- United States

- /

- Renewable Energy

- /

- NYSE:AES

AES (AES): One-Off Gain Drives Margin Improvement, Raises Questions on Earnings Sustainability

Reviewed by Simply Wall St

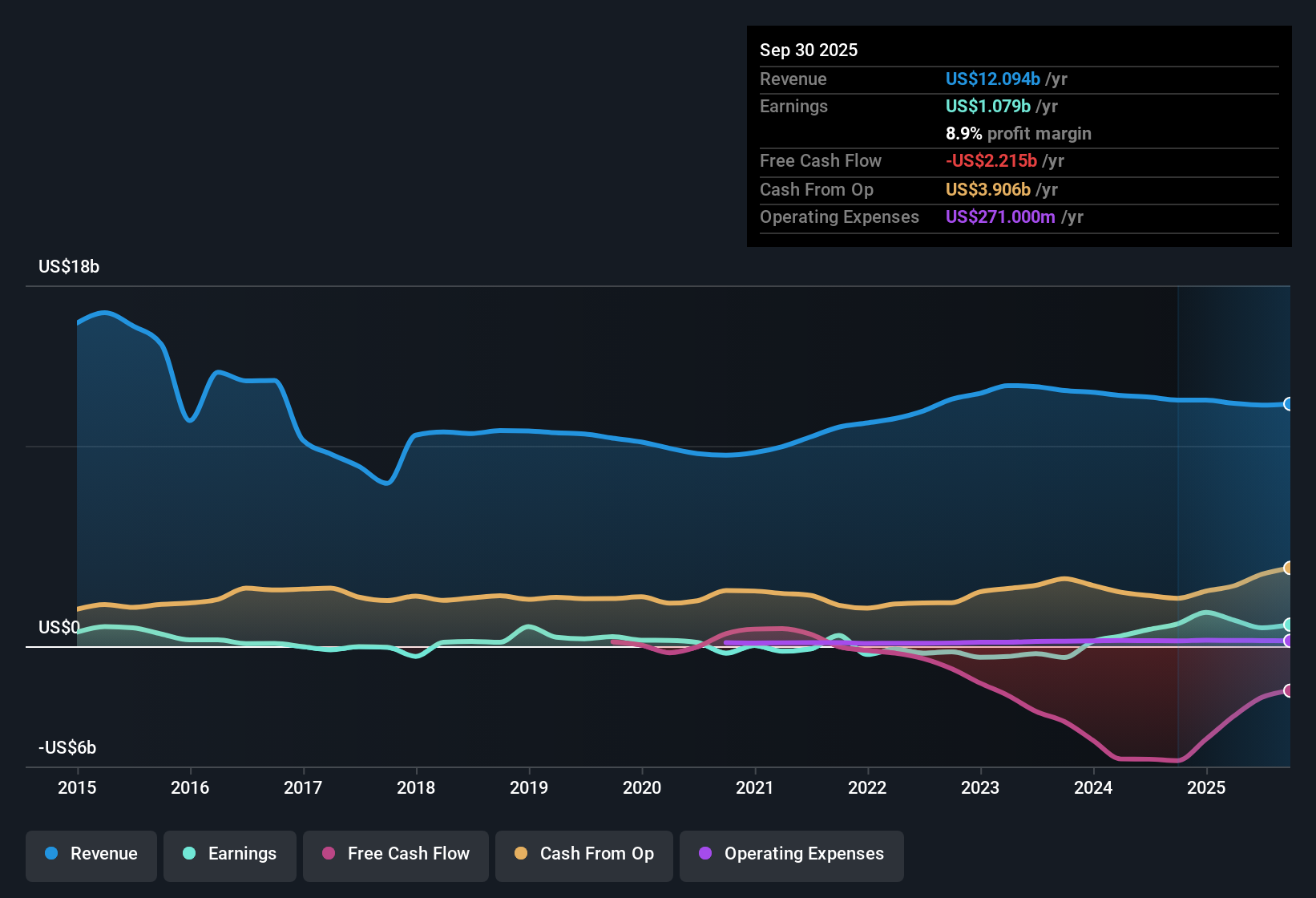

AES (AES) posted earnings growth of 9.7% over the past year, a step down from its striking 56.4% per year average over the past five years. Net profit margins improved to 7.6%, compared to 6.7% a year earlier. Shares currently trade at $14.22, notably below the estimated fair value of $19.28. With the company’s Price-To-Earnings ratio of 11x standing well below sector averages, investors will likely weigh discounted valuation against questions around the sustainability and quality of recent earnings.

See our full analysis for AES.Now, it is time to stack up these earnings numbers against the most widely held narratives in the market to see which stories hold up and which ones might face new challenges.

See what the community is saying about AES

Analyst Margin Targets Double Over 3 Years

- Analysts project net profit margins to climb from today's 7.6% to 14.5% by 2027, essentially doubling profitability expectations within just three years.

- The consensus narrative highlights that margin expansion is driven by a transition from coal to renewables, supply chain improvements, and accelerating demand from AI/data centers.

- Consensus narrative notes AES’s renewables pipeline and multi-year Power Purchase Agreements are seen as key to maintaining visibility on margin growth, even as industry-wide incentives and regulatory reforms evolve.

- At the same time, consensus warns heavy reliance on government incentives and high capital needs may challenge forecasts if margin expansion does not keep pace with costs and potential subsidy changes.

Consensus targets a dramatic margin boost, but can AES keep costs in check as incentives fade? 📊 Read the full AES Consensus Narrative.

$1.7 Billion Earnings Forecast: Can Growth Outrun Risks?

- Analyst projections put AES earnings at $1.7 billion by September 2028, up from $919 million today, though annual revenue is only expected to hold flat and not expand.

- According to the consensus narrative, scale and technology investments are expected to fuel resilient long-term earnings.

- The consensus points to continued investment in renewables and battery storage as supporting earnings and offsetting flat top-line growth, with AI-driven power demand playing a leading role.

- Still, the narrative calls out persistent risks from legacy fossil assets, potential asset write-downs, and future regulatory costs, all of which could undercut earnings quality despite headline growth.

DCF Fair Value Offers Upside to $19.28, but Valuation Remains Cautious

- Shares trade at $14.22, well below DCF fair value of $19.28 and an analyst price target of 14.88, while AES’s 11x PE ratio remains a steep discount to industry averages of 17.9x globally and 57.6x for peers.

- Consensus narrative emphasizes that AES’s valuation looks attractive thanks to sector discounts, yet this is counterbalanced by risk factors around sustained earnings quality and capital-intensive growth.

- Investors weighing entry point may find sector-wide optimism checked by substantial analyst disagreement, with targets ranging widely between $5.00 and $23.00, reflecting deep uncertainty around longer-term cash generation and balance sheet resilience.

- The narrative also notes that stable recurring utility revenue helps underpin the current discount, but warns that future value realization depends on margin follow-through and reliable subsidy support.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for AES on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you interpret the data another way? Share your perspective and shape your own story in just a few minutes: Do it your way.

A great starting point for your AES research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite a discounted valuation, AES faces concerns about flat revenue, heavy reliance on subsidies, and potential risks to earnings quality from legacy assets.

If steady top-line performance and resilience matter most to you, use stable growth stocks screener (2074 results) to discover companies consistently delivering reliable growth without the same headline uncertainties.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AES

AES

Operates as a power generation and utility company in the United States and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives