- United States

- /

- Other Utilities

- /

- NYSE:AVA

Avista (AVA): Assessing the Utility’s Valuation After Its Steady Share Price Climb

Reviewed by Simply Wall St

Avista (AVA) shares have shown a measured upward trend over the past month, climbing just over 6% despite a mostly stable news environment. This movement may pique the interest of investors assessing utilities stocks.

See our latest analysis for Avista.

Avista’s recent 30-day share price return of 6.4% follows a solid year-to-date climb and steady gains over the last 90 days, suggesting gradually building momentum. Looking further out, investors have enjoyed a 10.97% total shareholder return in the past year and 30.92% over five years. This highlights Avista's ability to deliver both short-term growth and long-term value, even without headline-grabbing news.

If this steady performance has you thinking bigger picture, it’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With steady gains and long-term returns on the table, the real question is whether Avista’s solid fundamentals are currently undervalued or if the market has already factored in future growth, leaving little room for upside.

Most Popular Narrative: Fairly Valued

With Avista’s narrative fair value of $40.60 nearly matching the last close price of $40.89, the consensus leans toward current pricing reflecting intrinsic worth. This equilibrium invites a closer look at what is shaping analyst conviction.

Robust, multi-year capital investment plans approaching $3 billion for 2025 to 2029, with additional upside from grid expansion projects and new generation needs tied to large load requests, position Avista to earn regulated returns and drive long-term earnings expansion.

Want to know what powers such valuation stability? Beneath this narrative are some eye-popping assumptions about earnings momentum and the company’s evolving investment pipeline. Ready to uncover which fundamental forces the analysts are betting on? Dive in to unmask the full equation guiding Avista’s fair valuation.

Result: Fair Value of $40.60 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory uncertainty and rising costs related to clean energy investments could quickly disrupt Avista’s currently stable growth outlook.

Find out about the key risks to this Avista narrative.

Another View: What Does the Market Multiple Say?

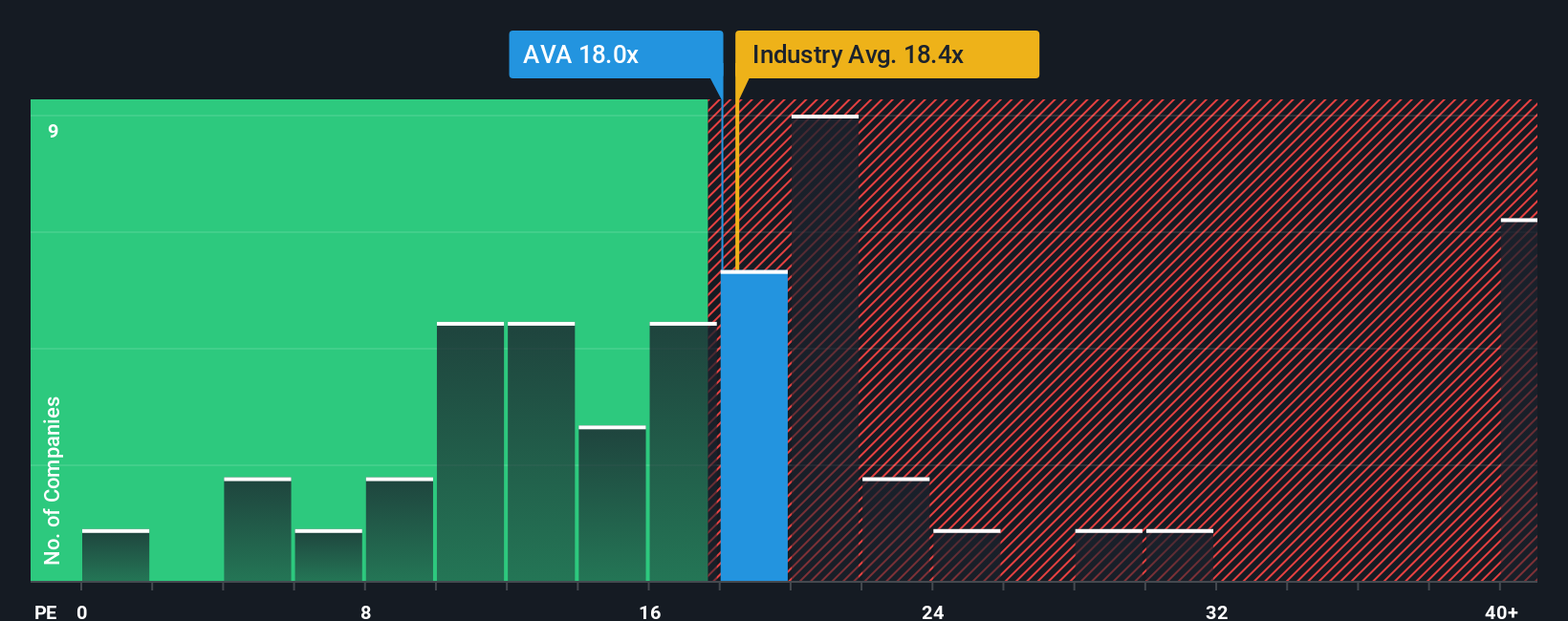

Looking through the lens of share price-to-earnings, Avista’s valuation sits at 17.6 times earnings, which is a bit lower than the average for the global industry (18.4x) and much lower than peers (26.4x). However, it is almost identical to its fair ratio of 17.5x, meaning there is not much room for bargain hunters or risk-takers to exploit. Could the market be waiting for a catalyst before moving?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Avista Narrative

If your perspective differs or you’re keen to crunch the numbers firsthand, crafting a personalized narrative takes just a couple of minutes. Do it your way

A great starting point for your Avista research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stick with the usual picks, you risk missing profitable corners of the market that others are already capitalizing on. Let’s get you ahead of the curve.

- Capitalize on the next tech breakout by scouting these 27 AI penny stocks, which are gaining momentum from the AI wave sweeping global markets.

- Maximize your income potential with these 18 dividend stocks with yields > 3%, which offer robust yields and steady returns for long-term wealth building.

- Step into tomorrow’s finance frontier and seize opportunity with these 81 cryptocurrency and blockchain stocks, as digital assets benefit from the surge of blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AVA

Avista

Operates as an electric and natural gas utility company in the United States.

Established dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives