Stock Analysis

- United States

- /

- Renewable Energy

- /

- NYSE:AES

AES (NYSE:AES) investors are sitting on a loss of 34% if they invested a year ago

The AES Corporation (NYSE:AES) shareholders should be happy to see the share price up 15% in the last quarter. But that doesn't change the reality of under-performance over the last twelve months. In fact the stock is down 36% in the last year, well below the market return.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

Check out our latest analysis for AES

Because AES made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last twelve months, AES increased its revenue by 3.5%. While that may seem decent it isn't great considering the company is still making a loss. Given this lacklustre revenue growth, the share price drop of 36% seems pretty appropriate. It's important not to lose sight of the fact that profitless companies must grow. But if you buy a loss making company then you could become a loss making investor.

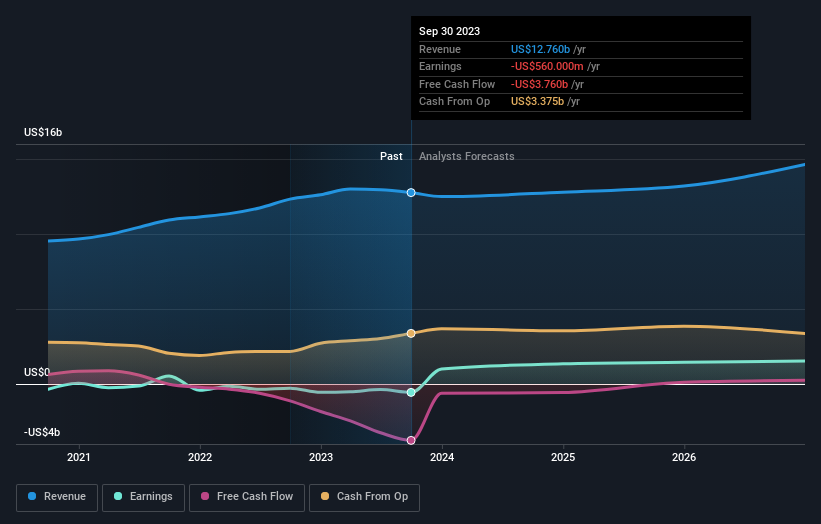

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. This free report showing analyst forecasts should help you form a view on AES

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for AES the TSR over the last 1 year was -34%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Investors in AES had a tough year, with a total loss of 34% (including dividends), against a market gain of about 20%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 3% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with AES , and understanding them should be part of your investment process.

AES is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether AES is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AES

AES

The AES Corporation, together with its subsidiaries, operates as a diversified power generation and utility company in the United States and internationally.

Reasonable growth potential second-rate dividend payer.