current valuation is not discounting material improvement beyond analyst estimates, suggesting investors should weigh upside carefully against the company’s below-market projected growth and persistent financial health questions.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Avista on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the data from another angle? You can shape your own view and share your narrative in just a few minutes. Do it your way

A great starting point for your Avista research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

While Avista maintains a solid track record, investors face concerns about below-market growth, financial health uncertainties, and compressed operating margins due to heavy investment demands.

If you want to focus on businesses with stronger finances and less balance sheet risk, check out solid balance sheet and fundamentals stocks screener (1972 results) that are built to stay resilient through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AVA

Avista

Operates as an electric and natural gas utility company in the United States.

Established dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives