- United States

- /

- Renewable Energy

- /

- NasdaqGS:TLN

Assessing Talen Energy After Its 85% Rally and Restructuring Momentum

Reviewed by Bailey Pemberton

- Curious if Talen Energy is priced right for your portfolio? Let’s look past the headlines and explore whether there is untapped value or potential warning signs behind the ticker.

- The stock has had a dramatic run this year, up a striking 84.9% year-to-date. However, it dipped 3.6% over the past month, which reflects both renewed enthusiasm and some recent market caution.

- Much of the recent momentum follows significant restructuring announcements and wider optimism in the utilities sector, as industry efforts to modernize energy infrastructure have made the news. These developments have put Talen Energy in the spotlight for both its growth potential and possible emerging risks.

- On our valuation checks, Talen Energy scores 2 out of 6 for being undervalued. This suggests there are reasons for both optimism and caution. We’ll review what these scores mean for investors using several valuation approaches. Additionally, stay tuned for a perspective on valuation that you might not have considered before.

Talen Energy scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Talen Energy Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model values a business by projecting its future cash flows and then discounting them back to today's dollars. For Talen Energy, this approach is grounded in careful cash flow projections and a two-stage estimate process, which assumes different growth rates over time.

Currently, Talen Energy is generating Free Cash Flow of $162.7 million. According to analyst forecasts and Simply Wall St's extrapolations, the company’s Free Cash Flow is expected to steadily grow, reaching nearly $1.96 billion by the end of 2029. This reflects notable optimism for the company’s future earnings power, especially as it continues restructuring and modernizing initiatives within the utilities sector.

