- United States

- /

- Other Utilities

- /

- NYSE:AEE

Evaluating Ameren (AEE): Is There Room for Upside After Recent Share Price Gains?

Reviewed by Simply Wall St

Ameren (AEE) shares have experienced some movement recently, prompting investors to take a closer look at the stock's underlying performance and current valuation. The company's recent returns show modest gains over the past year.

See our latest analysis for Ameren.

Ameren’s share price has seen a steady upward trend this year, with a 15.73% year-to-date gain. This suggests solid momentum even as shorter-term price returns have dipped. Over the long run, the company has delivered a 14.95% total shareholder return in the past year, reflecting consistent value creation as market sentiment changes.

If you’re curious what other stocks are gaining traction right now, consider broadening your search and discover fast growing stocks with high insider ownership

The question for investors is whether Ameren’s strong recent returns mean the current share price still leaves room for growth, or if the market has already priced in future gains and new positions may be less compelling.

Most Popular Narrative: 8.5% Undervalued

Ameren's current stock price of $102.99 sits below the most popular narrative’s fair value estimate of $112.57, suggesting the stock is widely seen as trading at a discount. This gap draws attention to the financial dynamics fueling the valuation and sets up a deeper look at what could drive future gains.

Rapid growth in data center demand, driven by digitalization trends and influx of hyperscalers seeking affordable, reliable electricity, has resulted in 2.3 GW of signed construction agreements and a robust pipeline extending well beyond 2032. This positions Ameren for substantial sales and revenue growth from large-load customers over the next decade.

What’s the secret sauce behind this bullish target? This narrative’s math factors in outsized growth linked to electrification, major grid investment, and a future profit multiple that rivals best-in-class utilities. Want to see which ambitious forecasts are powering that premium? Dive in for the numbers that could surprise even seasoned investors.

Result: Fair Value of $112.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainty around demand timelines and potential delays in regulatory approvals could present challenges to Ameren's projected growth trajectory and impact future returns.

Find out about the key risks to this Ameren narrative.

Another View: Multiples-Based Valuation Adds Nuance

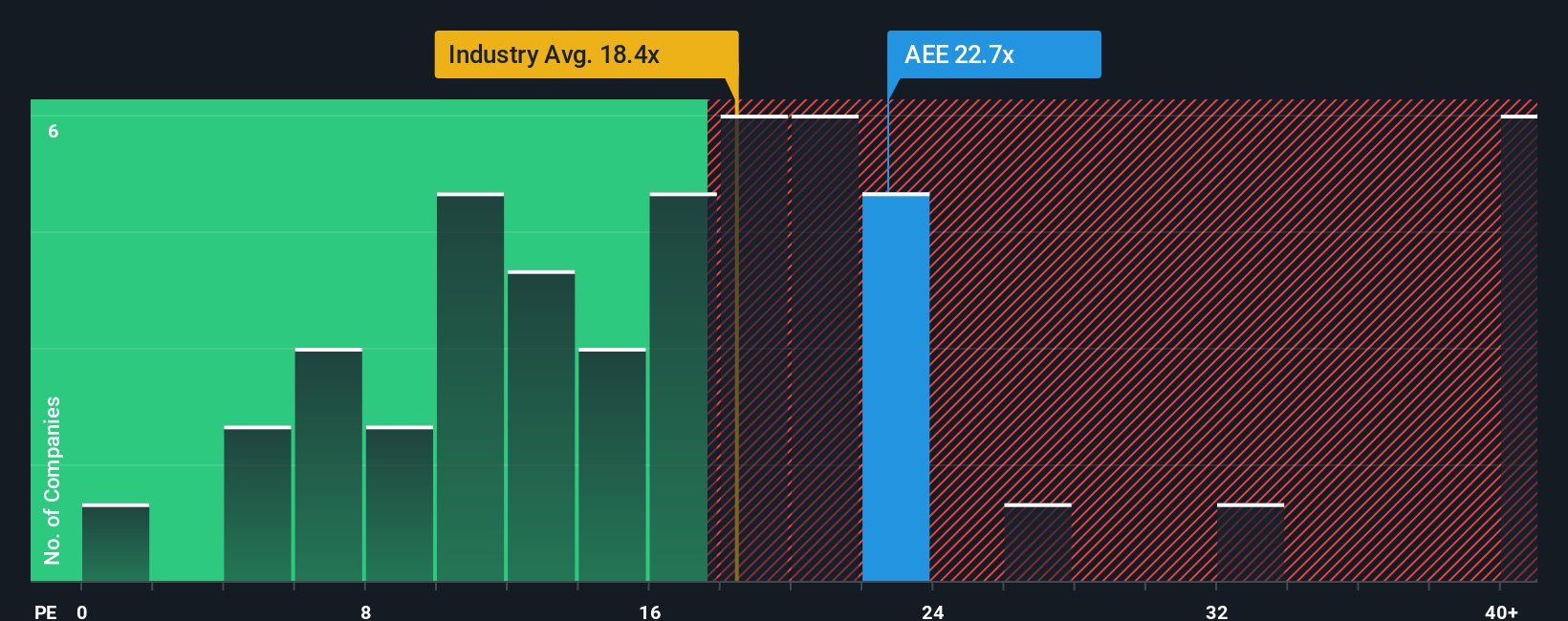

Looking through another lens, Ameren's price-to-earnings ratio stands at 19.7x. This is slightly higher than the global utilities industry average of 18x, but below both the average of its direct peers at 21.3x and the fair ratio of 20.6x that the market could move toward. This split suggests Ameren is not a clear bargain or an obvious risk, but sits in a transition zone where the story could shift quickly. Will the market close the gap, or is there a premium at risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ameren Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can easily shape your own story for Ameren in just a few minutes, and Do it your way.

A great starting point for your Ameren research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let standout opportunities slip by while focusing on just one stock. Get ahead of the curve with these targeted lists designed for forward-thinking investors:

- Spot high potential with these 3579 penny stocks with strong financials, which combine strong financials and a chance to catch growth on the ground floor.

- Capitalize on tomorrow’s technology by searching these 27 AI penny stocks, filled with businesses driving advances in artificial intelligence and shaping how industries evolve.

- Boost your portfolio’s income stream as you browse these 15 dividend stocks with yields > 3%, featuring companies offering yields above the 3% mark for reliable returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEE

Ameren

Operates as a public utility holding company in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives