- United States

- /

- Renewable Energy

- /

- NasdaqGS:TLN

Does Talen Energy's (TLN) Storage Partnership Hint at a New Era for AI Power Supply?

Reviewed by Sasha Jovanovic

- Eos Energy Enterprises and Talen Energy Corporation recently announced a collaboration to deploy multiple grid-scale energy storage projects in Pennsylvania, using Eos’ U.S.-made Z3 battery technology alongside Talen’s generation portfolio to address escalating power demand from AI and cloud computing facilities.

- This partnership not only expands Talen’s clean energy infrastructure but also provides a blueprint for integrating long-duration storage with existing assets to enhance grid reliability and accelerate AI-related capacity growth.

- We'll explore how Talen’s move to pair storage with its assets could reinforce its position as a crucial power supplier for the AI economy.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Talen Energy Investment Narrative Recap

To be a Talen Energy shareholder, you need to believe that surging electricity demand from AI and cloud infrastructure will sustain robust power pricing, allowing Talen’s generation fleet and energy storage initiatives to fuel long-term earnings growth. The recent storage collaboration with Eos Energy targets grid reliability and AI-driven demand, but does not materially shift the main short-term catalyst: the pace of free cash flow growth and successful integration of newly acquired gas-fired plants. The biggest risk remains Talen’s significant reliance on fossil generation, if decarbonization policies accelerate, profitability could be squeezed by potential retirements or asset impairments.

Among recent announcements, Talen’s expanded power purchase agreement with Amazon Web Services stands out. This deal supports Talen’s pivot to contracted, carbon-free nuclear energy, directly addressing the central opportunity highlighted by the Eos partnership, meeting hyperscaler data center loads with reliable, lower-carbon power contracts that can underpin new infrastructure investments.

On the flip side, investors should be mindful that, despite ambitious clean energy partnerships, Talen’s future earnings could still be exposed to faster-than-expected policy risks affecting its gas plants...

Read the full narrative on Talen Energy (it's free!)

Talen Energy's narrative projects $4.2 billion revenue and $1.1 billion earnings by 2028. This requires 25.1% yearly revenue growth and a $913 million earnings increase from $187 million today.

Uncover how Talen Energy's forecasts yield a $439.24 fair value, a 11% upside to its current price.

Exploring Other Perspectives

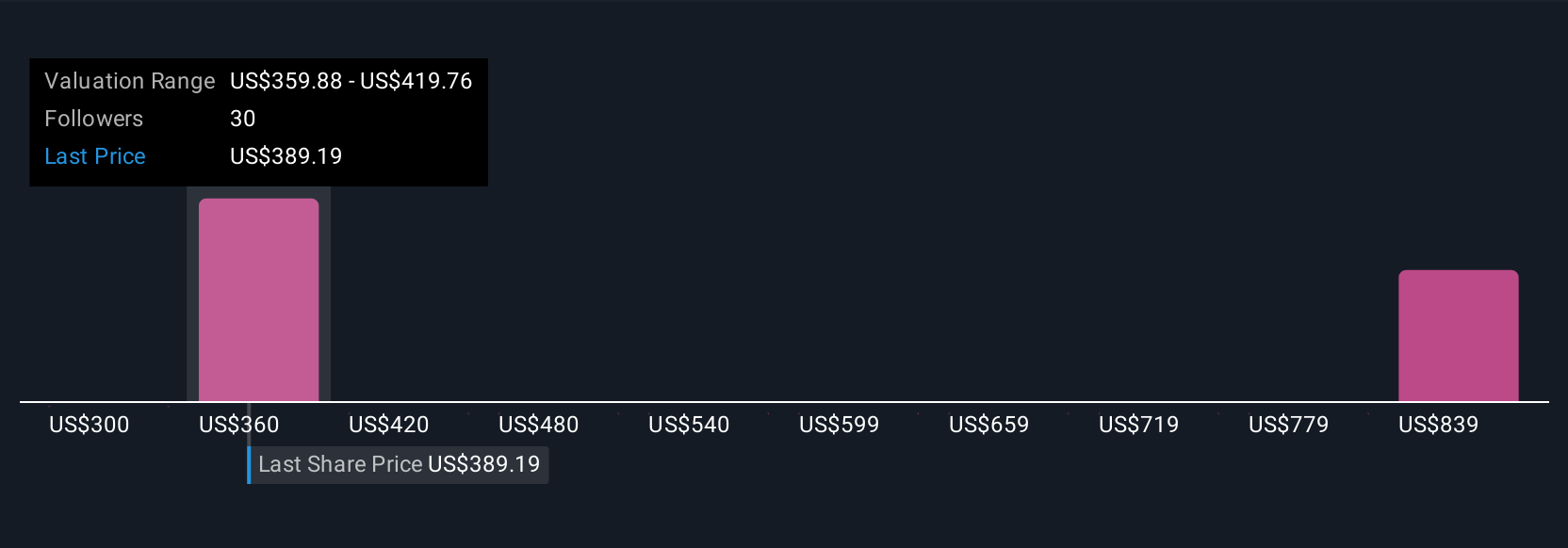

Simply Wall St Community members provided five fair value estimates for Talen Energy ranging from US$300 to over US$1,082 per share. With such a wide spectrum, consider how the company’s central role in serving AI-focused data center demand could drive very different long-term financial trajectories.

Explore 5 other fair value estimates on Talen Energy - why the stock might be worth 24% less than the current price!

Build Your Own Talen Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Talen Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Talen Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Talen Energy's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Talen Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TLN

Talen Energy

An independent power producer and infrastructure company, produces and sells electricity, capacity, and ancillary services into wholesale power markets in the United States.

High growth potential and slightly overvalued.

Market Insights

Community Narratives