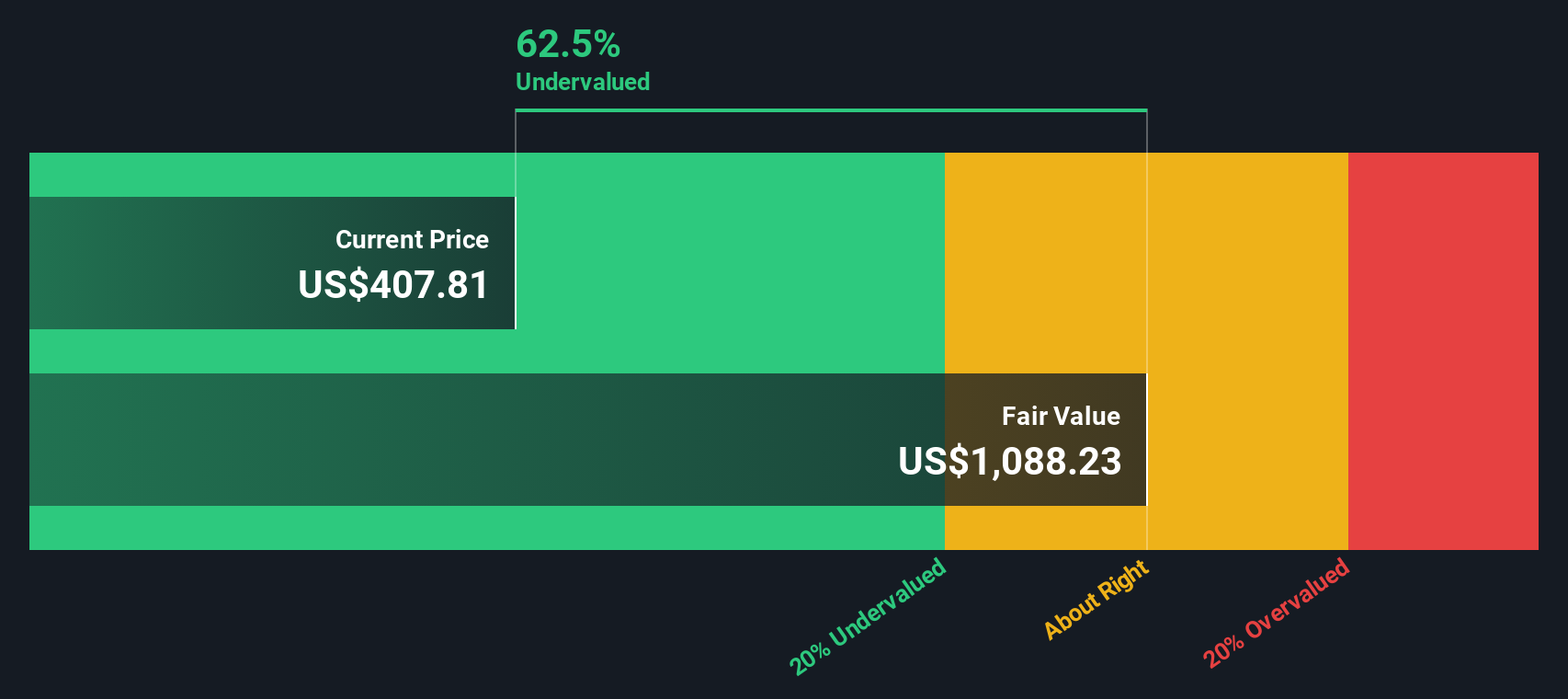

Using these cash flow projections, the DCF model estimates an intrinsic value of $1,080.40 per share for Talen Energy. This figure suggests a significant intrinsic discount of 63.7% compared to the stock’s current price, indicating that the stock is deeply undervalued at present.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Talen Energy is undervalued by 63.7%. Track this in your watchlist or portfolio, or discover 926 more undervalued stocks based on cash flows.

Approach 2: Talen Energy Price vs Earnings

For companies like Talen Energy that are profit-generating, the Price-to-Earnings (PE) ratio is a widely used tool for valuation. The PE ratio helps investors understand how much the market is willing to pay today for a dollar of current earnings, making it especially useful when comparing companies within the same industry or with similar growth profiles.

Growth expectations and risk play a major role in determining what an appropriate or "fair" PE ratio should be. Companies with higher expected earnings growth or a lower perceived risk often justify a higher PE, while those facing growth headwinds or greater uncertainty typically trade at a discount.

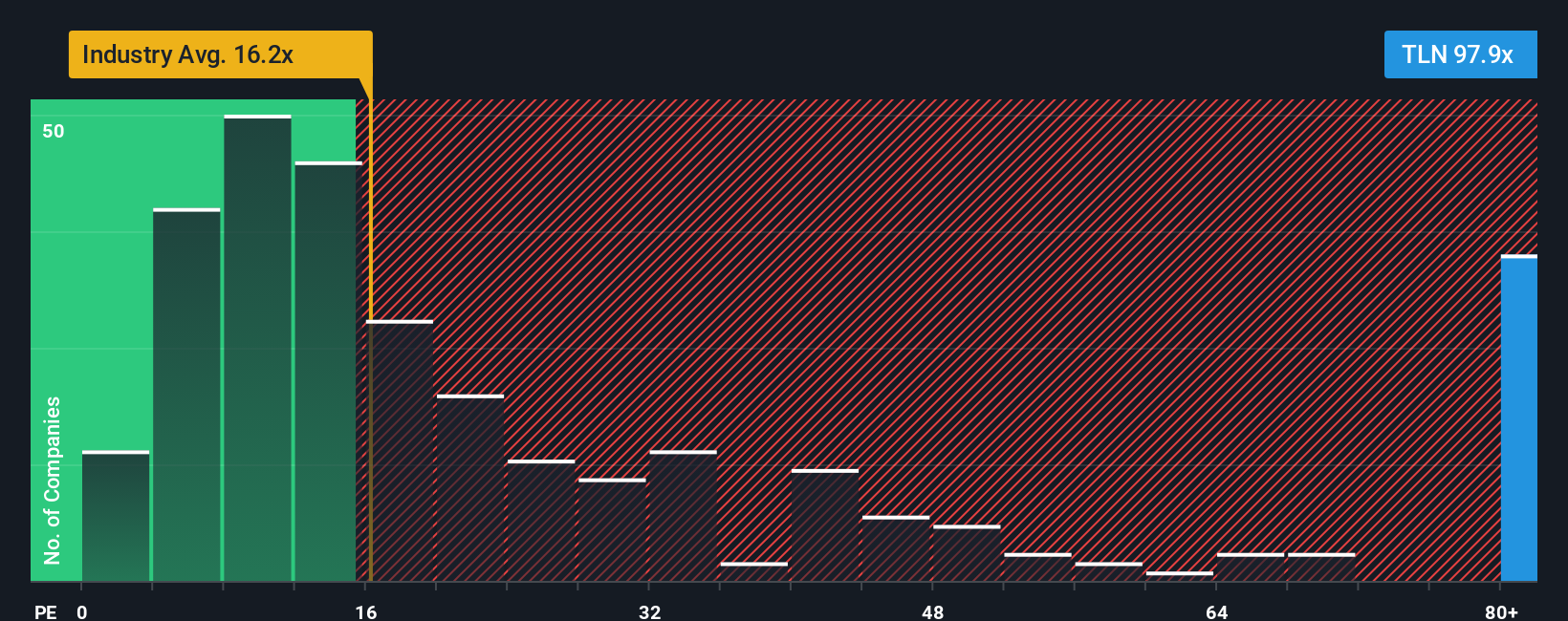

Currently, Talen Energy is trading at a PE ratio of 79.3x, which stands well above the Renewable Energy industry average of 16.8x and also exceeds the average among its closest peers, which is 28.6x. This signals that the market is attaching a significant premium to Talen, likely reflecting recent restructuring progress and anticipated future growth.

