- United States

- /

- Other Utilities

- /

- NYSE:AEE

Assessing Ameren (AEE) Valuation After Strong Year-to-Date Share Price Performance

Reviewed by Simply Wall St

See our latest analysis for Ameren.

Ameren's share price momentum has been strong through most of the year, with the stock up nearly 15% year-to-date, even after a recent dip of just under 1% over the past week. Over the longer term, the company’s total shareholder return has outpaced many peers, showing a noteworthy 22% gain over the last year and 38% for the last three years. This hints at confidence in both its growth prospects and stability.

If Ameren’s steady climb has you interested in other opportunities, consider broadening your search and discover fast growing stocks with high insider ownership.

But with shares already rallying this year, the key question is whether Ameren remains undervalued or if the market is fully reflecting its solid fundamentals and anticipated growth. Is there still value to unlock, or has future potential already been priced in?

Most Popular Narrative: 8.4% Undervalued

Ameren's consensus narrative pegs its fair value at $111.43, which stands noticeably above the last close at $102.02. This is seen by many as a sign of potential room for further gains. Price action and analyst expectations are setting the stage for elevated valuation debates this cycle.

Rapid growth in data center demand, driven by digitalization trends and an influx of hyperscalers seeking affordable, reliable electricity, has resulted in 2.3 GW of signed construction agreements and a robust pipeline extending well beyond 2032. This positions Ameren for substantial sales and revenue growth from large-load customers over the next decade.

Curious about the underlying math that powers this bullish perspective? The main storyline weaves together ambitious revenue, margin, and earnings leaps, built on assumptions you might not expect. To see which aggressive numbers and future industry bets fuel this narrative, you’ll want to read on.

Result: Fair Value of $111.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, actual demand for data center expansion and regulatory approval delays could challenge Ameren's growth narrative. This could put near-term revenue at risk.

Find out about the key risks to this Ameren narrative.

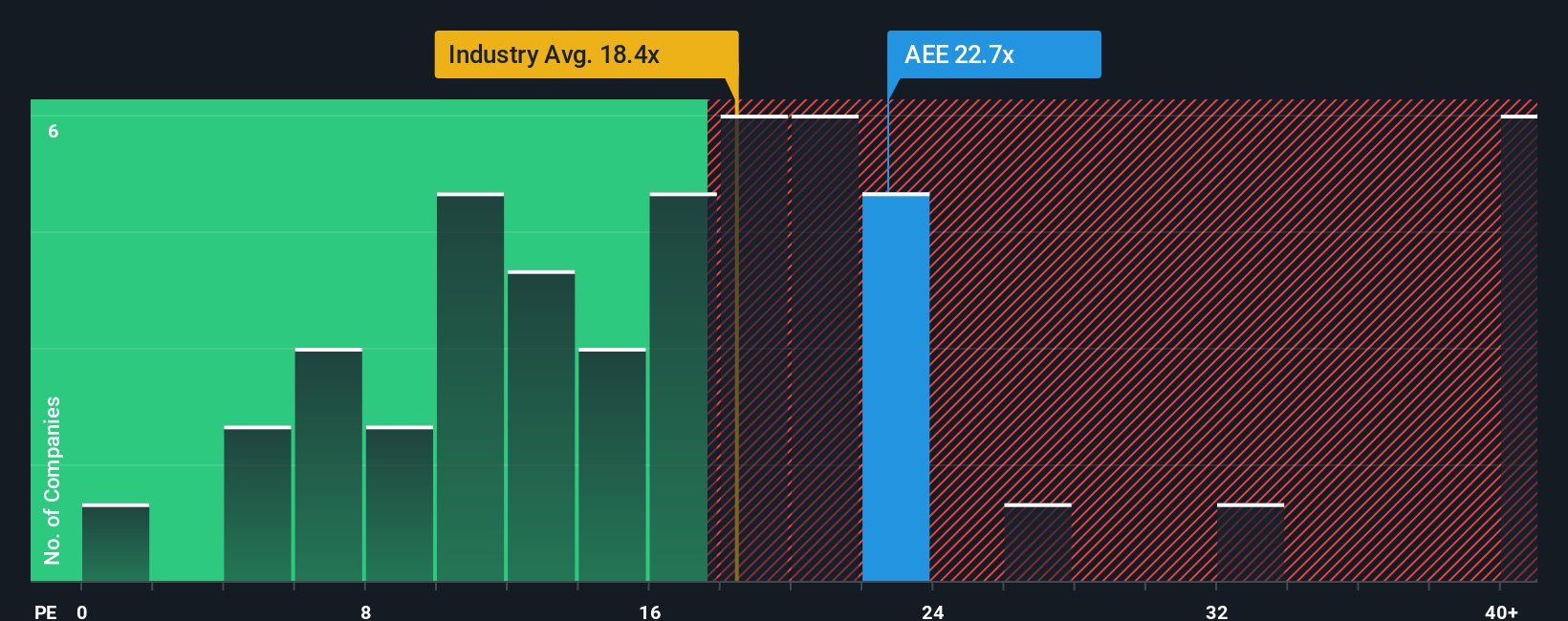

Another View: Pricing Based on Earnings Ratios

Looking from a different angle, Ameren's valuation compares less favorably against its peers when using the price-to-earnings ratio. The stock trades at 22.5 times earnings, making it more expensive than both the industry average of 18.1x and the peer average of 21.6x. Even when compared to the fair ratio of 21.5x, the gap is visible. These comparisons suggest the market sees stability, but there may be little margin for further upside if growth expectations falter. Could this premium price signal extra valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ameren Narrative

If your perspective differs or you want to take a hands-on approach, you can build your own narrative in just a few minutes. Do it your way.

A great starting point for your Ameren research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Seize your chance to get ahead. Don’t wait until others have already jumped on opportunity. Use the Simply Wall Street Screener to find tomorrow’s winners today.

- Uncover market gems by targeting value with these 845 undervalued stocks based on cash flows, where you’ll find companies with potential hidden in their balance sheets and future cash flows.

- Catch the wave of innovation and supercharge your watchlist using these 27 AI penny stocks. These picks are shaping industries through artificial intelligence breakthroughs.

- Boost your portfolio’s income potential and stability. Check out these 20 dividend stocks with yields > 3% that consistently reward shareholders with attractive dividend yields over 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEE

Ameren

Operates as a public utility holding company in the United States.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives