- United States

- /

- Renewable Energy

- /

- NasdaqGS:TLN

Talen Energy (TLN): Valuation Insights as Advanced Storage Partnership Targets AI-Fueled Power Demand

Reviewed by Simply Wall St

Talen Energy is partnering with Eos Energy to develop multi-gigawatt-hour storage projects throughout Pennsylvania, aiming to meet the growing electricity demand from AI and data centers. Their strategy involves using advanced zinc battery technology at both operating and retired plant locations.

See our latest analysis for Talen Energy.

This partnership with Eos Energy comes at a time when Talen’s share price is showing strong long-term momentum, with a year-to-date share price return of 79.4% and a remarkable 1-year total shareholder return of nearly 108%. Despite some recent volatility, including a 7-day share price dip of 8.5%, investors seem keenly focused on the company’s growth potential in AI-driven energy markets and its ongoing transformation efforts.

If you want to spot more companies positioned for growth in key tech and infrastructure themes, check out our curated list of top innovators in our See the full list for free.

Yet with shares already reflecting impressive one-year gains and analysts projecting more upside, investors must ask whether today's price still undervalues Talen Energy's growth or if the market is already looking ahead.

Most Popular Narrative: 13.3% Undervalued

With Talen Energy’s fair value estimated at $439 and shares last closing at $380.69, the most-followed narrative points to meaningful upside if key company milestones are achieved over the next few years.

“Major expansion and long-term extension of carbon-free nuclear power supply to AWS (1.9 GW through 2042) provide Talen with stable, inflation-protected contracted revenue streams from a blue-chip hyperscaler customer. This de-risks cash flows and enhances margin visibility.”

These projections hinge on aggressive margin improvement and growth rates that rival high-flying tech stocks. The valuation narrative holds a few surprises. Are you ready to discover the boldest bet backing this price?

Result: Fair Value of $439 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent dependence on fossil fuels and high debt levels could threaten margins and slow growth if decarbonization efforts or market pressures accelerate.

Find out about the key risks to this Talen Energy narrative.

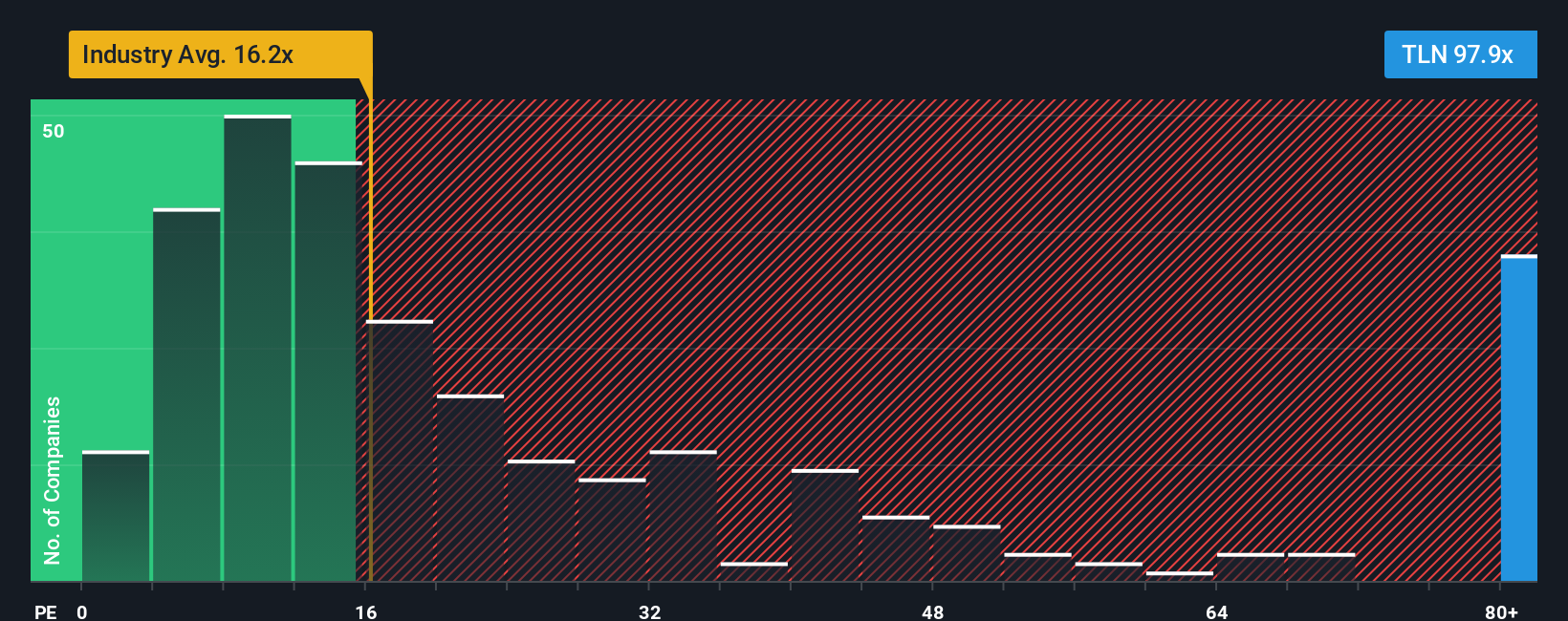

Another View: Multiples Signal a Premium Price

Looking at how Talen Energy is valued compared to the market, the company's current price-to-earnings ratio is 93x, much higher than both the global industry average of 16.6x and the peer average of 21.2x. Even when compared to its estimated fair ratio of 79.8x, Talen trades at a notable premium. This gap could signal optimism about future growth, but it also raises the stakes for any missed expectations. Will investors continue to pay up for Talen's potential, or is the price already stretched?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Talen Energy Narrative

If you see things differently or want to test your own assumptions, you can create and share a customized narrative in just a few minutes with our tools, and Do it your way.

A great starting point for your Talen Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Give yourself the edge by checking out our powerful screeners. Each one is designed to uncover unique stock opportunities you may be missing right now.

- Spot undervalued gems quickly with these 875 undervalued stocks based on cash flows, which highlights companies offering the most potential upside based on key cash flow metrics.

- Maximize your income strategy by targeting these 17 dividend stocks with yields > 3%, featuring stocks with yields greater than 3% and resilient track records.

- Ride the momentum in cutting-edge AI innovation by selecting these 26 AI penny stocks, tapping into companies transforming entire industries through advanced technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Talen Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TLN

Talen Energy

An independent power producer and infrastructure company, produces and sells electricity, capacity, and ancillary services into wholesale power markets in the United States.

High growth potential and slightly overvalued.

Market Insights

Community Narratives