Simply Wall St also provides a proprietary “Fair Ratio.” In Talen's case, this is 57.9x. Unlike a basic comparison with peers or broad industry averages, the Fair Ratio factors in the company’s unique earnings growth profile, profit margins, market capitalization, and industry and risk factors, giving you a much more tailored reference point when deciding if the stock is appropriately valued.

Comparing Talen Energy’s actual PE with the Fair Ratio, the current valuation appears somewhat stretched above what fundamentals justify. This suggests investors should exercise some caution at current levels, given the premium being paid for growth expectations.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1434 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Talen Energy Narrative

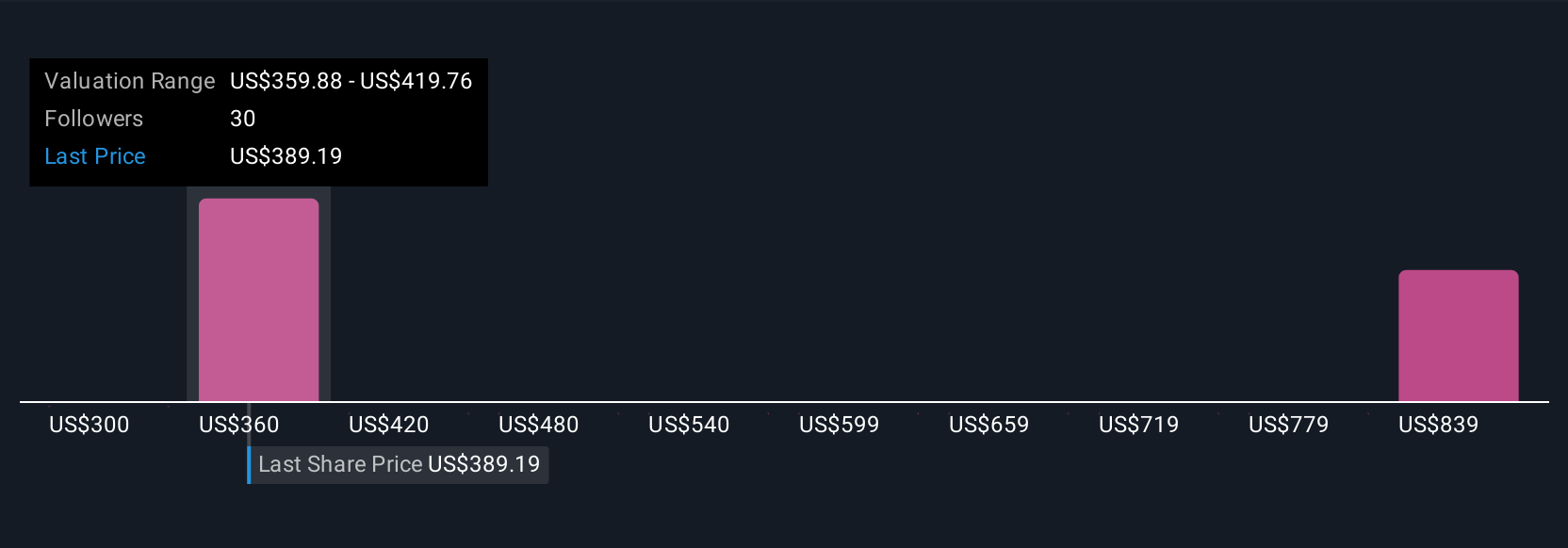

Earlier we highlighted there is a smarter way to understand stock valuation, so let’s introduce you to Narratives. A Narrative is a clear and accessible story you create about a company’s future, built from your own assumptions about fair value, projected revenue, profit margins, and the factors you believe will influence its direction. Instead of just reading the numbers, Narratives invite you to connect your investment thesis directly to the company’s financial forecasts and valuation, turning data into a story you can act on.

On Simply Wall St’s Community page, millions of investors use Narratives to track, update, and share their perspectives. This tool not only helps you see how your view compares to the market, it empowers better decisions because you can see at a glance whether your Fair Value is above or below today’s price, and know instantly if it’s time to buy or sell. Plus, Narratives update automatically as new information, news, or earnings reports roll in, so your perspective is always current.

For Talen Energy, you might find some investors forecasting strong, long-term growth from data center contracts and grid modernization, projecting a fair value near $450, while others, concerned about debt or risks from fossil fuel reliance, set their fair value closer to $307. This illustrates how powerful it is to express your own Narrative as markets and stories evolve.

Do you think there's more to the story for Talen Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Talen Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TLN

Talen Energy

An independent power producer and infrastructure company, produces and sells electricity, capacity, and ancillary services into wholesale power markets in the United States.

High growth potential with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success