- United States

- /

- Renewable Energy

- /

- NasdaqGS:TLN

Talen Energy (TLN) Is Down 8.9% After Unveiling Bold 2026 Profit Outlook and Buyback Completion

Reviewed by Sasha Jovanovic

- Talen Energy reported strong third-quarter results, with year-over-year growth in both sales and net income, and announced new guidance for 2026 projecting net income between US$875 million and US$1.13 billion, while also narrowing 2025 estimates and confirming the completion of a major share buyback program.

- An interesting detail is that despite annual net income for the first nine months being much lower than the previous year, the company issued a significantly higher guidance for 2026, highlighting expectations for substantial profit recovery ahead.

- We'll examine how Talen Energy’s robust 2026 earnings guidance could shift its investment narrative going forward.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Talen Energy Investment Narrative Recap

For investors considering Talen Energy, the core belief is in the company's ability to capture growing demand for power, especially as data centers and digital infrastructure expand. The recent jump in 2026 net income guidance is significant, but the near-term catalyst remains the fundamental recovery of profits; the biggest risk continues to be exposure to natural gas prices and policy shifts, neither of which appears materially changed by this update.

Among recent developments, the completion of Talen's large share buyback stands out. Retiring over 9.5 million shares, or 17% of the float, could improve future earnings per share and aligns shareholder interests with management’s stated goal of disciplined capital returns, reinforcing one of the major short-term levers for value creation.

By contrast, one detail investors should be aware of involves how future power prices and regulatory reforms could reshape...

Read the full narrative on Talen Energy (it's free!)

Talen Energy's outlook anticipates $4.2 billion in revenue and $1.1 billion in earnings by 2028. This scenario requires a 25.1% annual revenue growth rate and a $913 million increase in earnings from the current $187 million.

Uncover how Talen Energy's forecasts yield a $445.35 fair value, a 21% upside to its current price.

Exploring Other Perspectives

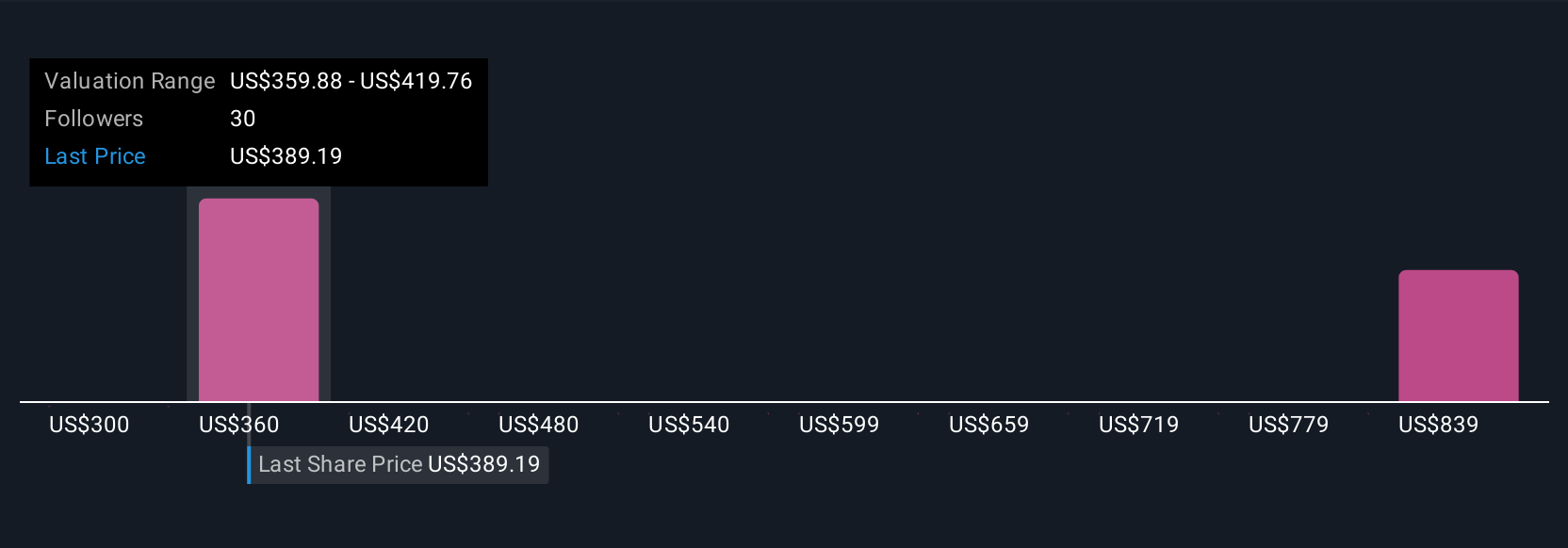

Five community members at Simply Wall St assessed Talen’s fair value between US$300 and US$1,141, revealing widely different outlooks from private investors. With future profit recovery tied to power prices and regulatory conditions, consider how much your own view of these fundamentals influences your assessment.

Explore 5 other fair value estimates on Talen Energy - why the stock might be worth 18% less than the current price!

Build Your Own Talen Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Talen Energy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Talen Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Talen Energy's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Talen Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TLN

Talen Energy

An independent power producer and infrastructure company, produces and sells electricity, capacity, and ancillary services into wholesale power markets in the United States.

High growth potential and fair value.

Market Insights

Community Narratives