- United States

- /

- Renewable Energy

- /

- NYSE:AES

AES (NYSE:AES) Completes Bellefield 1 Solar Project, Partners With Amazon For Clean Energy

Reviewed by Simply Wall St

AES (NYSE:AES) recently completed the Bellefield 1 project, marking a significant step in renewable energy, enhancing its environmental impact and creating jobs. The company's shares rose 9.9% last week, aligning with the market's upward trend of 1.3% amid broader positive economic data, including easing inflation and better-than-expected progress in China-U.S. trade talks. The scale and potential earnings from Bellefield 1, and AES's position as a leading provider of clean energy solutions, likely bolstered investor sentiment, adding weight to the overall positive market movement. This development demonstrates AES's commitment to driving future growth and sustainability initiatives.

We've identified 2 risks for AES (1 is a bit unpleasant) that you should be aware of.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The completion of the Bellefield 1 project by AES could potentially strengthen the company's narrative by enhancing its renewable energy portfolio, which aligns with its growth and sustainability goals. Given the company's strategic investments in new renewable projects, this could lead to improvements in U.S. utility efficiency. Over the past five years, AES's total shareholder return, including dividends, saw a 1.59% decline. This longer-term performance trails behind the one-year return of the U.S. Renewable Energy industry and the overall market, indicating challenges in achieving higher returns previously.

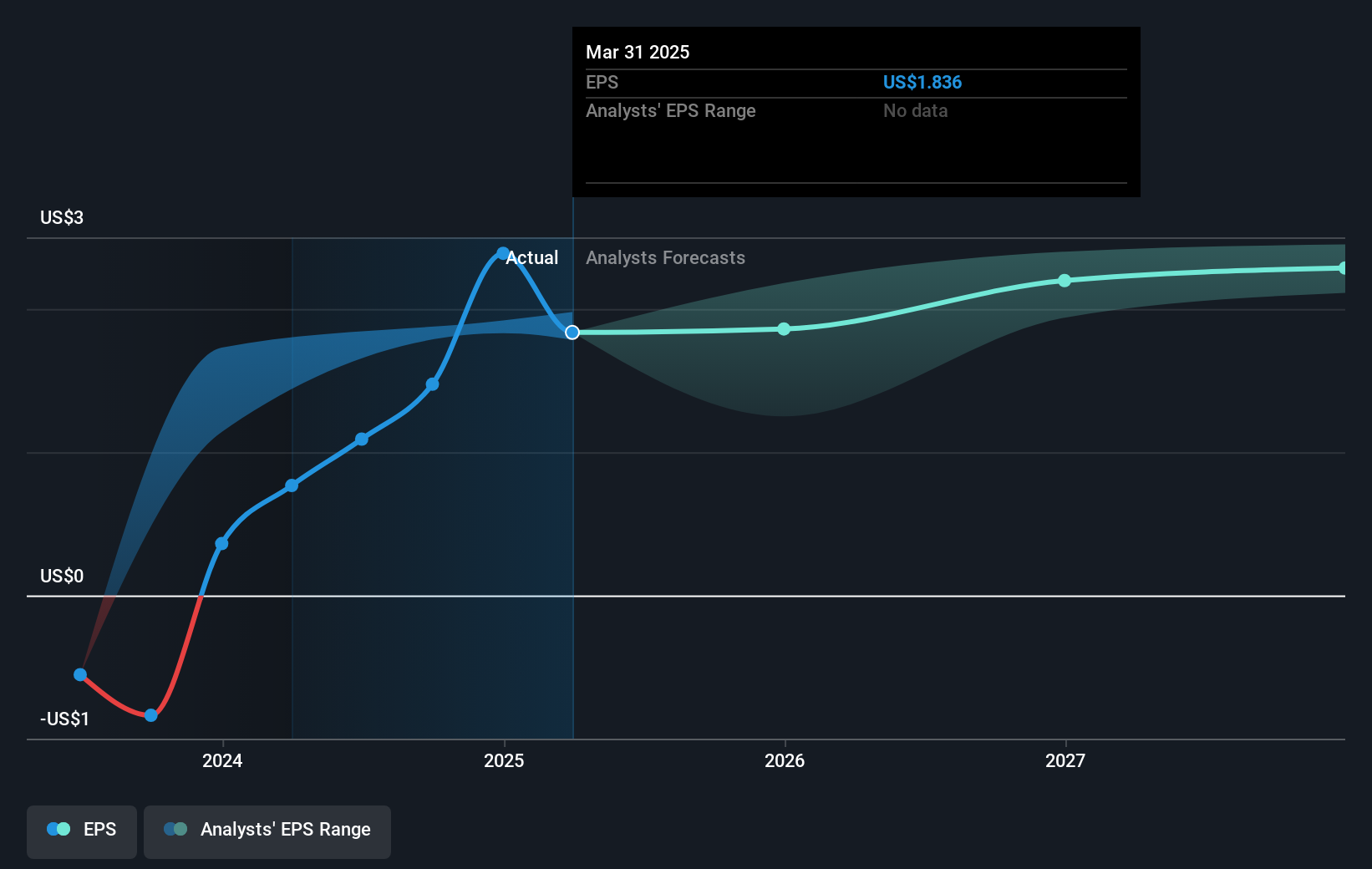

The recent share price increase aligns with the market sentiment and reinforces positive expectations for AES's future earnings and revenue, driven by ongoing growth in the renewables sector. The company anticipates a significant increase in earnings fueled by better margins from efficient supply chain management and infrastructure investments worth US$1.4 billion. These factors could uplift the company's revenue and earnings forecasts, potentially increasing investor confidence.

In terms of valuation, the current share price movement towards the consensus analyst price target of US$14.63 suggests room for potential appreciation. With the current price at US$10.44, this price target is 28.6% higher, reflecting optimism about AES's future revenue growth and improved profit margins. Investors may find this price target appealing if AES successfully executes its growth initiatives and manages existing risks effectively.

Understand AES' earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AES

AES

Operates as a power generation and utility company in the United States and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives